Executive Summary

Technology and data are fundamentally changing how we do business, making digital transformation a hot topic in the boardroom. What does digital transformation mean for the revenue organization? This whitepaper serves as an instructional guide for taking digital transformation from the boardroom to the revenue organization. It’s oriented around four critical actions:

- Understand the Buyer Journey

- Plan Revenue Motions

- Adapt the Structure

- Align Management Systems

First, we will do a deep dive into how your organization can digitize the Revenue Growth Model™. Then, we will explore what digitizing the Revenue Growth Model™ means to structure and management systems, including the impact on marketing, sales and service organizational design and roles, as well as emerging roles best-in-class companies now deploy.

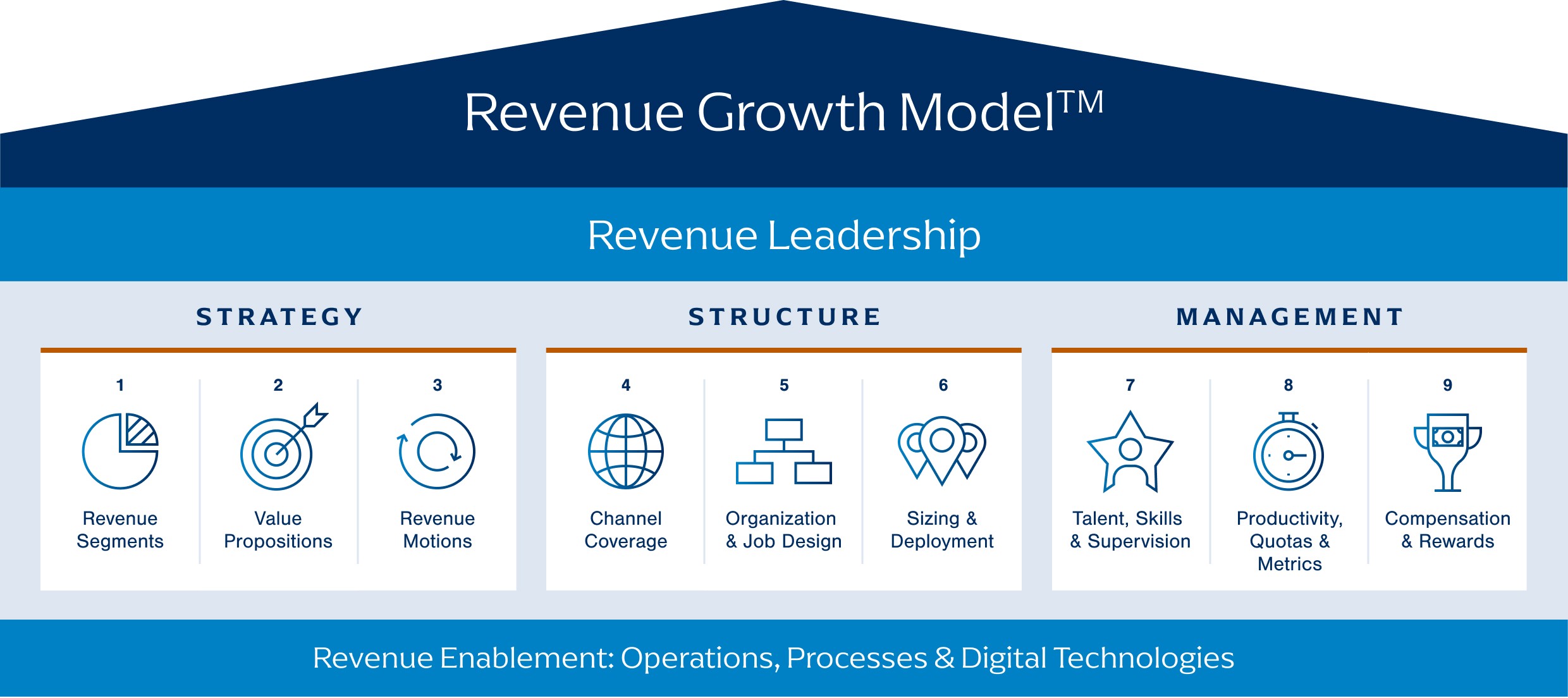

The Revenue Growth Model™

The Revenue Growth Model™ (RGM) is a linear framework, organized into three parts: Strategy, Structure and Management. Defining what digital transformation means to the revenue organization starts with Strategy and ends with aligning Structure and Management systems.

