Transitioning to XaaS

The software industry’s transition to recurring license revenue models has changed the way customers purchase products. In-year revenue per initial deal has shrunk to 20% of what it was in the perpetual license world. Expanding relationships with existing customers is now the crucial component of the subscription revenue growth model.

To successfully grow recurring revenue, sales and marketing organizations need to attract, retain and grow new customers via upsells and cross-sells (i.e., “land and expand”). Alexander Group’s research finds that the leading companies see their accounts grow annual expenditures by 60-70% from year one to year three. Unfortunately, many companies get stuck after the “land” phase, unable to achieve their ambitious upsell and cross-sell growth goals.

Will Only the Strong Survive?

For hybrid software companies, the importance of selling XaaS products is growing rapidly. Customers want more agile products and are also seeking solutions for a more diverse set of business applications, driving the need for customization and flexibility. Customers also want to pay as they go, transitioning away from upfront capital expenditure. These trends have investors buzzing over the prospects of XaaS as an incremental source of revenue growth for big software companies.

However, the transition from a perpetual to a XaaS license model is not an easy one. In fact, despite sizeable resources and scale, many big software companies are stuck in their XaaS transition and losing share to smaller competitors.

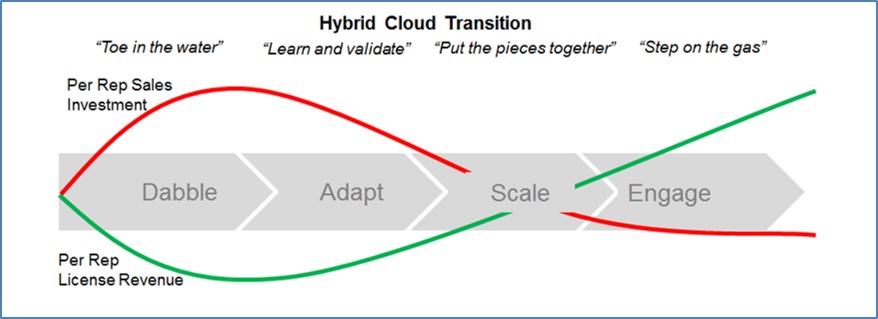

Here are four stages of sales model transition to effective XaaS selling, including the typical roadblocks and critical success factors at each stage. Be aware that this transition has a significant Darwinian dimension to it; only those companies that quickly identify how to become XaaS -ready will survive!

XaaS Sales Evolution Stage 1: Dabbling

Companies in the “Dabble” stage have relatively small XaaS businesses (typically less than 2% of their overall revenue). They’re unsure of their commitment to XaaS because they worry about the revenue cannibalization effect of shifting upfront revenue to ongoing revenue for existing and pending deals. They’re also reluctant to invest in extensive XaaS enablement and post-sales, or to move away from their implementation-focused partner model.

Dabblers are fearful of over-investing and spiraling into years of low profitability and high expense. When transitioning to XaaS, Dabblers try to push reps to close more deals, and thus offset the drop in first-year revenue per deal that can accompany a shift from upfront to subscription revenue (see figure below). As a result, they scrimp on the necessary role, comp and cultural investments to jump-start XaaS selling.

Takeaway: To move to the next stage, winning Dabblers have to commit to investing in the change and not try to get their reps to fund it out of their own pockets.

XaaS Sales Evolution Stage 2: Adapting

In the “Adapt” phase, hybrids begin to focus on active learning, i.e., they evaluate what works and make ongoing changes to accelerate the adoption of XaaS-selling behaviors. For example, they move reps towards a “land & expand” selling motion by modifying quotas and compensation. They also test out new above-the-funnel programs and value propositions to communicate XaaS benefits, and new post-sales account management roles to grow out-year revenue.

While Adapters’ focus on selling XaaS has increased, they are only partway there. At $100-250K XaaS ACV Bookings/rep, they have a long way to get to a sustainable figure ($800K-1MM/rep).

Takeaway: Winning Adapters spend time learning how to upgrade their pre- and post-sales models to convert customers to XaaS and help them grow their usage in future years, thus getting more customers and revenue per customer.

