Interpret Your Sales Benchmarks Carefully!

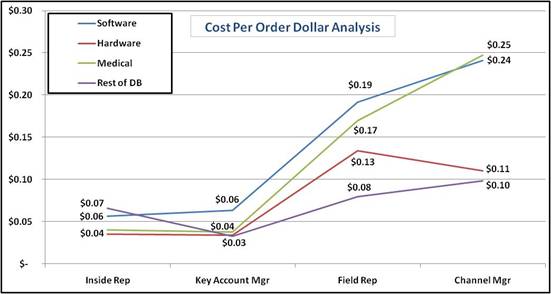

Take a look at the chart below. How would you interpret these results? This analysis of cost per order dollar by industry and by sales role is based on a sample set of company and rep data from the Alexander Group benchmark database of over 250 companies and 100,000 sales personnel. (Cost Per Order Dollar, or CPOD is simply all-in cost per head divided by revenue per head). What conclusions would you make if you simply tried to use the table below for insights on your sales organization? BE CAREFUL …

Based on the above, you might conclude the following …

1. Key Account Managers appear to have the lowest CPOD. Would you be correct? Most likely not. Deploying Key Account Managers (or Global, or Strategic Account Managers) is typically done for a company’s largest existing customers. The Key Account Manager is often managing a very large book of business. So the CPOD for the Key Account Manager role may be very misleading due to a) the huge amount of existing business they oversee, and b) the other sales headcount, including field, inside and perhaps even channel roles, that is also supporting the Key Account Revenue, but whose costs may not be included in the analysis.

2. Inside Sales Reps also appear to have among the lowest CPOD, and therefore, you might assume that you should use inside sales wherever possible in order to achieve the greatest “bang for the buck.” And in most cases with this one, you would be CORRECT. However, deploying Inside Sales is only appropriate for customer segments willing to buy over the phone.

3. Channel Managers in Software and Medical have the highest CPOD and therefore appear to be the highest cost route to market. MAYBE, but maybe not. In this case the channel costs such as channel marketing, commissions and rebates. The real answer will vary case by case, and requires careful interpretation and digging deeper in to the numbers to ensure a true apples to apples comparison.

POINT: No matter how good the data is that you look at to compare sales benchmarks, you can’t discount the importance of carefully vetting the results and not making recommendations “blindly” based on the data.

When it comes to sales benchmarks, do your homework and make sure you understand the numbers, the numbers behind the numbers, and the context of the numbers. The greatest lessons are learned through careful examination and testing. Sales benchmarks are never perfect, and expert analysis of what the numbers mean for your sales organization will help you make the best decisions.

Visit the Alexander Group’s Benchmarking practice.