Strategy

Today’s customers form opinions and make decisions in a world of ubiquitous access to information. These new behaviors change buying processes and, consequently, companies must adapt. Winning means deploying marketing, sales and service resources harmoniously along revenue segment-specific buyer journeys. A first mover advantage exists for those who quickly act.

With more awareness of options and solutions than ever before, customers form opinions sooner and are further along in their decision process. This impacts when they formally engage solution providers. Once that conversation starts they expect a tailored B2C experience in addition to the traditional pre- and post-sales B2B experiences. Understanding buyer journeys and preferences by revenue segment allows companies to tailor value propositions and inform revenue motions—how tactical Marketing, Sales and Service resources interact with customers.

Structure

New channel coverage and organization and job design show the most visible impact of digital transformation on the revenue organization. Regardless of size, a new digital environment creates new routes for markets to emerge and therefore creates new opportunities to engage with customers. Historically, marketing, sales and service formerly reported to separate functional leaders; however, these new, nonlinear routes are challenging legacy paradigms. An indicator of a company’s digital transformation can be seen when traditional field and inside sellers start using social media and business analytics to guide their daily routines.

Management

If structure changes are the most visible indication of a digital journey, adjustments are needed to the management components. Systems used to leverage a traditional model will not serve the digital revenue organization. High-value skills shift from product, domain and professional sales expertise to technologically adept. Organizations need to make invest in training to bring talent into the digital age. Coaching and management operating systems (MOS) require upgrading. Historic seller yields (and their quotas) are no longer stable barometers as digital investments create capacity and shorten sales cycles. Companies also must address incentive compensation eligibility as marketing and service resources play a bigger role in persuading the customer to buy.

Understand the Buyer Journey

When customers have problems, they look to providers for solutions. The world was simpler when customers followed a linear process to solve their problems. They discovered they had a problem, decided how they would solve it, brought in a couple of providers to bid on the job, selected the provider and moved forward with implementation.

Technology has fundamentally changed this journey. Social networks, search engine marketing (SEM), retargeting, AI-fueled e-marketing, online events, AR/VR, video, web chat, try and buy, freemium, self-serve platforms, ecommerce, and other digital motions educate customers and solve their problems faster. They also give competitors adept at executing these motions an advantage. These motions are often lowcost and scalable breaking down market entry barriers.

Digitizing the Revenue Growth Model™ starts with fully understanding the buyer journey. Investing in digital without a sound understanding runs the risk of selecting unnecessary or low-impact motions that quickly erode scale advantages.

To get started, conduct primary research to understand how customers make decisions. The below shows the phases of Alexander Group’s buyer journey framework and questions to consider when conducting research. The data collected by phase serves as the foundation to planning revenue motions and selecting the highest impact digital investments.

The output of buyer journey research is a detailed understanding of how customers navigate digital ecosystems as they work to solve their problems. These maps serve as critical inputs in planning revenue motions—how a company will deploy tactical marketing, sales and service resources to support customers along their journeys while positioning the company to win.

Realize

Buyer becomes aware of an issue or problem. Buyer decides to take action to further investigate and find solutions.

- What social networks do customers participate in?

- What online research do they subscribe to or conduct?

- What type of digital media do customers prefer to consume?

Explore

Buyer analyzes the problem in further detail, building a case for need and finding potential solution providers.

- What key words are searched?

- What sites are visited?

- Who are the influential voices (e.g., syndicated research, consultants, academics) and where do they interact digitally (such as websites, blogs, forums)?

- What events do customers attend?

