Three steps to improve sales effectiveness for growth equity companies

Over the past eighteen months, the Alexander Group has had the opportunity to engage with a number of private equity firms and their portfolio companies. This work has ranged from focused, tactical projects aimed at fixing a specific sales effectiveness challenge to wholesale sales transformation programs. As a result of this experience, we are coming to learn the unique needs of growth equity companies, which understandably can be quite different from very large, mature and diverse corporations. A recent discussion with a leading private equity investor helped us to hone our growth equity focus to three steps: 1) baseline sales effectiveness according to organization maturity, 2) identify simple, evolutionary ways to improve sales effectiveness and, 3) carefully examine current sales leadership capability to evolve across the maturity dimensions.

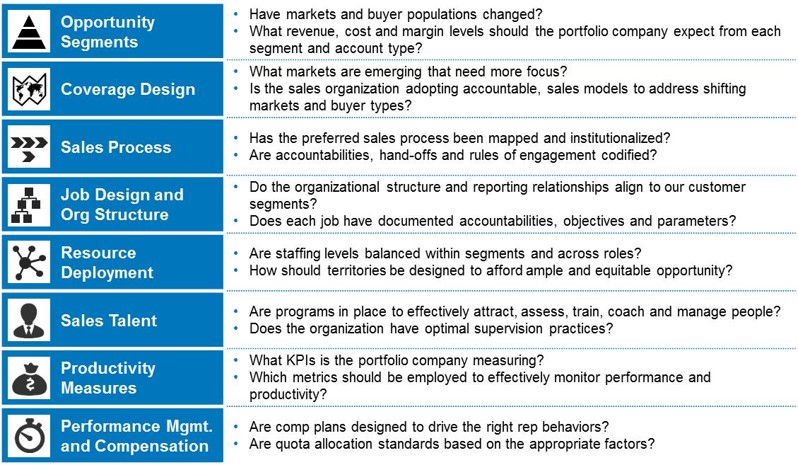

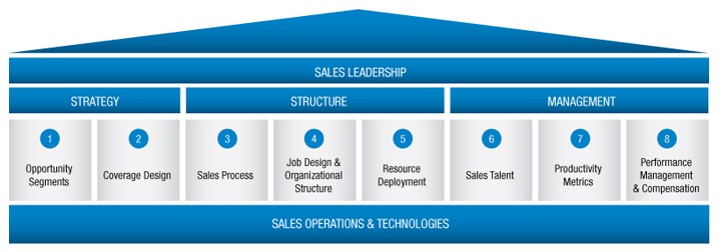

1. Baseline Sales Effectiveness. One of the most important undertakings an organization can do is to baseline the effectiveness of their sales organization. As a result of our work with Private Equity firms focused on growth equity, we developed a simplified, sales effectiveness maturity model (SEMM) that mirrors our 8 pillar, sales management system.

The SEMM provides growth equity investors and their portfolio leadership teams with insight and a score into their sales practices and processes against functional best practices. The maturity model takes in to account factors including company size, growth trajectory and revenue model to more accurately evaluate sales effectiveness across the pillars of the Sales Management System. For example, in contemplating the relative maturity of an organization’s go-to-market model, AGI assesses such diverse elements like how the company values its market potential, cascades that into opportunity segments, selects routes to market and, ultimately defines the coverage model. Similar approaches and rigor are applied to each pillar.

To learn more about AGI’s Sales Effectiveness Maturity Model, look for our upcoming article where we cover its dimensions in more detail.

2. Start Simple with Evolution in Mind. After evaluating the maturity of your investment company’s sales practices, processes and effectiveness, identify and lay out a plan for incrementally optimizing the organization. As sales management consultants, we occasionally fall trap in to thinking about grandiose transformative initiatives. However, most growth equity companies have the need for evolution as opposed to major transformation. Just because the Maturity Model might have five levels, does not mean that every company, across every dimension should strive for level five right away. This was reinforced for me during a recent discussion with an operating partner at one of the largest growth equity funds. He relayed to me some of the challenges their portfolio companies were experiencing. Most of them were indicative of earlier stages of sales effectiveness development: 1) how to effectively conduct a forecasting call, 2) how to manage the sales pipeline including probabilities, expected close dates and opportunities committed to close versus stretch opportunities. Upon reflection, my advice was to tackle the low hanging fruit first, then develop a blueprint to guide future areas of evolution and investment.

3. Take a Critical Look at Sales Leadership. In many growth equity companies VPs and SVPs of sales are homegrown or in the head sales job for the very first time. Their sales management repertoire is typically developed through a combination of finesse and gut feel based on their own experiences and perceptions from other companies. Private equity investors should evaluate sales leadership and management through two very distinct lenses. First, evaluate the incumbent based on the company’s short-term goals and objectives. Does the sales leader have the skills and experiences necessary to help the achievement of these goals? The second lens is more abstract and difficult to project and measure but equally, if not more, important. Project the business out for the next five years. As the business scales and increases in breadth and complexity, what changes will be necessary to ensure success? Does the leader have the requisite skills to navigate the path of success out in to the future, into higher levels on the maturity curve? By focusing on these two dimensions, you can define the training, coaching, development and potential success plan for the organization as it matures.

In short, growth-oriented investments provide an opportunity to deliver tremendous shareholder value and return on investment. To enable that return, Private Equity investors and portfolio company leadership will have to embark upon a shared journey that will encompass reinvention and evolution along the way. In no area will that be truer than in the company’s revenue engine and go-to-market organization. To succeed, baseline the organization’s sales effectiveness, identify opportunities for improvement and evolution, and ensure you have the right leadership in place to execute the plan and adapt over the investment’s life cycle.

Learn more about AGI’s Private Equity practice.

Originally published by: Jeff Hersh