European XaaS Study Overview: A Tale of Two Models

The Alexander Group’s technology market research on XaaS Sales Strategy debuted recently with an intensive qualitative and quantitative analysis of go to market practices in core vertical markets.

The research addresses both North American and European markets. This article will focus specifically on the EMEA findings which illustrate the distinctions between hybrid and pure play companies. It’s a tale of two models, of which the outcome may ultimately rest with the buyer.

For definition purposes, participants with 80%+ bookings from a recurring revenue source are classified as “Pure Plays” and all others as “Hybrids.” Both groups continue to expand their XaaS focus through investments in post-sales revenue roles, among other items. The European participants, both Pure Play and Hybrids, outgrew their North American counterparts in the last fiscal year, though this likely represents a bit of “catch up” rather than outpacing the market. Regardless, the major distinction still comes between Pure Plays and Hybrids rather than across geographies.

The Pure Play Story

European Pure Play companies committed to the XaaS model and continued to expand their percentage of bookings generated from XaaS offerings. A slight increase from 88% of booking in 2016 to 91% of bookings in 2018 implies a singular strategic focus on the models, a departure from the expected revenue model diversification where companies seek to create stability through new sources of value and “stickiness” with their customers. Instead, they have kept focus on the revenue model for the most part, while introducing new XaaS offerings.

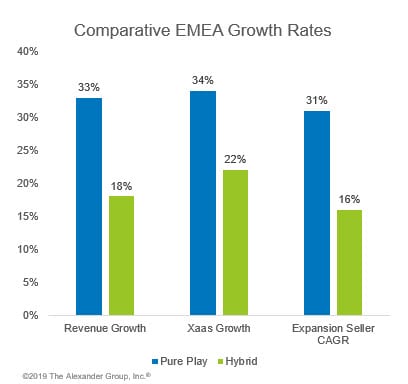

This commitment to the XaaS revenue model has allowed the European Pure Plays to extract the benefits of investments in post-sales revenue focus and less efficient expense-to-revenue structures by driving higher revenue growth, higher XaaS growth and higher expansion selling CAGR than their Hybrid counterparts.

Looking ahead, Pure Play XaaS companies might ask, “Where next?” XaaS customer growth (account acquisition) stayed level from 2016 to 2018 at 24% for both years. Can this trend continue? Expansion selling must continue to underpin the Pure Play model, but what else do they sell? Agile offering development (with feedback from sales!) and portfolio expansion through acquisition should be on leadership’s radar. Geographic expansion for European companies also demands review. Many study participants have some footprint outside of Europe, but not a majority of revenue. Readiness to increase investment in North America or Asia will be an ongoing discussion as well.

The Hybrid Story

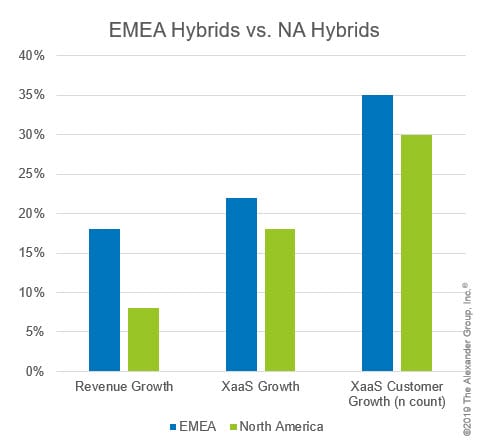

Hybrids continue to work through a transition to XaaS models. In particular, European Hybrids outpaced North American counterparts on overall growth, XaaS ACV growth and XaaS customer growth. It is not clear how much of this is a result of being a bit behind on a XaaS journey. European technology companies have significantly increased focus on XaaS models and focus, both, generally and in this instance, pay dividends over time.

In particular, the statistic on XaaS customer growth as compared to overall bookings growth highlights a critical market trend all revenue leaders in technology in Europe need to bear in mind: the industry, particularly large Hybrids, is in “land grab” mode. European participants report a 12-point difference between their overall XaaS growth (22%) and the rate at which they grew their XaaS customer base (35%). Eventually, hybrids will move into “expansion sell” mode; for now, they are focusing on converting their book (and likely yours!) onto their XaaS offering. While these revenue models require new ways of marketing, selling and servicing customers, our data show that Hybrids will continue to evolve (likely at an accelerated rate) each of these capabilities.

The Bimodal Revenue Question

Bimodal revenue (i.e., XaaS vs. one-time consumption such as professional services) raises questions for both Pure Plays and Hybrids. As mentioned above, the Pure Play question looks to the future. Will pressure to maintain 30% revenue growth rates force Pure Plays to diversify their revenue streams or has the XaaS revenue model fundamentally replaced these legacy types of offerings? The answer may lie with the buyers. The consumerization of B2B would indicate that on-demand, consumption-based models will replace more traditional sales motions, but B2B buying does not translate perfectly. For example, will the largest financial services companies in the world ever truly outsource security services to a managed provider from a risk perspective?

Hybrids (by definition) have the opposite issue. How do we manage our existing revenue base while accommodating the market’s demand for newer, more flexible options? Some of the more successful companies have actually split their customer base—and therefore their sales and marketing teams. Different offerings, targeting, quotas and sales compensation plans to create different behaviors in each segment. This requires detailed understanding of customer needs, but does allow focus in each population.

Conclusion

The Alexander Group’s XaaS research shows an industry in accelerating transition. Pure Play companies in Europe actually managed to move even more aggressively after their strategy. Hybrids increased investment in post-sales FTEs by nearly one-third as an overall total. Change continues and the data suggest a continuation of that trend.

Would you like to participate (no charge!) to understand how your model compares to the industry in Europe on the metrics compared to others? Contact us for more information.