Scope

Buyer considers options and determines potential vendors to discuss solutions. The company should be aware of these potential buyers.

- What are customers’ value drivers?

- Are customers able to find the information they need about us digitally?

- What challenges do customers run into when

Evaluate

Buyer understands options and selects to try the solution or purchase the offering.

- How does the customer prefer to engage during the sales process (in-person, virtual, self-serve)?

- How do customers prefer to trial (demos, try and buy, freemium/self-service)?

- What is the customer’s current experience with us?

Implement

Customer uses products or integrates solutions. Customer continues to work with company to integrate new offerings or updated solutions.

- What support does the customer need post-sales?

- How does the customer prefer to receive required support (self-service, web chat, email, video, AR/VR, phone)?

- What data does the customer need to monitor the success of the solution?

Advocate

Existing customer who is finding success will continue to renew, and may contribute or act as a reference to potential customers.

- How do customers and non-customers provide feedback (social, blogs, forums, syndicated research, direct to the company)?

- How do customers prefer to re-purchase?

Key Takeaways

Buyer journeys are not linear.

Companies need to be prepared for buyers to move between phases. Digital motions must anticipate this dynamic. For example, if a company invests in social networking to cover customers in the Realize stage, they must be prepared for the buyer to skip right to Scope. The social strategy may require investments in digital advertising retargeting to get the solution in the consideration set.

Buyer journeys differ by revenue segment and buyer persona.

Buyers from different industries often live in their own digital spheres. Additionally, there are often multiple personas involved in making decisions and their journeys are not always the same. It’s important to understand nuances in journeys for critical revenue segments and influential participants in the decision-making process.

Plan Revenue Motions

In this section, we describe the digital revenue motions by type and how to plan investments in alignment with buyer journeys.

Revenue motions refer to how a company engages with customers along their buying journey. Not only has technology changed the buyer journey, but it has opened new routes to market and means of engaging with customers. The second step in digitizing the Revenue Growth Model™ is planning which motion to deploy based on learnings from buyer journey research and anticipated ROI.

There are three types of revenue motions—Marketing, Sales and Service. The following offers a description and examples of digital versions of each:

Marketing

Engaging with customer segments to generate awareness and communicate value populations. Often referred to as “little m” marketing, involves tactics such as website, collateral, events and multi-channel promotional campaigns.

- SEO and SEM

- Digital Advertising (PPC)

- Retargeting (Web Scraping)

- Content Marketing

- E-Mail Marketing

Sales

Engaging with the customer to win business. Differs based on the value-add a customer requires (often due to the complexity of the product).

- E-Commerce (Direct and Indirect)

- Try and Buy (Freemium)

- Virtual Demos

- Click to Buy

Service

Engaging with the customer post sales to solve problems, support solution adoption and enable repurchase.

- Web Chat

- Self-Service Portal

- Video (includes AR/VR)

Organize your buyer journey research by revenue segment (based on attributes that aid in prioritization or directing revenue motions such as market size and strength of the company’s value proposition). Look for commonalities across segments by journey stage.

If high priority segments are using LinkedIn to gain insights on solution providers or key decision-makers follow an industry influencer, these are likely high-impact investments. If buyers prefer to try a limited feature version before committing long term, then a self-serve try and buy or freemium offering should be considered. If the competition’s self-service portal is creating switching costs, the investment will likely pay for itself through improved renewal rates.

Not all motions are good investments. If buyers are already coming to the company’s website when they have a problem, investments in SEO and SEM might not deliver incremental returns. Instead, doubling down on digital content marketing is a better play. An important consideration about digital revenue motions: Just because you can, doesn’t mean you should. Digitizing the Revenue Growth Model™ is not only about adapting to new buying paradigms, but also using technology to gain scale advantages, improving return on marketing, sales and service investments.

Key Takeaways

Digitizing the Revenue Growth Model™ does not mean eliminating traditional “analog” revenue motions.

