Should Salespeople Be Paid on Profits?

GM of the division and Finance heads are meeting with the sales team.

Finance chief (mutters under his breath): “We have to solve this discounting problem.”

GM (stiffens): She has had this conversation with the VP of sales in the past. The division is bleeding profits, and the sales force is the epicenter of this problem. Her view: Sellers should not treat division pricing as a throw-away starting number.

GM continues, “I know we are going to get the same argument from the VP of sales. Do you want volume or profits? You decide! However, you can’t have both at the same time.

She has resolve: The sales compensation plan will be modified to pay on profits and not just revenue.

In a sense, both viewpoints have merit. The GM and finance head cannot operate the division with eroding profit margins regardless of the source. Fortunately, if sellers are the source of price discounting, it’s a solvable problem. Meanwhile, the VP of sales is correct to anticipate that higher pricing may suppress sales revenue. This outcome will also hurt division profits by driving up unit costs.

If sellers are the source of price discounting, changing the sales compensation plan might help. But only to an extent. Pricing issues are seldom the sole fault of sellers. Yes, sellers can be contributing agents by accelerating price erosion. However, pricing pressures often (and more likely) arise from neglected product strategies, unanticipated competitor actions and shifting buyer sentiment. The sales compensation plan is ill-equipped to solve these systemic issues. More on these issues later.

Yes, there is a lot of finger-pointing. Before we get to both short- and long-term pricing solutions, let’s examine the logic of paying salespeople on profits. In some instances, it is fully warranted. In other cases, not so much.

When Sales Personnel Are Paid on Profits

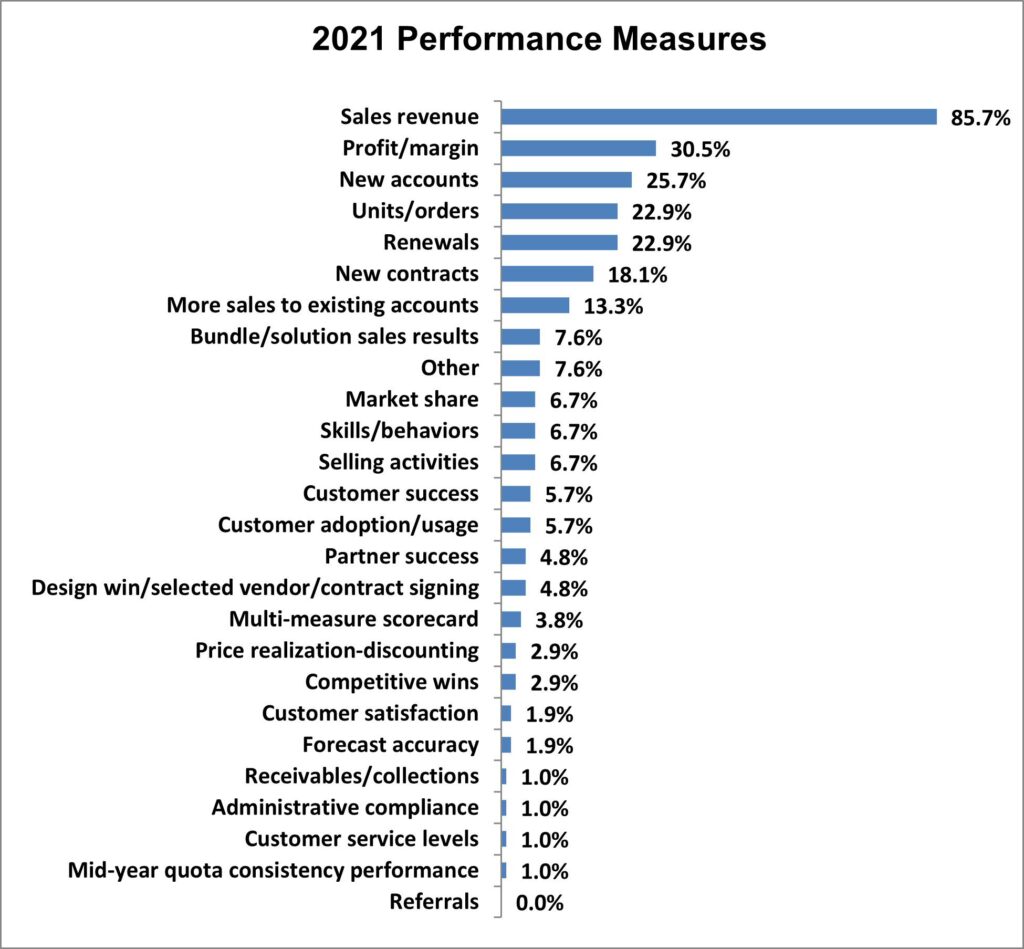

First, let’s start with market practices. Yes, in some cases, sellers are paid on profits. The Alexander Group’s 2021 Sales Compensation Trends Survey reveals the most popular incentive pay measures. Profit ranked number two on the list by 30.5% of the participants, trailing revenue by 85% of the respondents. (Multiple selections were permitted.) What does this mean? Slightly less than a third of the companies use profit as a sales compensation performance measure.

Source: Alexander Group’s 2021 Sales Compensation Trends Survey

So, what is the conclusion? It’s not unusual to pay sales personnel on profit performance. Okay, when should this occur (i.e., paying salespeople for profit performance)?

Here are some examples of when paying for profit performance is a good idea.

- Sellers Can Negotiate Price. This is simple. If sellers negotiate sales price, and thus the margin, reward them for successfully getting better pricing.

- Sellers Can Sell More Profitable Products. In some cases, the mix of products sold affects profitability. Rewarding sellers to sell the right mix of profitable products—yet, still meeting customers’ needs—should earn higher incentives.

