Customer Performance Segmentation

Segmentation is a highly valuable tool to uncover hidden growth opportunities. Many segmentation techniques are available. One such technique is Customer Performance Segmentation. This technique evaluates the underlying customer base to identify both positive and negative growth trends at the account level. Customer Performance Segmentation can identify incremental double-digit growth opportunities.

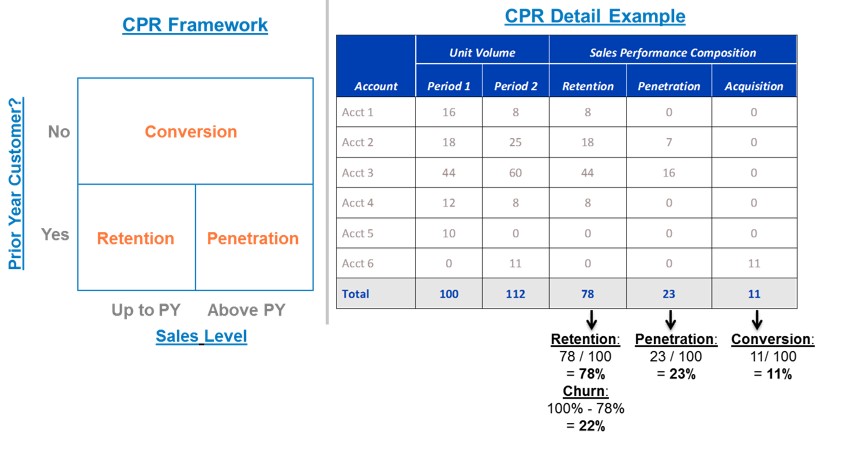

This segmentation technique relies on actual customer performance to identify opportunities. Sources of revenue are decomposed. At the foundation, revenue is classified into Conversion, Retention, or Penetration Revenue. In markets where most customers and potential current buyers are known, Conversion accounts can be those that are defined as accounts with significant growth rates. This segmentation technique addresses a number of key questions:

- How is growth achieved?

- Are we growing by acquiring new business or are we relying too much on existing accounts?

- Are we observing consistent growth patterns across markets and accounts?

The illustration below details the basics of Customer Performance Segmentation.

To conduct the segmentation, 24 months of account-level revenue data is required. For each account, the source of revenue is assigned to conversion, retention and/or penetration. Once the analysis is complete, the results are analyzed in aggregate to identify trends. Account level results are also reviewed to identify both high performance and low performance accounts. Done properly, performance trends are highlighted.

To conduct the segmentation, 24 months of account-level revenue data is required. For each account, the source of revenue is assigned to conversion, retention and/or penetration. Once the analysis is complete, the results are analyzed in aggregate to identify trends. Account level results are also reviewed to identify both high performance and low performance accounts. Done properly, performance trends are highlighted.

To better understand performance trends, root cause research is required. Customer surveys help identify root causes for both high performing and low performing accounts. Findings from these customer studies can help uncover new segments and growth strategies.

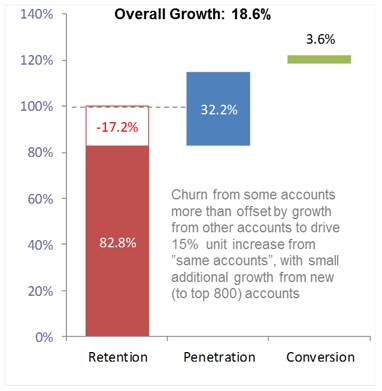

Consider this real world example. An AGI client had an impressive run of double-digit growth, but the growth rate hid a few alarming trends. The company was experiencing 18.6 percent growth which was driven by exceptional penetration selling, but 17 percent of the revenue was churning on an annual basis.

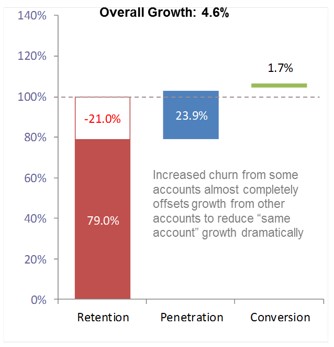

During the next year, growth slowed significantly. Penetration selling slowed by approximately one-third and churn increased by twenty-five percent.

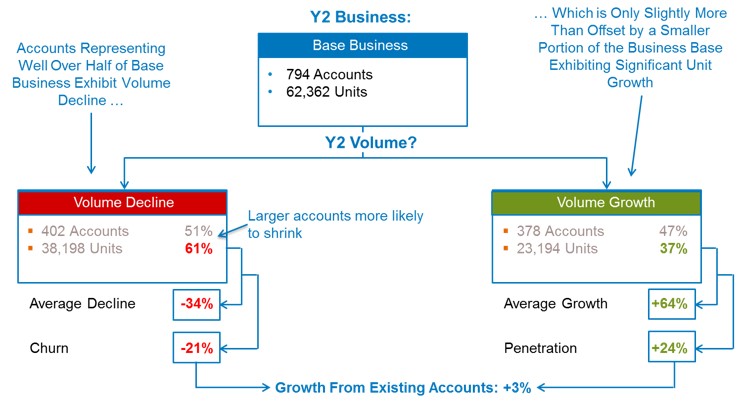

Further analysis revealed that more accounts were declining than growing. The company had a very significant customer churn problem.

The company billed itself as having a growth technology that was well positioned for double-digit growth. Customer surveys revealed a well-known product that was in an extremely competitive marketplace. The revenue growth strategy focused more on new customer acquisition to drive revenue growth.

This strategy was successful in the past, but major concerns were arising. Once users trialed the technology, ongoing usage was driven by ease of doing business. It turns out the company’s revenue generation strategy was fatally flawed. The strategy ignored a very important segment that was comprised of high-volume current customers.

High-volume customers loved the technology, but the company was not easy to do business with. Competitors exploited this weakness, which threatened to derail a highly successful growth story. Customer performance segmentation highlighted the need to invest in retention selling.

By investing in a retention strategy, growth was reinvigorated. Decreasing churn by 50 percent was all that was needed to reinvigorate double digit growth.

Want to learn more? Please visit Alexander Group’s Revenue Growth Strategy practice page.

Contact an Alexander Group Revenue Growth leader.