Pharma Sellers: Differentiate and Calibrate Your Message

At a recent EyeForPharma conference in Philadelphia, one theme rang clear: Put patients at the center of the pharma industry. Speaker after speaker noted how pharmaceutical manufacturers and their partners need to create flexible, regionally sensitive, patient-first and patient-relevant commercial models. No longer should models revolve solely around the health care provider (e.g., the physician) or even the new emerging decision makers (e.g., value committee). Instead, the pharmaceutical manufacturer’s research, development and commercialization of much needed and innovative therapies must first reflect the needs of the patient. When evaluating commercial models, pharma manufacturers should consider two themes: differentiation and calibration.

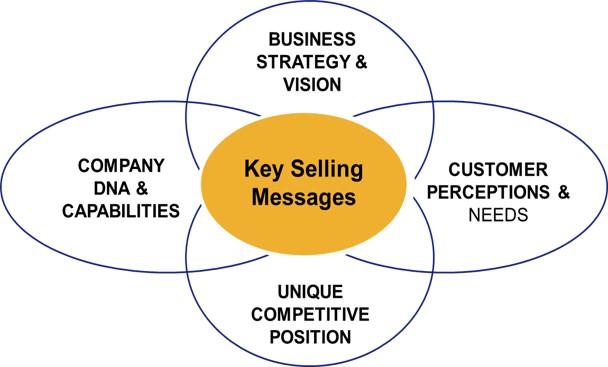

One point of failure the Alexander Group (AGI) frequently encounters is the fatal disconnect between marketing, sales and service in what we refer to as Value Proposition development and delivery. (See figure below). Failure to proactively collaborate on customer-tuned value propositions leads to selling messages that lack the specificity, evidence and customer relevance to be effective. When clients get this piece correct, they are well on their way to creating a successful patient-first commercial model.

QUESTION 1: What differentiates your offering from the competition? Specifically, what differentiates a company’s offering in the mind of the patient? Answering this question requires a degree of understanding about patient relevance. Consider, for example, two patients (A and B) suffering from Parkinson’s disease. Patient A describes her priority as keeping her disease and symptoms from her co-workers and employer. Patient B’s concerns, on the other hand, center on how his involuntary leg motions at night keep his partner from sleeping soundly. Under this scenario, simply delivering standard of care messaging and data will not successfully differentiate one’s offering in a meaningful way for the patient. Understanding and creating comprehensive patient profiles will enhance understanding the importance and relevance of one’s competitive advantage. Put another way: the standard of care approach to health care does not work in a world moving towards individualized medicine.

QUESTION 2: Does your average sales person have the insights, evidence and messaging to be effective at the point of influence? Again, this is a deceptively simple question. Note the phrase, average sales person. Too often, clients describe the need to simply find “another 10 sales people like (insert name of top sales person here).” AGI’s experience suggests such a sentiment describes a losing sales strategy. Consider that the top 10 percent of a company’s sales force are typically “natural athletes.” Organizations can take actions to better reward and support the top 10 percent (and they should). However, those actions do not apply to the primary question involving the average sales person. The focus here is on the “massive middle” (i.e., the average performer that makes up 60 percent of a commercial organization). The average sales person requires relevant evidence to support them at the point of influence.

Take for example, a medical diagnostic organization struggling to sell their (more precise) test into hospitals. While the offering included data to support better accuracy than the nearest competitor, sales remained stagnant. Once the client viewed the value proposition from the end user’s perspective—the competitive diagnostic involved a finger prick while the more precise diagnostic required both a finger prick and a stool sample—they recognized the key detail.

Now, imagine the audience for this message to be the hospital nursing staff responsible for administering the test. The existing value message of “more accurate” failed to motivate nurses to suggest the more accurate test. Luckily, the manufacturer took a closer look and realized the impact of misdiagnosis. It turns out, misdiagnosis (in part to the less accurate finger prick tests) led to several additional weeks of patient time in the hospital. Suddenly, a calibrated patient-first message made the value proposition far more compelling to the nursing staff. Nurses suddenly understood the value associated with the up-front effort of collecting a stool sample.

As health care moves from fee-for-service through population health management to individualized medicine, the concept of relevant, substantiated and calibrated value propositions becomes even more important. Be sure to understand the competitive advantage of your offering under each and every relevant scenario. Then, focus on enabling your average sales person to be able to deliver your most compelling value proposition at the point of influence.

The Alexander Group understands how to translate marketing/product messages into impactful value propositions for your sales organization. Contact us to learn how we can assist you in becoming a more patient-centric organization with a well-defined, relevant and substantiated value proposition.

Learn more about Alexander Group’s Pharmaceutical Sales practice.

Read more AGI insights on the Pharma industry.