PE Managers: Transform the Customer-Facing Organization For Growth

Private equity managers raise funds and make deals based on their ability to create above-market returns for their investors. For most of the ’80s, ’90s and early ’00s, PE firms relied heavily on financial engineering and operational improvements to reduce costs, improve cash flow and create value. Competition in the marketplace has rendered these skills commonplace. Acquisition target valuations today already account for financial and operations improvement opportunity. Therefore, PE firms in search of more profitable investments must acquire a new skill – driving organic growth. Research indicates revenue growth creates more shareholder value than cost cutting, improving free cash flow or multiple expansion – combined. For PE firms to create above-market returns for their investors, they must add driving organic growth to their repertoire of skills.

Cost out doesn’t stand out. This may come as a challenge to the typical PE firm with deep expertise in finance and operations but little or no in-house expertise in marketing and sales. The goal of financial engineering and operational improvement is about reducing cost to lower price and/or improve margins on the business. PE managers can often accomplish these strategies quickly, resulting in short holding periods – even 12 to 18 months. But with so many PE firms highly skilled at financial and operational value creation, a cost-out strategy doesn’t stand out anymore, making it close to impossible to outperform PE rivals with this strategy alone.

Organic growth is a different story. To drive top-line growth, the variables are often more external than internal. Who are the best customers to focus on? What needs do they have that the company’s offerings might solve? What insights can companies glean from customer and market data to guide the development and launch of future offerings? How do we deliver the right message to them and win and grow their business in a cost effective manner? B2B sales organizations can be expensive. Having the right leadership and sales talent is critical. Driving organic growth often requires industry-specific knowledge and experience. And B2B buyer behavior is evolving quickly as decision makers have access to more information than ever before. The differences between a cash-out strategy and one focused on organic revenue growth can be stark. Consider the characteristics and objectives of each, below.

Attractive growth requires transformation. So where can PE firms experience attractive portfolio growth? Answer: in companies with outdated go-to-market models that are ripe for transformation. This means many legacy practices that worked great in the past must now go the way of the horse and buggy. Companies operating with LOBs organized around product must organize around the customer. Functions like product development, marketing, sales and customer service operating in siloes must learn to operate seamlessly around the customer experience. Growth leaders should first pare down costly high-touch field sales forces. Instead, they must focus on only the highest potential customers and prospects while inside and online sales personnel handle larger and larger chunks of the business. Partner and distribution networks need to transform to be accountable for the portion of the customer experience they serve and get paid accordingly.

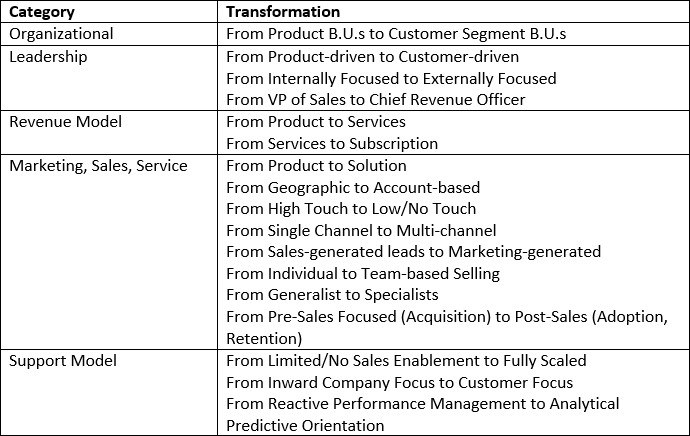

Go-to-market model transformations. Consider the following types of transformations companies may need to make. There is a common theme here … get closer to your customer.

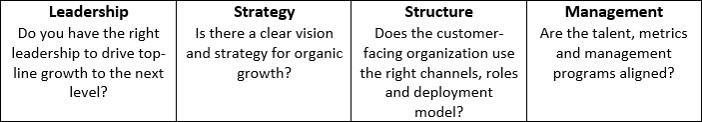

A ‘go-to-customer’ framework. The type or types of transformation(s) needed depends on the company. Whether conducting due diligence for a potential acquisition or evaluating a portfolio company, PE firms should use the following framework to examine the customer-facing organization.

This is the first in a series of articles on how PE firms can develop this capability. Future articles will explore each of the above elements from our framework in greater detail.

Read part 2, part 3, part 4 or part 5 of this series.

Learn more about Alexander Group’s Private Equity practice.

Original author: Paul Vinogradov