Instead, digital motions should be additive or a scalable replacement of traditional motions. For example, a company has developed a series of high–impact, AI-driven e-mail marketing campaigns to existing customers. The offers go out to customers with a convenient click-to-buy feature. The campaign frees up sellers to focus their time selling more complex solutions.

Marketing, Sales and Service lines are blurred in a digital world.

Take this scenario: customer uses organic search to find a company’s offering and is directed to a web page where they can opt-in for a free trial and subsequently signs up when prompted at the end of the free trial. What was Marketing and what was Sales? Digitizing the Revenue Growth Model™ requires us to think in terms of motions and the buyer journey vs. classic functional silos.

Adapt the Structure

This action outlines the new routes to market and describes how to transition investments in resources to align with an optimized go-to-customer model.

Digital Transformation most tangibly affects the Revenue Growth Model™ through changes in channel coverage, organization structure and job design.

Selecting routes to market used to be far simpler. There were fewer choices–indirect (for example, resellers, integrators and distributors) and direct (for example, hunters, farmers and specialists). Customer demands were straightforward–communicate features and benefits and be easy to do business with.

Technology has changed the game. E-commerce proliferation and customer expectations have jumped from B2C to B2B. Executing an effective e-commerce strategy means investing in a platform and building a team of highly skilled resources–feature and promote products, optimize and manager search engines, and rapidly service (and re-sell) customers. Unrelenting customer pressure to keep up with leading experiences (e.g., Amazon) means companies must continuously optimize the channel.

Technology has birthed new channel options beyond e-commerce: Chat, Social, Try and Buy, Freemium, Click to Buy and Self Service (Exhibit 1) are all now part of the channel mix conversation. Companies can stand up low-cost, scalable, customer aligned routes to market in a fraction of time that it takes to recruit, onboard, train and ramp a professional sales organization or channel partner.

Emerging channel coverage options can have an immense impact on the buying experience and translate to above-market growth. However, they compete for a fixed pool of investment capital. Companies simply cannot afford to deploy all available options (even while executing an omnichannel strategy). Channel coverage decision-making in a digital world requires in-depth understanding of the customer and careful strategic planning.

In addition to enhanced e-commerce, there are additional channels organizations should consider the following:

Chat

Social

Try and Buy Freemium

Click-to-Buy

Self-Service

New channel options and an expanding role for Marketing challenge legacy organizational design paradigms. Marketing, Sales and Service have historically reported to separate functional leaders. With expanding gray area between these roles and more complex go-to-customer models being deployed, the call for common leadership is louder than ever. Two solutions to consider include:

The Chief Revenue Officer

Process and Metrics

When formal reporting lines and structure changes are too disruptive or inappropriate (like business readiness, risk, competing priorities), companies must rely on process and metrics to ensure they plan and execute revenue motions harmoniously. Assigning accountability to the revenue or sales operations functions to run annual growth planning processes helps align teams as leaders set budgets and write growth plans. Traditional sales metrics for Marketing and Service is a paradox. Advances in technology have elevated the ability of both Marketing and Service to influence a purchase to an all-time high. Individual and shared accountability for delivering financial results for assigned customers, products and geographies can align these functions.

Aside from the influx of new routes to market, digital transformation’s impact on the revenue organization can be felt more tangibly through a new mix of marketing, sales and service roles. New roles born out of the application of technology to revenue growth include:

Digital Marketing Manager

Content Specialists

Social Media Specialist

Chat Specialist

Data Scientist

Key Takeaways

Digitizing the Revenue Growth Model means considering new routes to market.

Understanding the buyer journey and carefully planning revenue motions serves as the foundation for narrowing the routes to market that will optimize growth rates and ROI.

Prior to making incremental investments in digital capabilities, it’s important for companies to baseline marketing, sales and service costs. In addition, companies should understand where there are opportunities to shift spending from legacy, low(er) ROI and less customer-aligned investments.

Companies need organization structure changes or more tightly aligned processes and metrics to manage an expanded mix of channels and the growing gray area between Marketing, Sales and Service.

