Health Insurance Sales Compensation

Four threats to your program’s “wellness”

Selling health insurance is not what it used to be … “Obamacare.” ASO. Increased regulation. Provider-insurers. Private exchanges. Narrow networks. Mobility. Retail stores. The list goes on …

Given all of these industry changes, how health insurance carriers compensate sales reps is in flux as well. Effective sales compensation design and program management is critical for carriers to reach their business goals. Gone are the days when carriers paid reps using a simple commission rate on medical contracts or number of members. Today, carriers need to consider several factors including strategic drivers, motivators, tradeoffs and external impacts when architecting their sales compensation programs. Carriers also need to adopt better program management and governance approaches to ensure consistency, accountability and sound decision-making to maintain effective sales compensation plans in the new age of health care.

In our experience working with several carriers, we’ve observed a host of issues with their sales compensation programs. Here are four of the most prevalent and important comp program issues carriers must address:

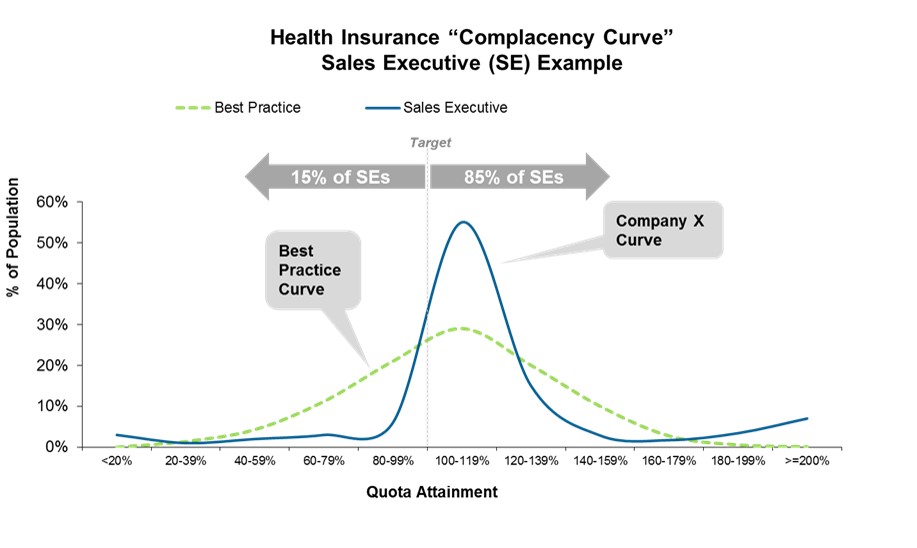

- The “Complacency Curve.” For many carriers, over 80% of sellers are achieving or exceeding quota, well above the 60-65% best practice level. Combine this with insufficient performance management (i.e., low performers stick around far too long), unsophisticated goal setting, and uneven manager coaching, and you have a well-brewed recipe for complacency in the sales organization. Companies are realizing the need to set more aggressive quotas, spread out their seller performance distributions and better manage the performance “ecosystem” to combat this historical complacency.

- Overly Complex Plans. Does your plan pass the “spouse test” – can your reps explain how they make money in a two-minute description to their spouses? If not, your plan is likely too complicated. Plans with three or more measures or multiple accelerators or a laundry list of product commission rates or intricate point systems or convoluted calculation methods are signs the program is over-engineered. Carrier plans ought to focus on the most important metrics (e.g., members, retention, revenue), bucketing products into a few categories (e.g., core vs. strategic growth products), and simplifying card rates or accelerators to just a few. It’s time many carriers put their comp plans on a “diet” from the bloated plan structures we’ve seen prevailing for years. Instead, design simple, clear plans, and leverage leadership and management to drive behavior, rather than relying on the comp plan to cover everything.

- Meaningless Measures. A performance measure is only as effective as the attention it garners from a seller. Using measures for “ancillary” products comprising only 10% or less of a seller’s variable target incentive generally has little to no motivational value. For example, let’s assume we have a health insurance sales executive who has $40,000 in total variable target incentive with three measures in the plan: New Medical Contracts, New Dental Contracts and Wellness Products Sales. Let’s assume these are weighted at 65%, 30% and 5% of the target incentive respectively. Is the $2,000 per year associated with the Wellness measure going to get the seller out of bed thinking about Wellness products? And how about when the $2,000 gets broken down into four quarters, to $500 per quarter? The rep may as well focus on the two core products and not even worry about the Wellness goal.

- Poor or Nonexistent Program Governance. It’s not enough to have a well-designed sales compensation plan for sales roles. Without sound goal-setting practices, clear plan communication, active year-round management, and annual health-check analytics, the risk of program failure is high. Many companies lack an annual sales compensation planning calendar with agreed-upon responsibilities and accountabilities for each process step. Few have established and use well-designed escalation procedures. Many functions play a role in program governance, but the majority of responsibility falls on Sales Operations or HR to lead a cross-functional Design Team (made up of Sales, Sales Ops, Finance, and HR). Executive leadership must also invest time to ensure the right direction, cost and communication of the program. Carriers must develop a governance process with clear responsibilities and accountabilities to manage the sales compensation program throughout the year in order to avoid the program running amok with various leaders making independent decisions related to sales compensation.

Do any of these issues sound familiar? How is your carrier sales compensation program working? Given the dynamics of the health insurance industry today, is it time for a holistic review?

Contact us to learn more about how Alexander Group can provide a “wellness solution” for designing and managing your sales compensation program.