XaaS Sales Evolution Stage 3: Scaling

In the “Scale” stage, companies see how they can build on their successes and grow them to get scale. Scalers typically deploy a mix of XaaS-focused selling roles (e.g., hunters in the wild, hunters in the zoo, and quota-carrying customer success managers). Their Expense to Revenue ratios fall towards 50%; the majority of reps are now well-versed in articulating XaaS value propositions; and Marketing and Sales are building out web programs for prospect self-learning.

Scalers still have some problems to overcome. They have high costs due to lingering legacy sales models that are not XaaS-ready (e.g., they are too heavy on field sales resources and pre-sales engineers, versus lower-cost inside sales with broader reach). Scalers also lack a strong XaaS channel sales development function (e.g., referral and app development) and therefore must originate most of their XaaS deals via the direct organization.

Takeaway: Winning Scalers focus on taking what’s working and growing it to increase efficiency, e.g., modifying their sales motions (closing small and mid-size deals with inside sales), and building out XaaS-specific channel relationships.

XaaS Sales Evolution Stage 4: Engaging

Companies in the “Engage” stage are “stepping on the gas” towards long-term XaaS profitability, driven by a high ratio of out-to-first-year revenue from accounts (i.e., post-sales account management is efficiently driving adoption, upselling and cross-selling). Their ratio of sales expense to net new annual XaaS bookings may still be high (near 100%), but out-year retention and upsell revenue drives sales expense to revenue below 35%.

Engagers have robust “above-the-funnel” customer engagement models, including strong try-and-buy capabilities, prospect self-learning resources and technically savvy lead generation. Customers are well-informed about the XaaS product’s capabilities and offerings before they ever talk to a rep. Engagers also extensively leverage partners for referrals and app development, further broadening their market reach. As the XaaS product suite grows, Engagers also move to cross-sell new products effectively, thus driving even more stickiness and revenue per account.

Takeaway: Winning Engagers focus on enhancing their post-sales account management to drive higher out-to-first-year revenue ratios, minimize churn and capitalize on cross-sell opportunities as they roll out more XaaS products.

The four stages of XaaS Sales Evolution help organizations understand the challenges they face along the road to XaaS-selling optimization. How fast a company is able to move through the stages depends on its commitment to building XaaS-specific capabilities and its ability to overcome strategic, tactical, and cultural roadblocks.

Aligning Sales Compensation to Accelerate the Transition to XaaS

Customer needs, pricing trends, implementation efficiencies and investor expectations continue to push software companies into the XaaS. Successful companies must re-evaluate and potentially re-configure every aspect of their go-to-customer model. One visible sign of a company’s commitment to the XaaS is their treatment of sales compensation. What sales compensation changes and potential trade-offs do hybrid software companies make as they transition from “Dabble” to “Engaged?”

Aligning sales compensation can be one of the most challenging and internally contentious issues as part of the transition to XaaS. The participants in Alexander Group’s research reinforced this point. A majority of the hybrid companies responded they are struggling with alignment of their sales compensation programs and highlighted four key drivers of their struggle:

- Fear of sacrificing existing revenue

- Concern about churn rates

- Inability to set quotas

- Risk of increased turnover

Sales Comp Treatment for Dabblers: A Dollar Is a Dollar

Ninety percent of the hybrids responded that sales compensation has a significant impact on their XaaS business. They recognize that to move beyond “Dabble,” they need to align their plans with the emerging priorities of the business. Yet 38% of the respondents provide no special treatment in their plans today. Even the most loyal sales representatives are unlikely to sacrifice their personal earnings to promote the new XaaS product. Companies with solid messaging, effective collateral and misaligned sales comp plans may find themselves stuck in Dabble purgatory: a land of big expectations and missed results.

Sales Comp Treatment for Adapters: Solution Parity

Hybrids in the “Adapt” phase focus on active learning coupled with adjustments to their go-to-customer model. In terms of compensation, they commonly drive parity between their XaaS and traditional offerings. Sellers still have a single quota and their XaaS sales receive a credit uplift or similar treatment. Credit uplifts typically vary between 1.5X and 3X, depending on the company’s pricing model and deal structure.

The upside to the parity model is that it supports a “customer first” approach where the company is equally supportive of both solutions. The risk is that sales representatives are drawn to their comfort zone and experience with the legacy solution. Parity approaches can have a short shelf life in companies with aggressive XaaS objectives.

