Selling Around Price in a Commodity Market–Lessons Learned in Health Insurance

What if you had to sell a commodity but could not sell on price? That’s the dilemma many health insurance carriers face with community-rated plans. Sellers compete solely on price where price flexibility is minimal or non-existent. This effectively shuts out sellers from price-disadvantaged regions. How can organizations adopt innovative approaches to pricing difficulties that increase both sales penetration and growth?

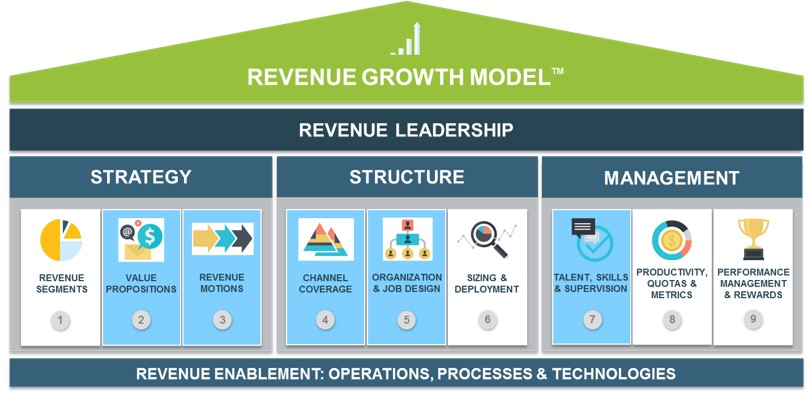

The case studies below illustrate the sales strategy Alexander Group (AGI) developed with three recent health insurance clients using AGI’s Revenue Growth Model™ as a framework. The examples focus on three solutions:

- Refocusing revenue motions and value propositions (strategic pillars)

- Realigning channel coverage and job design (structure pillars)

- Upgrading sales talent and skills (management pillars)

Figure 1: AGI uses the Revenue Growth Model™ as a framework to assess, design and support Commercial Design projects.

STRATEGY: Evolving Revenue Motions & Value Props: A large national carrier needed to adapt their go-to-market model to better fit their changing product strategy. With fixed pricing for medical plans, the client re-focused on selling ancillaries (e.g., wellness) and specialty products (e.g., vision, dental) to drive profitability. The new revenue segments and customers required a new set of value propositions and communications. AGI carefully coordinated a plan that aligned the sales and marketing teams. These value propositions emphasized the impact of wellness programs, integrated care networks and specialty products in order to enhance customer value.

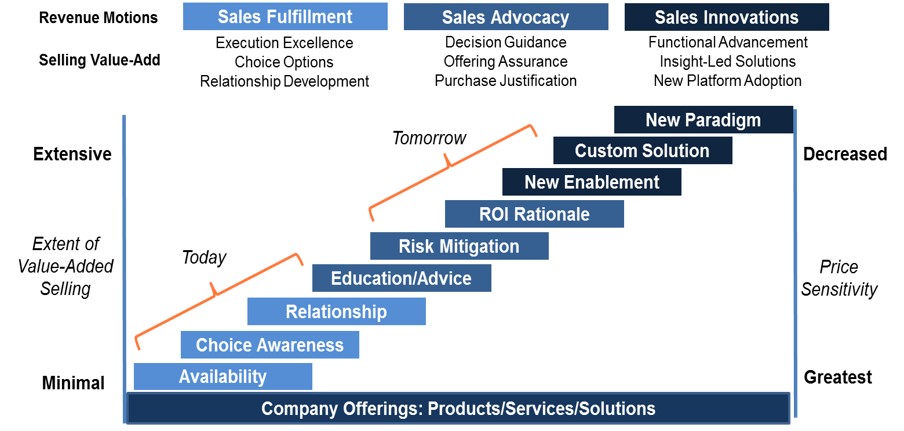

In addition, AGI constructed an alternative revenue motion to shift the carrier from its transaction fulfillment motion to an advocacy innovation revenue motion. In essence, AGI helped transform the carrier’s go-to-market model to a go-to-customer model. Carriers were no longer able to talk about price or availability; they had to focus on “advocacy” and “innovation” revenue motions (see figure 2).

Figure 2: Price Sensitivity Decreases as Value-Added Selling Increases

The new advocacy motions demanded a new suite of activities, capabilities and tools designed to educate members and brokers on the incremental benefits and value of the carrier’s brand in order to demonstrate return on investment. AGI provided:

- Mapped “innovation” motions

- Targeted provider and broker programs to emphasize the benefits of a new integrated care delivery network paradigm

- Established justification for time and effort of new requirements, processes and accountabilities

