Healthcare Leaders Invest for Growth

Each year the Alexander Group (AGI) conducts a pulse survey of revenue leaders to understand goals, investments and challenges for the year ahead.

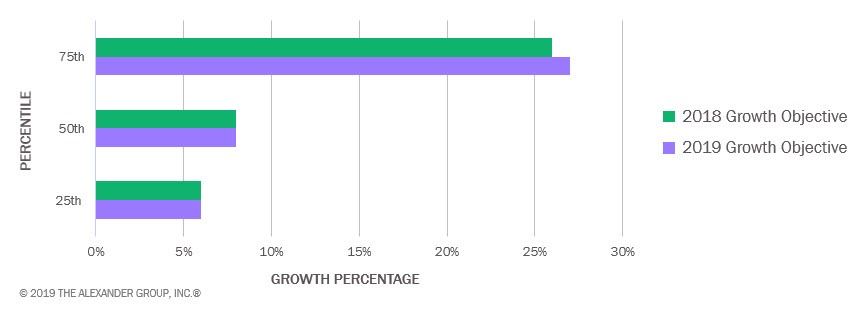

This year’s twelfth edition offers responses specifically from leaders within the healthcare industry. Our respondents, whose companies range in size from $500 million to more than $5 billion in revenue, showed continued optimism in their ability to build upon a successful 2018 to achieve equally aggressive 2019 growth aspirations:

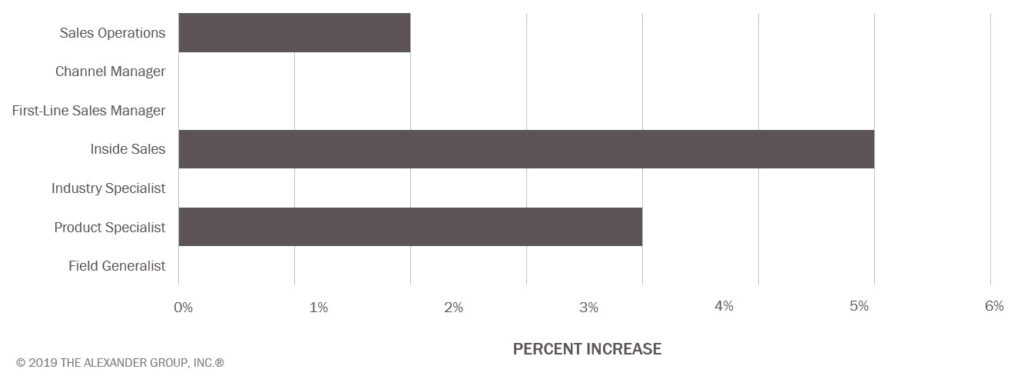

As you might expect, sustaining such aggressive growth rates requires targeted investment in the form of both dollars and headcount. Specifically, we found revenue leaders looking to increase sales expense and/or headcount for those resources that directly interact with providers/customers or those that increase overall organizational effectiveness. We did NOT see increases in “generalist rep” roles:

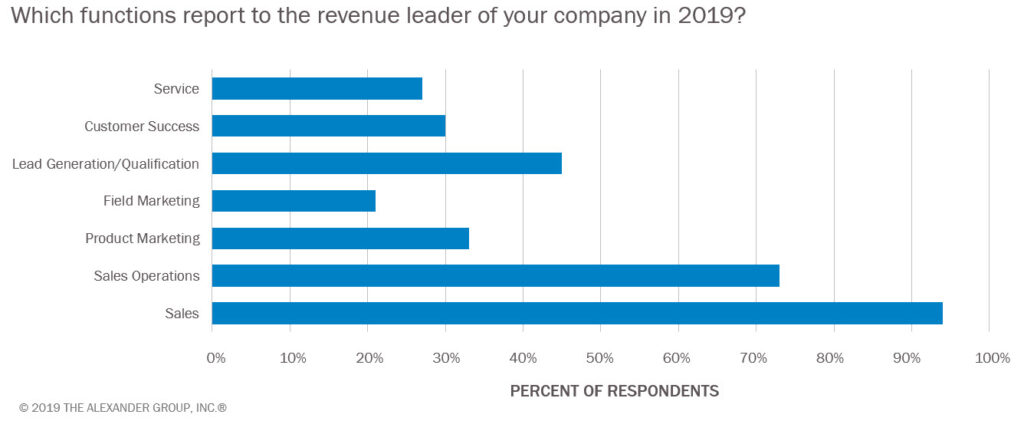

Maintaining growth in the complicated healthcare ecosystem requires a coordinated, multifaceted approach across marketing, sales and service. As such, another trend beginning to emerge is the increasing responsibility falling within the purview of the revenue leader. We anticipate the percentages around somewhat non-traditional areas within the revenue leader organization such as customer success, field marketing and service will continue to increase:

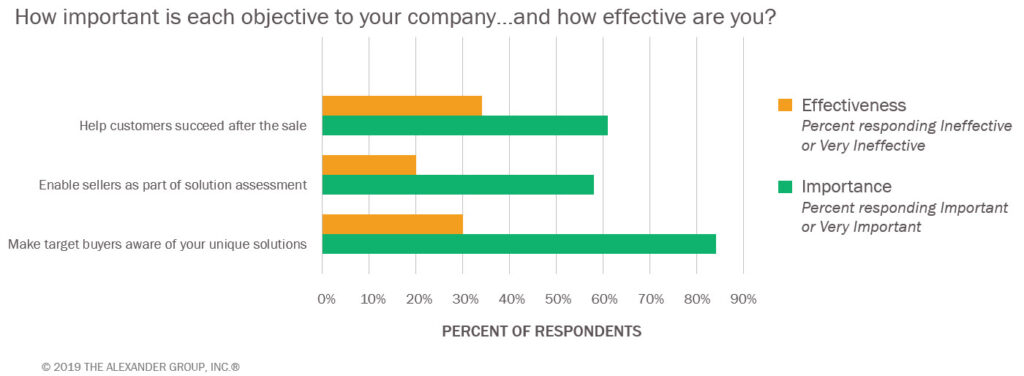

Finally, we did find areas where healthcare revenue leaders were struggling to achieve their objectives: Customer awareness, solution assessment and adoption.

In other industries, each of these objectives would lend themselves nicely to the execution of a successful digital strategy. Given regulatory concerns inherent in healthcare, we do not find the slow uptake of digital particularly surprising. However, AGI believes the inevitability of executing a successful digital coverage strategy, even within healthcare, remains.

Healthcare leaders continue an optimistic outlook heading into 2019 and anticipate making targeted investments in support of achieving their growth goals. Is your organization investing sufficiently in areas such as commercial operations and inside sales? If not, you could find yourself falling behind.

Receive a personal briefing on insights gathered as part of our 2019 Pulse Survey−Healthcare Cut. Or participate in our current research study aimed at providing insights around the strategies, roles and investment by medical device, pharma/biotech and health tech companies across the Buyer Journey. Contact us to learn more.

__________

Related Resources

Senior Healthcare Executives

Exclusive in-depth discussion of the top trends in key commercial investment areas for 2019

Learn More/Register

Navigating the New Healthcare Ecosystem

New whitepaper offers insights about Innovative Technology, Changing Job Market, Commercial Model Evolution and Leveraging Revenue Motion

Read More