The digital revenue organization features a new mix of roles carefully designed around the buyer journey using a new suite of tools and data to drive top-line results.

Align Management Systems

The digital organization features marketing, sales and service team members with a new competency model. They are adept at using technology as part of everyday life. They are receptive to change and are quick to adopt new tools. They proactively seek data to support decision-making.

This new talent profile requires companies to rethink how they invest in training programs and develop talent. Not only do companies need to deliver learning digitally (in addition to traditional formats), but also the type of training must evolve. Marketing, Sales and Service resources will need to learn how to use new tools, leverage new means of engaging with customers (social media) and apply data to day-to-day decision-making.

Manager coaching frameworks also must evolve. Companies on the leading edge of digitizing their revenue growth model indicate one of the top impediments to adoption is front-line sales manager opt-out. Line leadership must lead by example and reinforce the use of technology in their day-to-day interactions.

Digital breeds a new suite of stable metrics to direct, monitor and manage the revenue organization. As companies invest in enterprise data, management leaders have more information at their disposal to define and set more accurate targets. Where it was once difficult to measure the impact of roles like marketing managers or Customer Success, companies can now accurately calculate and track ROI.

Productivity paradigms have also shifted. As companies invest in digital transformation, the yield of the revenue organization must increase or risk having the plug pulled on further expenditures. Digital raises the bar on traditional Marketing (opens, clicks, qualified lead volumes), Sales (throughput per seller) and Service (efficiency and effectiveness) performance objectives. New yields should also translate to reduced operating expenses.

Incentive compensation used to be a program only available to Sales. Historically, eligibility has been available only to those who have a significant influence on the purchasing decision and to those to whom one can assign an accountability for a sales target. Advances in technology and a new set of metrics are challenging legacy eligibility paradigms. Additionally, the role of the CRO is creating the need to align Marketing, Sales and Service to a common objective–revenue growth.

These realities are causing companies to think hard about what roles to include in the incentive compensation program. If marketing team members have a suite of sophisticated tools that allow them to effectively cover a product or customer segment with no or minimal sales intervention, should they carry a financial objective? If a service team member has the ability to issue and close a quote immediately without triaging to a sales person, should they be paid an incentive for this activity?

Key Takeaways

Digital transformation requires revenue organizations to rethink how they recruit and develop talent.

Competency models, training offerings and manager coaching must evolve to support the new reality. Technology creates the means to more effectively direct, manage and monitor the revenue organization. Companies must harness data to understand productivity, raise the bar and justify continual funding.

Long-held incentive compensation paradigms–most notably eligibility–are challenged in this new world. Roles that were once not eligible are now taken into consideration due to their degree of persuasion and a company’s ability to accurately track their financial impact.

Conclusion

Revenue leaders should consider these questions when developing their digital roadmap:

- Do we understand how our go-to-market investments align with the buyer journey (e.g., Are we spending money where and when customers are forming opinions and making decisions)?

- What is our Customer Acquisition Cost and where are the opportunities to improve?

- Where are our gaps in buyer journey coverage?

- What routes to market will best address gaps and align with customer preferences?

- Are we investing in the right technology stack to most effectively enable marketing, sales and service team members?

- How equipped is the revenue organization to adopt digital principles (e.g., Do we have the right mix of skills and capabilities)?

- Where do we start? What is the right sequence of investments?

- How do we get executive support, funding and line manager adoption of new ways or operating?

Revenue Growth Blueprint

The Digital Revenue Organization: Executive Interview with Tiffany Bova

How Data Is Changing Revenue Growth

About Alexander Group

Alexander Group understands your revenue growth challenges. Since 1985, we’ve served more than 3,000 companies across the globe. This experience gives us not only a highly sophisticated set of best practices to grow revenue—we also have a rich repository of unique industry data that informs all our recommendations. Aligning product, marketing, operations and finance efforts behind a successful sales organization takes insight and hard work. We help the world’s leading organizations build the right revenue vision, transform their organizations and deliver results.