3 Sales Incentive Traps to Avoid

No industry understands the pressure to be nimble better than integrated and pure-play digital media advertising companies. Over the past five years, these organizations have had to quickly respond to changes in product strategy, business objectives and other market factors. These marketplace shifts have led sales leaders to make tough go-to-market decisions, constantly placing bets on which products to sell, how to introduce them, and how to position new solutions to different customer segments. As a result, the incentive plans need frequent updating to stay aligned with the growth objectives of the business. Sometimes good intentions result in plan design ideas that sound good on paper but turn in to costly mistakes. Here are three sales incentive design traps for media ad sales leaders to avoid.

Sales Incentive Traps to Avoid

Trap #1: Overreliance on SPIFs

An organization with declining core revenues relied heavily on SPIFs and auxiliary product commission rates to drive focus across its full product portfolio, sending out a quarterly “Executive Memo” with rates for an ever-growing list of specialty products. However, what leadership really wanted was to slow core revenue losses and grow digital product revenue.

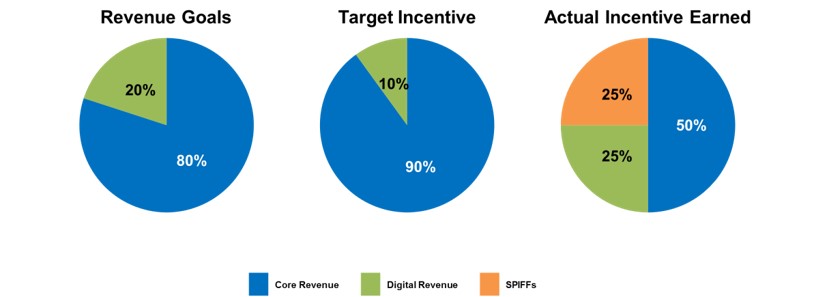

In Figure 1, it is easy to see the sales incentive misalignment; core revenue and digital products should be the main focus, which was supported by Target Incentive weighting of 90%. However, when AGI examined Actual Incentive paid by product, one fourth was earned from products and contests outside of the core plan design. In other words, incentive paid out to sellers was not aligned with the company’s business goals. Incenting for several different revenue streams outside of the sales compensation program distracted the sales force and inhibited the organization’s strategic objective attainment.

Figure 1: Proliferation of Product Commissions and SPIF result in misaligned incentive payments

Many organizations can come to over-rely on SPIFs, making them predictable and diluting focus away from the core products that drive success. If SPIFs are never taken away, the sales force can feel entitled to the additional income, and earnings expectations may inflate. When taken away, morale can deflate and there is always a retention risk.

In order to drive the right focus on your key business objectives, it is imperative that you start with aligning the incentive program to the most important drivers and reduce reliance on auxiliary SPIFs to support revenue growth. Although it takes great courage to take away SPIFs, you will achieve a clear message and gain laser focus on the products that matter.

Trap #2: Product Commission Rates Drive Product-Centric Sales Behaviors

The complex and rapidly changing marketplace creates the need for frequent go-to-market strategy changes. As more products are introduced, the sales team must spend additional time and effort to learn how to sell their ever-expanding product portfolio. Concurrently, most advertising customers want a business partner who understands their objectives and can create a holistic solution, not sell them the product of the month. If your incentive program doesn’t evolve with your sales strategy and your customer’s buying behavior, there is bound to be some tension.

Rate cards that offer reps different commission rates by product can lead to the sales rep “shopping the plan,” i.e., selling specific products that are either easier to sell or offer higher rates. This behavior drives “product pushing” rather than a customer-centric sales strategy. To avoid this behavior, incentive plans can equally incent the entire portfolio, provide higher pay for bundled solutions or solutions that “right fit” the customer’s needs, or leverage a hurdle mechanic to ensure portfolio goals are met.

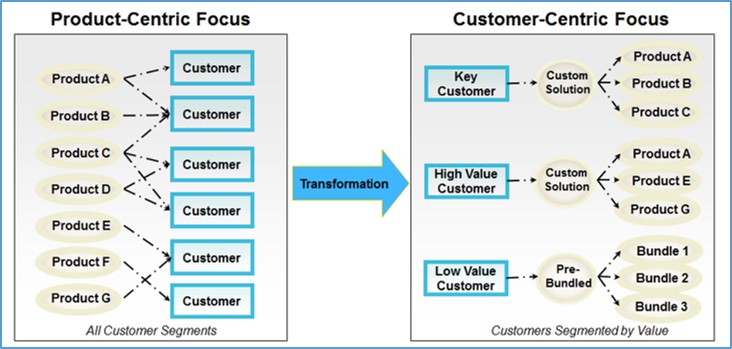

Figure 2: Transforming to a customer-centric sales organization involves truly understanding each customer’s needs and aligning a solution to fit. Successfully executing this shift to customer-based value offerings involves several key challenges that require careful and thorough management orchestration.

