The Rise of Lower-Cost Sales Roles

A crucial shift in how major hospitals buy medical devices has prompted a rise in the deployment of lower-cost sales roles. The Alexander Group’s Medical Device Sales Trends Study revealed significant growth constraints facing medical device companies. Growth has slowed to an anemic rate of 3.1% and margins have decreased 5%. The culprit? Major hospitals have changed how they buy. Historically, physician preference drove usage and ultimately the purchase of medical devices. Today, hospitals and the health care system are facing margin pressures, which is changing the buying process for medical devices. Clinical outcomes and total cost of product usage continue to override the physician’s waning influence in device purchase.

However, the new buying process creates a sizeable challenge for the traditional industry sales and service model. In the past, medical device vendors routinely persuaded the highest-value physicians to use their devices based on technical features and benefits. To convince doctors and staff of the benefits, sales representatives would serve as technical experts in cases. This created a dependency: physicians and nurses became dependent on sales representatives for technical product questions as well as ensuring the appropriate device was available at all times. As a result, highly compensated sales representatives transformed into technical service representatives. As hospitals began asking for steeper discounts, a significant challenge emerged.

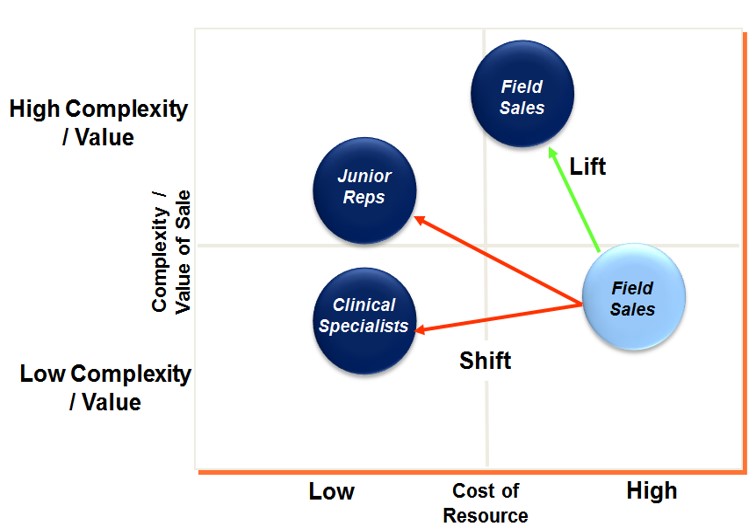

Customers demanded service, but the margins that funded the service came under enormous pressure. Something had to change. Enter the Shift and Lift model. Sales leaders shift lower-value service activities to less costly resources, thus freeing expensive sellers to help grow the business. Generally, these less expensive resources consist of junior representatives and clinical specialists. The illustration below provides a representation of the model.

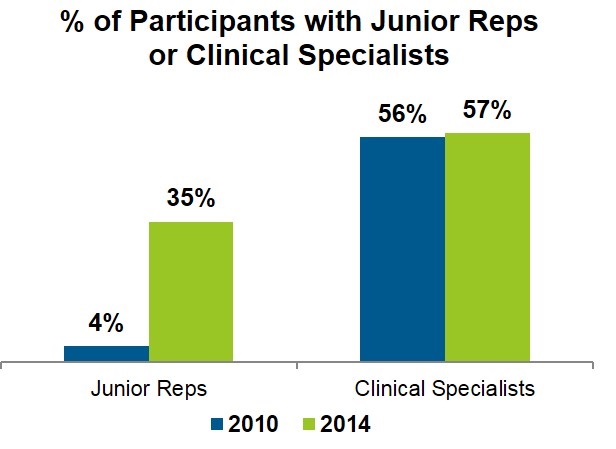

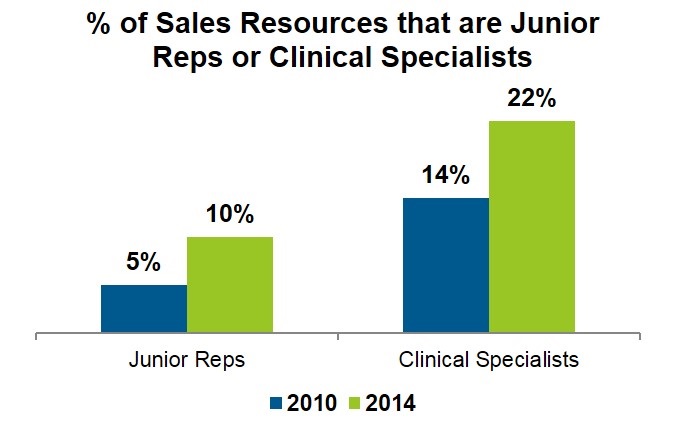

Clinical specialists are not new to the industry and the percentage of companies utilizing clinical specialists is fairly stable. On the other hand, the percentage of companies utilizing junior representatives has increased dramatically. In Alexander Group’s most recent study, the percent of companies utilizing junior representatives increased from 4% to 35%.

For both roles, headcount has also increased substantially. In 2010, these roles represented less than 20% of the sales force headcount. Today, they represent over 30%.

The overwhelming industry trend is to increase the usage of less costly resources that focus on lower-value service activities. Product and/or business needs drives the decision to utilize clinical specialists or junior representatives. Generally speaking, clinical specialists are trained, allied health professionals whereas junior representatives are less experienced sales representatives who receive clinical training to support the products and services they represent.

The overwhelming industry trend is to increase the usage of less costly resources that focus on lower-value service activities. Product and/or business needs drives the decision to utilize clinical specialists or junior representatives. Generally speaking, clinical specialists are trained, allied health professionals whereas junior representatives are less experienced sales representatives who receive clinical training to support the products and services they represent.

The deployment model of the resources can vary substantially from company to company. Deployment models include:

- Pairing with a more senior sales representative

- Providing open territory coverage

- Floating based on local geographic needs

- Assisting with large conversions

- Conducting clinical training programs (clinical specialists only)

When deployed successfully, these resources increase selling time and sales growth at a lower cost.

If you would like to learn more about how to successfully deploy clinical specialists and junior representatives, please contact us.