Is medical device sales going rep-less?

The rep-less model looks like another IDN strategy to lower price. But it may portend a new growth opportunity in services for vendors. What’s going on?

Driven by cost pressure and the relentless focus on unit price, the more sophisticated IDNs decompose their vendor price, breaking down SG&A, and sales rep-related costs more specifically, even asking vendors to give them their sales rep pay levels and quota sizes. Vendors comply if the IDN is large with market power. The IDN objective is to pressure vendors to remove excessive sales expense from the price equation. Rather bold. But why? The kerfuffle started with orthopedic implants a few years ago, when some IDNs purported that vendor SG&A accounted for up to 40 percent of the implant price. Hospitals didn’t see much value in the rep, although the orthopedic surgeons may have. Some hospitals were so disillusioned with the combination of high prices and excessively influential reps that they kicked out the sales reps and argued for lower prices. Now, as hospital administration takes the purchasing reins from physicians, the rep-less model is expanding beyond implants to other medical product categories.

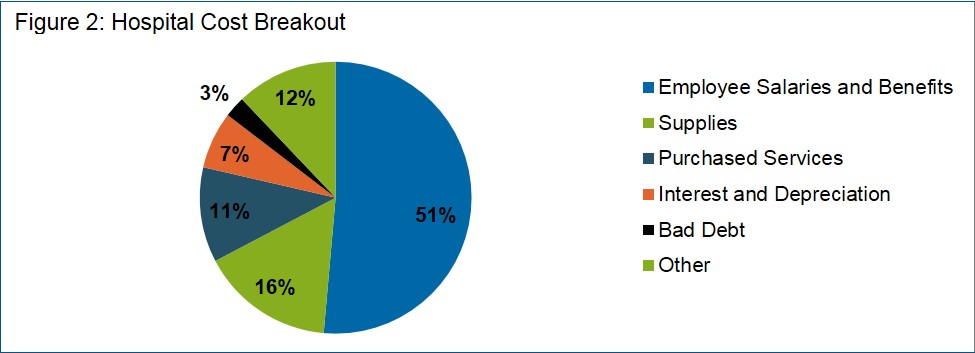

It goes something like this … The hospital encourages the vendor to eliminate the sales rep calling on that hospital. In so doing, the hospital declares it has lowered the vendor’s sales cost and thus deserves its fair share of the savings in the form of lower price. For example, say a hospital purchases $1M of product from a vendor. And say they learn the vendor pays $375K in total cost for the sales rep that calls on that hospital. The hospital would expect to recoup some portion of the $375K in the form of price reductions by going rep-less. This portion could be the share of the rep’s total expense attributable to that given hospital. Sometimes the hospital and vendor consider the hospital-specific expense as identical to that hospital’s share of the rep’s quota. For example, if a hospital wants to go rep-less with a vendor, and the vendor sales rep has a $10M total territory quota, and the given hospital accounts for $1M (10 percent), then the hospital may expect the vendor to reduce aggregate price by $37.5K (10 percent of the rep expense). See Figure 1 below.

Sales Implications and Choices in a Rep-less World

Sales Implications and Choices in a Rep-less World

Once the rep-less account is uncovered, the sales leader must make a few immediate decisions. First, the sales leader should realign sales territories so the affected rep territory can be built back up to its previous size. In the above example, the rep needs another $1M of territory value. Ripple effects from rebuilding one affected territory may require realigning many or all sales territories. The end result may reduce total field rep FTE levels. Alternatively, the sales leader may assign new accounts to keep territories and sales headcount intact. The last option would be reducing the affected rep’s quota from $10M to $9M. However, preserving the overall expense-to-revenue ratio would require reducing rep expense by $37.5K.