Trap #3: Retroactive “Hit Your Objective” Plans Pay Big… for a Little Incremental Revenue

Top line revenue growth is often the top priority for digital media companies. To put greater emphasis on growth, some media companies have experimented with high retroactive commission rates that kick in when the rep hits a certain revenue target. In other words, a rep can earn an accelerated commission rate on all revenue dollars if a specific revenue objective is met.

While these plans are extremely enticing to reps and motivate them to reach their goals, they can be very expensive and create huge commission payouts for little incremental revenue. Furthermore, once the rep hits the target and realizes a big retroactive payout, their motivation to keep selling can wane.

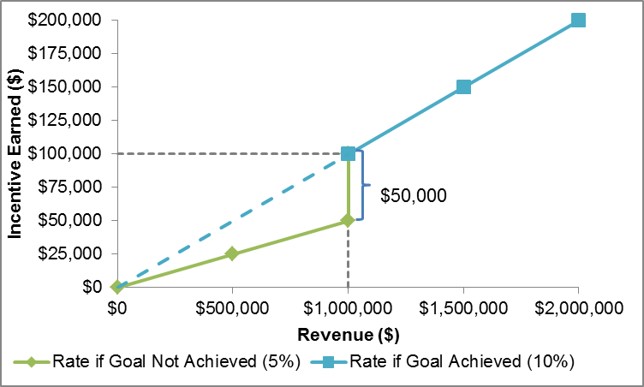

Figure 3: Example of a retroactive, dollar one commission plan. Base rate of 5% paid if goal is not achieved. Accelerated rate of 10% paid, back to dollar one, if goal is achieved.

We’ve seen several media sales teams use an iteration of this plan mechanic, and unfortunately, we have found that is doesn’t support aggressive growth tactics. For example, one organization had a substantial number of sellers just achieve their individual revenue goals. However, the sales organization did not hit its overall sales objective. Upon further investigation, it was discovered that sellers drove their revenue just slightly above 100% of goal, collected a massive incremental payout and largely stopped selling. As a result, the organization exceeded its incentive budget and was sacked with a high cost of sale.

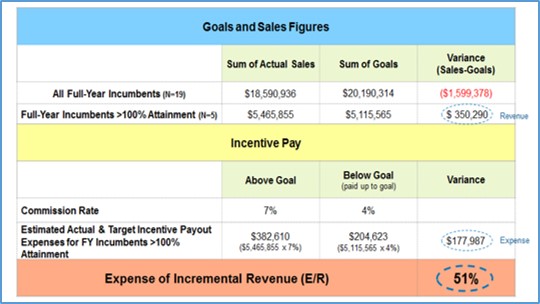

Figure 4: Dollar one commission structure paid an extra $177,987 of incentive for an incremental $350,290 of above-goal revenue, resulting in incremental revenue E/R of 51%.

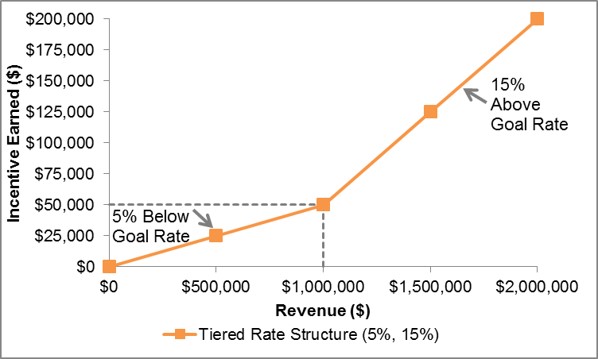

These retroactive commission mechanics can promote undesirable selling behavior. A better approach is to offer a tiered, accelerated commission structure that is not retroactive, but instead takes effect once target is achieved. The outcome supports a strategy of growth, still provides an attractive overachievement incentive, and results in less distracting and costly payouts.

Figure 5: Example of a tiered commission plan that pays one rate (5%) for below goal revenue and one accelerated rate (15%) for above goal incremental revenue.

In Summary

If you’re a sales leader in digital media, watch out for these three incentive traps. You want to avoid an incentive plan that pays out all or more of the incentive budget for below par sales results. Getting a clear understanding on where your incentive dollars are going and how to best align your plans to your growth objectives can be an onerous task. The Alexander Group has extensive experience working with media advertising organizations and can help you examine your sales incentive program to make sure it supports your current growth objectives and pays for the right type of sales performance.

Learn more about Alexander Group’s Media Sales Practice.