Sales compensation trends for pharmaceutical sales

Pharmaceutical organizations have weathered rapid change over the past decade. Large sales forces rationalized by promotional response models and the desire to maximize share of voice, have become less influential with their physician audiences as doctors lose autonomy to payers’ who exert more control to reduce drug costs. Physician autonomy has been further reduced as many doctors become employees of large institutions and networks. This can reduce sales person access and influence even further.

Pharmaceutical sales organizations have responded by “right-sizing” field operations and re-allocating resources to Managed Care key account groups, with rebates and related spending now exceeding field sales expenditures.

In many cases, field sales compensation has not kept pace with these changes. Programs are often misaligned with current sales realities.

Critical comp plan changes to consider include:

- Measures which form the basis for plan design: Not all Rxs are created equal. As branded categories become increasingly competitive, it becomes even more critical to align plan measures with growth opportunities and brand strategies. Prescriptions that are likely to be leading indicators of new value creation, and therefore future growth may be emphasized. Incentive plans can also be designed to reward desired indications or the most attractive physicians.

- Plan formula type: Most sales incentive plans are “pure bonus” plans, paid based on percentage goal attainment at all performance levels. We have seen situations where this may result in over-payment for production from small territories, and conversely potential under-payment for territories with larger goals. Alternative plan designs that reward those with larger territories based on Rx volume over goal may be considered. These plans are still goal-based, but avoid the “large territory penalty” some reps face if larger base sales make it difficult to continue to achieve large percentage overage rates vs. goal.

- Payout curve calibration: Our 2012 Pharmaceutical and Biotech Survey indicates that many sales organizations exceed their sales compensation budgets, without corresponding sales results. This is often due to plan payout curves that contain highly accelerated rates. In these cases, the overage payouts to those exceeding their goals far more than offset the “savings” realized from those who do not achieve theirs. Reducing the degree of for above goal performance and applying decelerators at extremely high attainment levels (that may arise from external circumstances) can help address this problem. In all cases plan costs must be simulated to ensure that aggregate payouts align with overall sales force performance.

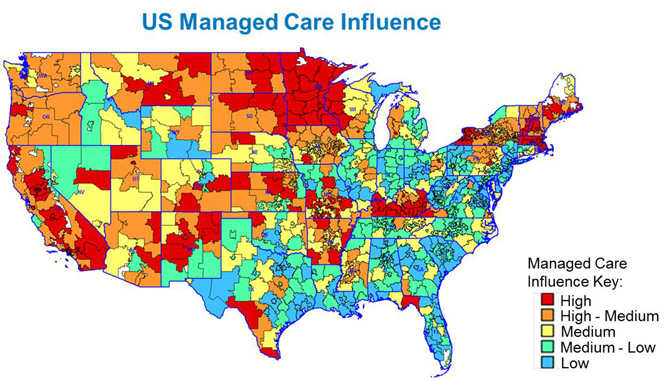

- Territory goaling: Goals represent the critical foundation for most sales incentive plans. However, goaling is often flawed because it does not consider all of the elements of “attainable potential” available to each salesperson-especially in light of the declining power of individual physicians and the increasing influence of external forces such as Managed Care, illustrated in this Managed Care Influence map below. Though payer influence is important, impact on prescribing decisions are likely to vary by territory.

Most pharmaceutical sales organizations have faced the daunting prospect of change, moving from an “arms race” to more precise, targeted approaches for covering physicians, payers and institutions. More change will be required as sales organizations address the changing needs of larger, integrated providers—many of which are take on the a payer function, or align themselves with a select set of insurers. In this new world, it becomes even more important to align incentive plans with emerging sales roles to ensure that plans motivate all sales people at all times, while remaining fiscally responsible.