If the story ended here, it would be a sad one for the device vendor. Cutting price and reducing sales coverage is no way to grow. Instead, proper account management and contracting should ensure some type of rep-less quid pro quo where both hospital and vendor share risk and reward. In this example, if the vendor reduces price by $37.5K, then the vendor must get something in return. Ideally, this would include a hospital commitment to greater contract compliance or a sole source deal, allowing the vendor to make up for the rep-less price reduction with greater sales volume.

But maybe the win for vendors lies not so much in greater product volume but in profit from delivering valuable services to the rep-less hospital. To be sure, today’s device sales rep delivers a huge amount of “free” service to the hospital. The fact is, these services are not free; their costs are buried in the product price. Our hospital ride-alongs with dozens of leading device vendor reps reveal that most of their time can be spent not selling but rather delivering services that hospitals value, and thus may be willing to pay for, including:

- In-servicing and training department staff on the use and maintenance of the product

- Ordering, shipping, unboxing and stocking products on shelves

- Cleaning and sterilizing products

- Arranging trays and kits

- Attending cases and providing real-time consulting/solutions to unanticipated problems including when procedures “go south”

Generally making sure the OR, labs or other facilities run smoothly

Services in a Rep-less World: A Vendor Opportunity

All of these valuable services are part of the legacy quid pro quo, whereby hospitals permitted reps to influence doctors and purchasing decisions, in return for valuable “free” services provided by the vendor rep. The rep-less model would put an end to this legacy. However, these services are still valued by hospitals, so the question is … who exactly is going to deliver them in a rep-less world?

We see a few examples emerging. Mercy Hospital Springfield in Missouri (spine devices) and Loma Linda University Medical Center in California (orthopedic implants) have gone rep-less and by all reports have cut their device spend materially. However, they’ve also hired full time hospital technicians to handle the services once delivered by the quota-carrying device sales rep. We also see third-party services companies and GPOs popping up to deliver the same services. So the rep-less models will require additional spend in either hospital employees or purchased services.

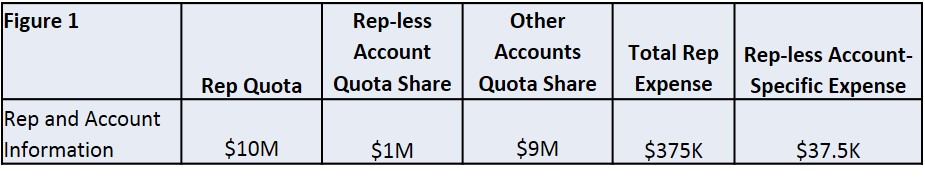

Hospitals are labor-intensive, with over half of all operating costs devoted to employee salaries and benefits. Supplies, including all types of medical devices, make up the second largest portion at 16 percent. The third largest bucket is purchased services. See Figure 2, below. Increasingly, hospitals are connecting the dots, purchasing supplies and services that directly or indirectly reduce associated labor costs. It would be a pity if the emboldened hospital administrator cost-cutters pushed too hard to eliminate vendor reps to get device price cuts, only to pay more in the end with unintended additional labor costs.

Conclusion

Vendors are best off by taking the bull by the horns and actively developing a rep-less value proposition. To this end, last summer, Smith & Nephew launched its Syncera rep-less brand, offering low-priced legacy hips and knees without rep support (but with an iPad app). Wright Medical did something similar in 2013. But these vendor-driven rep-less programs offer less for less. They also do not address the emerging service vacuum that will suck the life out of well-intentioned hospitals and vendors alike in a rep-less world. The bolder vendor value proposition will deliver valuable services to hospitals at a fair margin alongside lower-priced products. This will require updating customer marketing, strategic account management strategy, and field deployment. The rep-less trend can be an opening for clever device leaders to differentiate themselves, and accelerate revenue growth without adding sales cost.

AGI’s medical sales consulting practice helps device clients strengthen their position in hospitals in an increasingly competitive and complex selling environment. Our clients achieve success by delivering insight to hospital customers and adapting winning practices from outside legacy hospital sales models.

Learn more about our Medical Device practice.