- Sellers Can Influence Deal Features and Deliverables. Custom-configured solutions often require custom-configured pricing. Sellers’ incentive should reflect the effectiveness of the initial pricing and, when delivered, the profit outcome of the final customer-accepted solution.

- Sellers Can Offer Buyer Inducements. Providing volume discounts needs to be justified by actual purchase levels. Sellers can provide additional inducements—often free or at a discount—to win the sale. Examples of such inducements include an extended warranty, early shipment, free service support, reduced training costs, and discounted upgrades. Each of these inducements carry a cost, thus reducing the overall profitability of the sale. Yes, sellers’ pay should reflect the impact of these discounts.

- Sellers Can Negotiate Terms. While unusual, in some cases, sellers can negotiate contract terms. Of importance are payment requirements and return policies. Timing and criteria of payments can affect deal profitability. Return policies can be expansive and generous, again affecting overall profitability.

In each of these cases, sellers affect profit outcomes. The purpose of sales compensation is to pay for successful persuasion: getting the order and getting better profit dollars when sellers can influence profit outcomes. In such cases, profitability is a suitable sales compensation element. As expected, the reverse scenarios operate, too: If the seller cannot affect price, mix, features, inducements and terms, then the sellers’ pay should not be tied to profit outcomes.

Sales Profit Measures

EBITA (earnings before interest, taxes and amortization) and net operating profit are effective corporate profit measures. Consider the following seller-centric profit measures.

- Gross Profit Dollars. Gross profit dollars are one of the most popular, and most problematic, measures of profitable sales success. Gross profit is the sale price minus the cost of goods (COGS) including fixed and variable costs. It excludes depreciation, amortization, overhead costs, and taxes. Effective cost-allocation methods can assign fixed and variable costs to each transaction, thus answering the question: How much money did we make on this deal? Problematic? Yes, gross profit dollars are a problematic measure for managing sales personnel. As a standalone measure (not modified by gross profit margin percent), sellers have a propensity to “discount to save the order.” In their view, some gross margin dollars are better than none. The result: Gross profit dollars as a measure may drive high volumes at low gross margin percent. Additionally, sellers get distracted by the “cost of goods” number. Thinking, in some cases, “Wow, that margin is excessive; the company can take a small haircut on price.”

- Gross Profit Margin. Gross profit margin is expressed as a percent. The calculation is sales price minus cost of goods divided by sales price. It’s a powerful measure of how effective the seller is at securing margin spread. But, alas, you cannot spend a percent. Without the accompanying gross margin dollars as a size measure, gross profit margin is simply an interesting statistic.

- Loaded Gross Profit and Margin. A modification to pure gross margin dollars and gross profit margin is to add a marketing margin to the cost of goods. This amount can vary by product. The added marketing margin hides the true cost of goods. Unfortunately, loaded gross profit dollars and margin measures suffer the same fate as these same measures without the “load.”

- Discount/Price Realization. Discount is usually expressed as a percent off of list price: e.g., 25% discount. Leadership can manage sellers’ pay by measuring their average weighted discount. A similar concept is price realization that measures the distance from list price: e.g., 92% of list price. In both cases, such measures cannot stand alone. They need a volume measure, such as revenue, gross margin dollars or number of units sold, to validate the size of the order.

- Average Sales Price. While not a great measure—it has no reference to a cost basis—average sales price reflects the upward or downward trend in pricing, or comparison to the market median. Using average sales price is a tacit admission that the company has little control over market pricing.

- Product Mix Index. Some measure of product mix, preferred products, configuration, or solution package can reward sellers for selling more profitable products.

Sales Compensation Solution

Sales compensation formulas can successfully reward profitable selling. The best designs have two elements: a production measure and a profit measure. Gross profit dollars and gross profit margin are a natural pairing. Another effective pairing are sales revenue and price realization. Using a sales compensation “linked” formula design allows the first measure (volume) payout to be modified by the second measure (profit percent). Linked designs include hurdles (minimum level of performance of second measure affects payout of first measure), modifiers (first measure payout modified/multiplied by second measure performance) and matrices (a grid with increasing rewards for both volume and profit improvement). Expect numerous iterations when creating such formulas. Testing and modeling different payout scenarios will ensure plan designers have crafted the payout formula to accomplish both objectives: volume growth and profitable sales.

Address the Real Issues

When sellers find they are pressured into discounting, there are often upstream challenges driving this behavior.

- Prices Are Too High. Simple enough. When product management has to absorb excessive costs to achieve unrealistic profit levels, the market will shun the offering. The only path is to discount the product to match market practices.

- Wrong Strategy. When companies fail to match and exceed product advancements, emerging market segments and alternative channels, the company is left with competing on price. Most established market leaders are seldom beat by peers; instead, they are displaced by new market entrants with a different and more compelling value proposition.

- Obsolete Sales Model. At some point, the sales model needs a comprehensive review. Are we calling on the right customers? How do customers want to buy? Do we still need this expensive field sales resource? In mature markets, the original high-growth sales team may need to move some customer purchases to a lower selling cost-fulfillment team. Management can redirect costly sales talent to large profitable volumes where customers have high uncertainty and risk.

Back to the Meeting

Upon entering the office, the VP of sales says: “Well I am glad you are here. I know we have a pricing challenge. So, we are planning to introduce a new training program called Performance Pricing. This will teach our reps how to achieve the best pricing for our products. Next, we plan to add a profit modifier to the sales compensation plan. And, finally, we are changing the criteria of the President’s Club to recognize more profitable selling.”

The GM and head of finance are gracefully speechless.

Looking for more sales compensation content? Visit our Sales Compensation Resource Center.

David Cichelli is a revenue growth advisor for the Alexander Group. Connect with him on LinkedIn.