Transforming Your Sales Organization for Growth

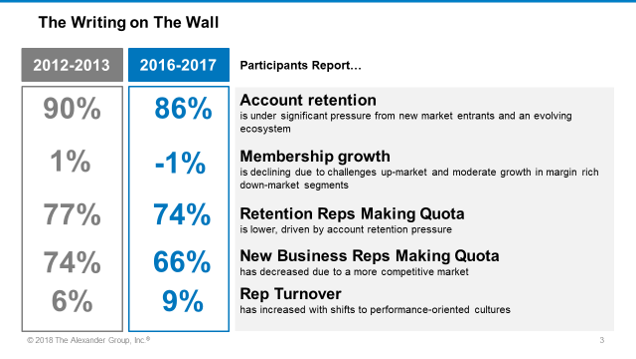

The health insurance industry has faced years of uncertainty–from new legislation, to new buying expectations and new entrants in the market. Alexander Group’s recent research finds the health insurance industry continues to show signs of strain. Key vitals indicate not only a downward trend on both membership growth and retention, but also a decrease in the number of sellers making quota and an increase in sales employee turnover.

Given these dynamics, revenue leaders are facing a crossroads in their path to continued growth. To succeed and get back on the growth track, it requires revenue leaders to invest in new sales organization strategies and capabilities.

Given these dynamics, revenue leaders are facing a crossroads in their path to continued growth. To succeed and get back on the growth track, it requires revenue leaders to invest in new sales organization strategies and capabilities.

Expanding beyond traditional sales models

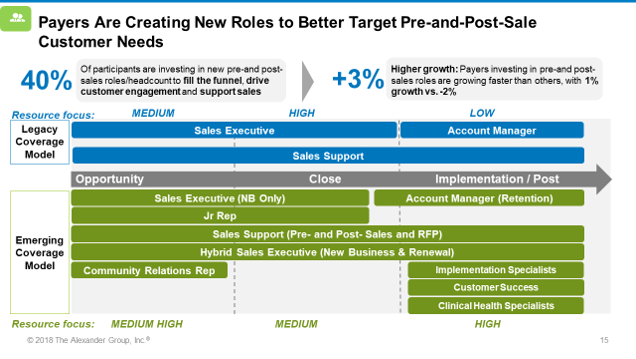

With a more competitive and demanding marketplace, payers are evolving the legacy sales executive and account manager model to better meet customer needs. To do this, payers are investing in new pre-and post-sales roles that drive top of the funnel activity, customer engagement and better support sales. Alexander Group’s (AGI) research found that payers who invested in new roles experienced 3 percent higher growth than their peers who maintain a legacy sales model. Leading payers are:

- Investing in Lead Generation/Community Development to develop employer relationships within the community and hand off to the sales organization to pursue with broker partners

- Deploying Junior Sales Reps to provide support across the sales process and build a bench for sales executive and account manager talent

- Expanding Post-Sales Customer Success to drive employer engagement around population management, utilization and new programs and improve customer experience through the initial onboarding experience

Establishing a pay for performance culture

Inherent in transforming a sales organization is shifting the supporting sales compensation program to align with the new strategy. Payer sales organizations of the past were a “nice place to work,” with more than 75 percent of the sales organization meeting or exceeding their sales goals. In today’s competitive market, AGI’s research shows the number of sales representatives meeting or exceeding goal has declined to 66 percent, which is in line with AGI’s ideal performance distribution. To maximize the return on investment of their sales organization, revenue leaders are shifting the expectations of what high performance looks like. This includes changes such as:

- Creating a stronger link between goal performance and incentive pay

- Setting the expectation and rewarding for book of business growth

- Focusing on cross-selling to expand outside of the traditional products

Enabling with new tools and resources

To support a pay for performance culture, investments in tools and resources are required to position the sales team for success. These investments include greater management coaching, training programs and updated CRM systems. Greater coaching will be critical to scale the sales organization of the future and manage to the new expectations of high performance. Training programs provide sellers the consultative skills needed to sell new and different products and services to an increasingly demanding customer base. Lastly, updated CRM systems provide a streamlined interface for sales reps and managers to drive pipeline performance and integrate with quoting and implementation systems.

If your sales organization is at a crossroads, the Alexander Group can help transform your organization for growth. Contact us.

Visit our Health Insurance practice page for more ideas on how health insurance carriers must adapt to market changes for profitable growth.

Original author: Jenna Greco