Sales Comp Treatment for Scalers: XaaS Emphasis

“Scaling” hybrid companies recognize that at some point they need to prioritize XaaS over their legacy products. Fifteen percent of reserach participants emphasize XaaS in their sales compensation plans. They implemented add-on bonuses, incentive uplifts or rich credit uplifts (e.g., up to 4x ACV or more) in conjunction with a total sales quota. As a more aggressive option, some Scalers established a separate XaaS measure. Typically the measure modifies the accelerator rates. Meet the XaaS objective and earn an even higher over-achievement accelerator on total sales.

These additional treatments are all upside from the seller’s perspective; there is no penalty for not selling XaaS. The downside is that salespeople do not have to sell XaaS to reach their quotas.

Sales Comp Treatment for Engagers: Weighted Target Incentive

Companies that reach “Engage” are reaping the benefits of their investments in the form of lower expense to revenue (E/R) and the march towards long-term XaaS profitability. XaaS drives a significant portion of the revenue and receives even greater focus in the sales compensation plan. The most aggressive participants in this year’s study weighted XaaS up to 70% of total target incentive in their core plans. Sales representatives now have to sell XaaS if they want to earn their target incentive. Adding a linkage between the two measures (i.e., requiring reps to meet the XaaS objective to earn accelerators on total sales) reinforces its importance even further.

Ineffective quotas are one of the biggest risks to the success of plans using separate, weighted measures. The organization’s ability to deliver across the XaaS solution – from development through post-sale account management – heightens, as XaaS becomes the primary focus of the business.

Post-Sales: the Critical Investment for XaaS Growth

To be successful, leadership needs an effective post-sale growth model, one that invests significantly in post-sale roles.

Software companies continue to promote XaaS & subscription offerings, often with smaller initial deal sizes that they expect to grow in subsequent years. But achieving ongoing growth within customer accounts can be both challenging and costly. To be successful, leadership needs an effective post-sale growth model, one that invests significantly in post-sale roles.

Investing in a High-ROI Post-Sale Coverage Model

The framework for how companies can best approach the challenge of building an effective post-sale growth model begins with the realization to spend significantly more after the initial sale.

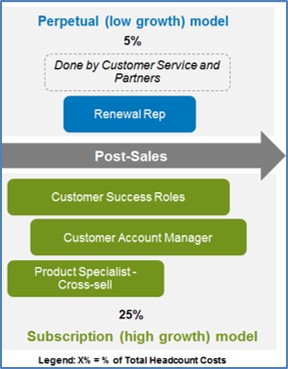

Compare traditional software, in which companies engage in “sell and renew” activities, selling a big perpetual license deal upfront, with minimal post-sales activities beyond renewing maintenance. On the other hand, in the XaaS & subscription world, companies sell smaller deals with shorter contracts, and then grow the recurring revenue in the out-years (i.e., after year one). In this model, roughly 15% of the customer lifetime value comes in the first year, while as much as 85% comes in the out-years1, as vendors expect to grow revenue by 20-30% per account, per year.

In the traditional software world, sales leaders focus sales budgets heavily on the “close,” deploying expensive resources (e.g., technical specialists and product experts) to aid field hunters in closing large perpetual license deals. Lower-cost renewal representatives manage maintenance renewals; the customer support group manages customer satisfaction. As a result, traditional software sales models typically invest less than 5% of overall sales expense in their post-sale roles, instead focusing 90+% on the “close.”

In the XaaS world, companies are shifting their investments towards post-sales, investing 3-4 times more in post-sales headcount than traditional software companies. The Alexander Group’s research found that some companies invest as much as 15-20% of total sales expense on post-sales headcount. In fact, 65% of the study’s pure-play XaaS companies spent more than 10% of sales expense on post-sales in 2015, and 100% say that investment is growing.