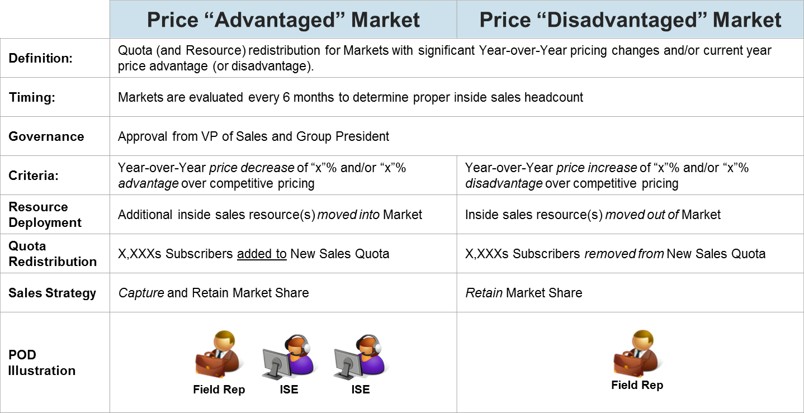

STRUCTURE: A Fresh Look at Coverage and Jobs: At another client, AGI helped develop an optimized and more flexible coverage model and team. AGI transformed the traditional approach of assigning inside sellers fixed territories and field representative pairings. The new process allowed the sales team to dynamically shift inside sales resources to markets where pricing was advantageous – literally putting the sellers where they could do the most good. Consistent monitoring of capacity & optimal deployment enabled targeted sales teams to dominate market share and penetration for insurance products in the more favorable pricing regions, while holding share in regions where carriers were at a pricing disadvantage.

To ensure successful implementation of this strategy, AGI helped the client create a dynamic resource reallocation process, which included several key components (including proper governance):

- Definition: What is the scope of the resource reallocation?

- Triggers: What “triggers” determine reallocation?

- Timing: How often will the carrier analyze markets for additions/subtraction of resources?

- Governance: Who approves these changes to the sales force? How does the organization prevent abuse of this process?

- Deployment: Which resources can the organization relocate? How can the seller best serve all of the markets?

- Quota Redistribution: How much quota do the movable resources bring with them to the new market? How much quota relief does the disadvantaged market receive?

Figure 3: Illustrative Process for Resource Reallocation

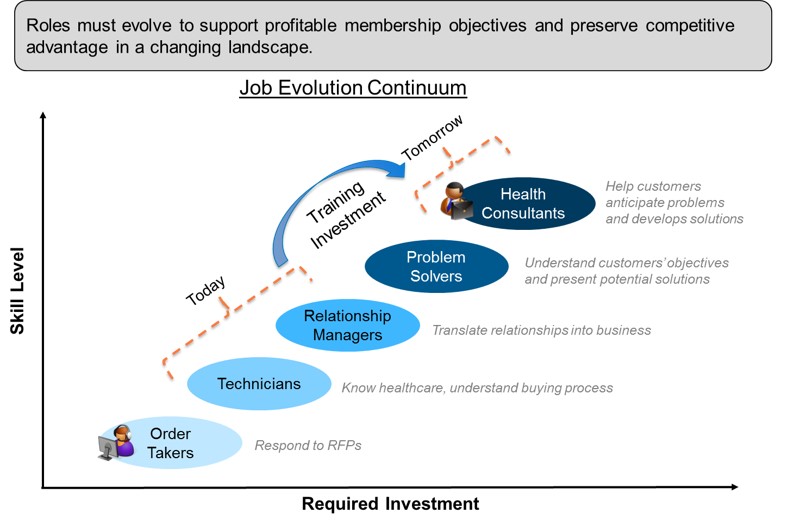

MANAGEMENT: Upgrading Talent with New Competencies and Skills: Value-focused revenue motions require different skills and competencies. In response, organizations must upgrade their sales talent to adopt new motions. AGI helped another client conduct a relook at the key sales competencies required to evolve jobs as technicians and relationship managers to true “health consultants” who can anticipate broker and member problems and develop solutions (see figure 4).

Figure 4: Evolution of Health Insurance Sales Roles

AGI determined that the critical upgrades centered on industry knowledge, ecosystem leverage, sales pursuit, and planning and organization. For broker-focused hunting roles, for example, sellers had great health insurance industry knowledge but had limited knowledge of key market trends, member dynamics and pricing strategies. As a result, these sellers could not appropriately articulate the company’s brand promise or competitively position its suite of offerings with a compelling value proposition, i.e., they couldn’t overcome the gravitational pull of “low price.”

After making key training investments in industry knowledge and other key topics (e.g., how to leverage partners, value-/solution-selling and strategic account management), this carrier’s market share erosion gradually ceased. In fact, brokers with large books actually started increasing this carrier’s share of their book. They recognized both the value of the solutions and a more coherent and focused sales methodology.

In summary, external factors outside of Sales’ control can create revenue challenges. The key is to diagnose the problem and provide your sales team the competitive advantage needed to capture market share. By using the Revenue Growth Model™, AGI strategically solved each client’s unique challenges, and thus provided an excellent return on sales investment.

If you are interested in learning more about AGI’s approach to resolving unique health insurance issues with a robust focus on revenue growth, please visit our Health Insurance practice to contact us.

Read more about Alexander Group’s Revenue Growth Model™.