Sales readiness survey: using field input to improve sales productivity

In a world of “big data,” many companies often overlook one of the most efficient and effective ways to quantitatively analyze sellers’ feedback: a sales readiness survey. The Alexander Group’s (AGI) specialized Sales Readiness Survey uses field perceptions of key attributes to evaluate an organization’s overall capabilities and productivity. The right combination of sales readiness questions and sales time benchmarks helps sales leaders effectively improve sales productivity.

High-quality feedback helps identify problem areas, generate new ideas and provide a basis for establishing solutions. Well-constructed feedback efforts go beyond traditional employee surveys. The right questions can provide insights to a range of topics not easily quantified, such as:

- Does marketing effectively enable the sales force, providing quality value propositions, collateral and leads?

- Is the sales process effective, using the right mix of sales and support roles? Do sellers get enough quality customer-facing time? Is the handoff between sales and service smooth?

- Do sales representatives receive adequate training and development?

The two case studies below highlight how the Alexander Group uses its proprietary Sales Readiness Survey. The compelling insights around sales readiness feedback from field sales representatives and managers help leadership identify and prioritize initiatives to drive organizational change.

Case Example 1: Improve coaching and lead quality

Arguably the most important job in the sales organization is the first-line manager. The most effective managers use a significant portion of their time to develop and assist sales representatives. The end goal is driving higher team productivity. But too often, first-line managers gravitate away from coaching and spend excessive time selling.

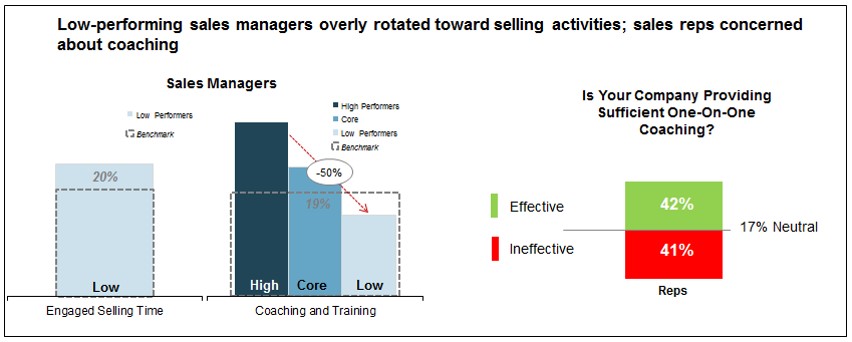

As part of a broader sales productivity assessment, AGI recently administered an online Sales Readiness Survey to a software company’s sales personnel. They gathered sellers’ and managers’ perceptions of management capabilities and working time spent across various categories. Results showed that over 40 percent of sellers felt that day-to-day coaching was insufficient. The corresponding time results showed that high-performing sales managers performed the most coaching; low-performing managers spent well over the industry average in customer-facing selling time and 50 percent less coaching time than their high-performing peers (see figure 1). The findings revealed the need for more coaching for underperforming sellers, as well as the relationship between coaching and performance.

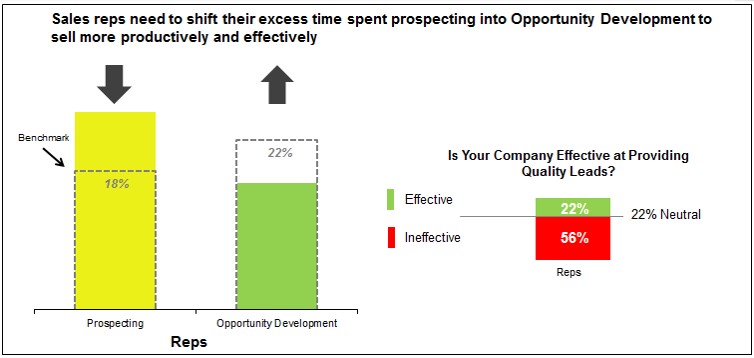

The Sales Readiness Survey also revealed sellers’ dissatisfaction with the leads marketing provided to them. They indicated they spent significantly more time prospecting than the Alexander Group benchmark. This finding helped management recognize that by improving the quality of leads (i.e., setting better guidelines for qualified leads), they could decrease sellers’ prospecting time and increase development time.

Case Example 2: Too much sales representative time on customer service

Alexander Group conducted a cross-region assessment of an insurance company that featured a Sales Readiness Survey. The goal was to evaluate one of the company’s core selling roles – account manager – and provide insight into the implications of sales time and management capabilities.

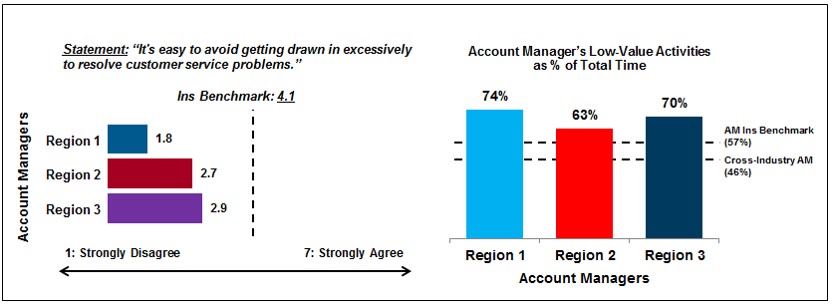

It was quickly apparent that the surveyed account managers were spending too much time in low-value activities, taking away from their opportunities for engaged selling time. Furthermore, well over 50 percent of account managers disagreed that it was easy to avoid getting drawn into solving customer service problems.

Instead of having a clean handoff between sales and service, account managers felt obligated to resolve customer service issues within their accounts. This was particularly evident by their customer service time (a category within low-value activities), which was 30+ percent higher than benchmark for all regions. This insight led management to dive deeper into the sales and customer service process. A better understanding of the disconnect between job “design” and job “execution” helped leadership look for ways to increase selling time.

What would your organization say about sales readiness?

Combining a seller-level perception and time study can yield powerful insights and drive organizational change. While anecdotal and qualitative feedback is valuable and can provide directional guidance, Alexander Group has found that detailed, targeted and quantitative feedback is a stronger tool for analyzing issues and establishing a basis for solution development. For business leaders considering a Sales Readiness Survey, four lessons are useful to keep in mind: keep the questions objective, survey the field twice per year, survey multiple roles and keep the question count under 20.

Are you curious how you can better gather and analyze feedback from your sales force?

Contact Alexander Group or visit the Sales Analytics page for more information.