Picking the Right Post-Sales Roles

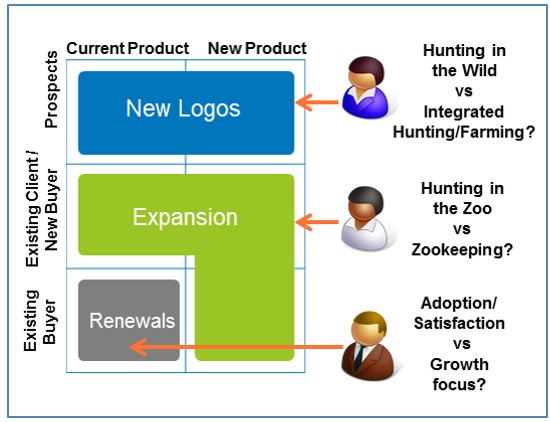

As pure-play XaaS companies run out of low-hanging fruit (new logos) and have to drive growth within the customer base, they need specialized post-sale roles. Similarly, many hybrids (i.e., traditional software companies transitioning to XaaS), recognize the need to sell XaaS to their customer base.

Many XaaS companies have deployed a customer success manager (CSM), a sales & support resource with limited pay at risk that is focused on driving adoption, satisfaction, nd in some cases, renewals. That is a positive first step, but after a short period companies typically realize that their CSM is unable to drive much focus on upselling or cross-selling.

Some companies will then explicitly tie their hunter representative to post-sale account growth in addition to their hunting—called “hunting in the zoo”—and often augment with sales specialists who can sell into existing accounts (as distinguished from traditional hunting—i.e., “hunting in the wild”).

However, for some vendors, this approach of using multiple sales representatives who upsell or cross-sell elements of the company’s solutions can be difficult to coordinate and can confuse customers. In these cases, companies may choose to deploy an account manager with significant pay at risk and a large growth target to coordinate everything from adoption through cross-selling. This role, sometimes called a “zookeeper” because of their deep knowledge and coordination of the account, may also team with a customer success manager, so they can stay focused on growth activities.

What’s the right model for your sales organization?

The decision on which roles a company should include in their post-sale coverage model depends on several key variables, including the opportunity for new logo acquisition, upsell growth, cross-sell potential, renewal stickiness as well as average sales cycle length and deal size.

When evaluating a company’s need for post-sale capabilities, consider these questions:

- How much XaaS revenue should be coming from post-sale activities?

- What/who are the buying points for upsell and cross-sell decisions?

- Does the company have the right resources/DNA mapped up against those buying points?

- Does the company have a clear process for how we can track and manage the post-sale process?

- Does the company have a clear idea of ROI from deploying post-sale resources?

The Upsell and Cross-Sell Imperative

Here are four key changes companies can make to their upsell and cross-sell models to enable future success.

