Medical Device Sales: Return of Revenue Growth

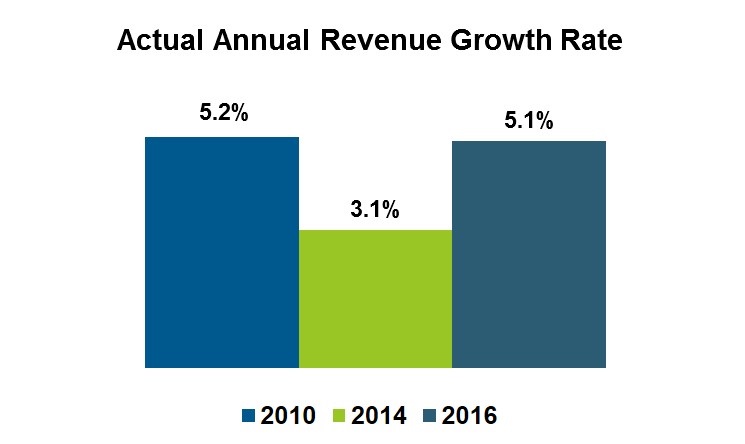

Revenue growth has returned to the U.S. medical device industry. Year-over-year revenue growth topped 5 percent last year, rebounding from a low of 3% in 2014. Growth is now back to 2010 levels. How are medical device companies achieving this growth? More importantly, how can they accelerate future growth? And what stands in the way?

Expanded Portfolios Will Lead to Long-Term Success and Create Coverage Complexity

Most device vendors are expanding their product portfolios and developing new solutions to help their hospital customers develop new revenue streams. This requires a more complex sales organization with additional technical skills and solution-selling capabilities. The fastest growing device companies manage across all revenue motions. These leading-edge commercial organizations deliver value through product fulfillment, customer advocacy and innovation across both clinical and financial dimensions. They deploy the right jobs at the right resource levels in the right places.

Drive Growth Through Targeted Investments

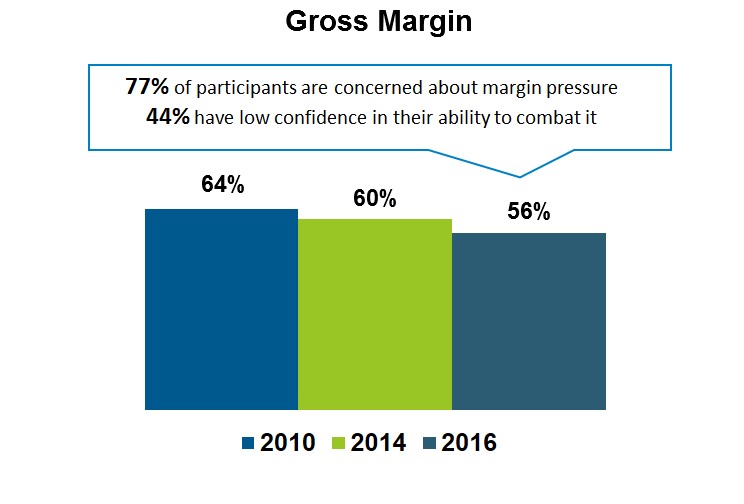

At the same time, the most important medical device customers–hospital CEOs–foresee greater revenue uncertainty and pressure on operating margins. They point first to the transformation of the reimbursement system, including the rise of at-risk contracts with payers. In addition, as healthier patients are directed to lower-cost non-acute sites, two things happen to hospitals: inpatient revenue declines; and the severity of those who end up in hospitals increases. The specter of treating more uninsured patients in a modified ACA world further dampens the hospital margin outlook. So hospitals will continue to pass on margin pressure to their vendors and continue to demand lower prices. As a result, vendor margins will continue to decline about a percentage point each year. See the figure below.

U.S. Medical Device Revenue and Gross Margin 2010-2016

In turn, device leaders will hold tight to their marketing, sales and service purse strings. Medical device vendors reduced their sales expense to revenue ratio from 16.9 percent in 2014 to 15.5 percent last year. It’s not all cost cutting. Medical device vendors are making targeted investments in their commercial organization to drive growth. Leading-edge companies make the following investments:

In turn, device leaders will hold tight to their marketing, sales and service purse strings. Medical device vendors reduced their sales expense to revenue ratio from 16.9 percent in 2014 to 15.5 percent last year. It’s not all cost cutting. Medical device vendors are making targeted investments in their commercial organization to drive growth. Leading-edge companies make the following investments:

- Expand key account management to innovate and differentiate at large accounts

- Deploy software and IT sales specialists to sell connected devices and help hospitals leverage data analytics

- Expand field marketing to sharpen value propositions and messages

- Deploy lower-paid junior representatives to expand field coverage and execute routine (fulfillment) activities without increasing costs

Contact an Alexander Group Medical Device practice lead.