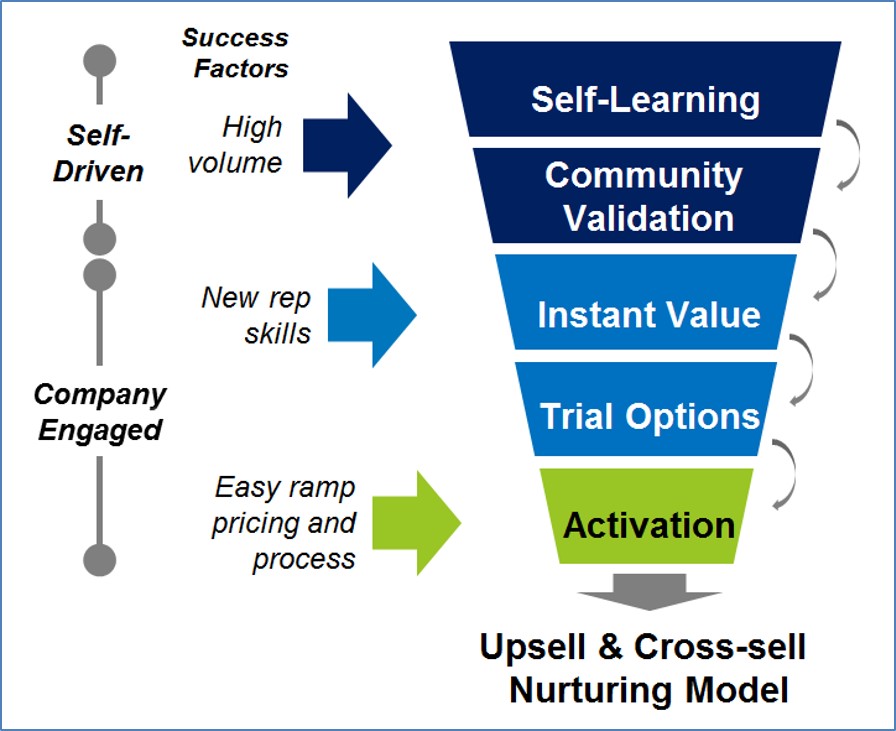

1. Above-the-funnel programs should effectively demonstrate value to customers

As companies look to grow revenue through upselling and cross-selling, the need for well-developed above-the-funnel capabilities (ways for customers to engage with products and solutions and evaluate the impact on business outcomes) rises to the forefront. Existing customers who see value in deployed solutions are more open to hearing about additional solutions that can positively impact their businesses. Software vendors that clearly show customers’ achievable outcomes set the table for highly scalable upselling and cross-selling success.

But in reality, many vendors today do not use above-the-funnel upsell and cross-sell programs to the extent they should. Free trials and freemium versions can help build strong awareness and familiarity with products and solutions, while outcome-centric use cases create a compelling reason to learn more. Sixty-two percent of the participants in Alexander Group’s research indicated that freemium and trial-based programs have a significant impact on their businesses. Sophisticated cross-sellers are also investing heavily in more robust online capabilities to drive awareness, education and engagement.

2. Tailor value propositions to customer needs

Effective upselling and cross-selling requires companies to formulate specific value propositions and then deliver them at the right time, to the right influencers. Poorly defined, generic value propositions can inhibit upsell and cross-sell growth. When shopping for technology, customers look for solutions to improve their competitive advantage. Effective value propositions should accommodate those needs. Marketing’s role in the value proposition development process demands heavy involvement. Marketing must understand how the products address specific business problems or outcomes, thus enabling them to produce more compelling collateral and messaging.

And in upselling and cross-selling, sales representatives require sufficient training to link more of their customers’ business problems with their offerings and solutions. Management should ensure that sellers are not over-reliant on their existing customer relationships and extensive product knowledge (i.e., “speeds and feeds”) to sell new products. Instead, management needs to help sellers create value through consultative discussions with customers, gaining deep understanding of business problems and using that knowledge to craft compelling value proposition messages.

3. Increase investment in upselling and cross-selling resources

Today, many subscription companies, as they shift away from perpetual models, are doubling or tripling their investment in post-sales resources dedicated to retention and growth. Within the more aggressive companies, post-sale resources can account for as much as 25% of sales headcount cost, with some of the most aggressive approaching 40%. But a key component of the post-sales model rests on how organizations orchestrate those resources to drive the most value out of upsell and cross-sell opportunities. Organizations with large upsell and cross-sell growth opportunities and diverse portfolios are employing customer account managers to own retention and growth and orchestrate resources (i.e., customer success, product specialists and hunter reps). The customer account manager role helps ensure stronger connections to all of the various influencer points and focuses on long-lasting relationships with customers that span multiple lines of business.

4. Sales compensation plans should reward the right behaviors

Effective sales compensation plans align with revenue strategy and drive the right behaviors. And in recurring revenue models, those behaviors should heavily focus on upselling and cross-selling. Some recurring revenue companies focus on growth within existing accounts, agnostic as to whether it comes from adjacent or core products. Others are very specific about driving growth through sales of adjacent products. It can be frustratingly difficult to move sales representatives out of their comfort zone, whether it is promoting subscription over perpetual, adjacent products over core, or expand over land. Yet, many companies do not reward sellers adequately for the right activities or results.

Upsell/cross-sell treatment in the sales compensation plan can range from product parity (i.e., reducing or eliminating solution bias in support of customer preference) to separate measurement and linkages (i.e., strong emphasis). For comparison, 38% of the hybrid companies in recent Alexander Group research provide no treatment for XaaS versus perpetual sales, while 12% of hybrids use a separate measure. The right level of upsell/cross-sell emphasis in the sales compensation plan should be a reflection of the upsell/cross-sell strategy, sales motions and selling roles.

Keys to success for your upsell/cross-sell model

How important are upselling and cross-selling to your revenue growth goals? What changes should you consider to your model?

If you’d like to learn more, please contact an Alexander Group Technology practice leader.