Manufacturers face many challenges in today’s complex business environment. A highly aligned and skilled sales force will help drive top line growth. Sales compensation is a key sales management program to drive this success. Yet many companies employ sales compensation plans that reflect a simpler world of the past. The sales compensation plans fail to incent behaviors that address some of the key challenges facing manufacturers today.

Stagnant territory growth is a problem that troubles many manufacturers. Today’s highly competitive environment and a retention-focused sales team often contribute to this issue. However, manufacturers frequently rely on outdated sales compensation plans that place too little incentive pay on revenue growth. Another challenge in today’s manufacturing environment is the product portfolio has become increasingly complex. The days of selling a single product line, manufactured in one location are long past.

To further complicate the sales process, key customers are global with dispersed buying decisions. Successful account penetration requires a global, team selling strategy rather than a local, independent seller approach. Dated sales compensation plans that don’t differentiate products, recognize new team selling complexities and global implications leave the seller to decide which products to sell. The individual seller’s strategy may not be consistent with the company’s growth plan. Sales compensation plans must support the growth strategy and act as a bridge to translate company goals into sales outcomes. To be clear, sales compensation is not the leading driver of renewed growth. There are many issues that may restrict the manufacturer’s growth engine. However, companies can motivate growth oriented selling behaviors by increasing the effectiveness of sales compensation dollars.

We will examine methods to correct errors in sales compensation plans to address these challenges:

- Stagnant Territory Growth

- Expansive Product Portfolio

- Global Customers

Today’s manufacturers have limited resources to face increasing competition and demanding customers. Growth-oriented businesses don’t want to tell their salespeople that succumbing to these challenges is acceptable. But that’s effectively what happens when the company pays significant incentive dollars for retention business. Sales compensation plans should motivate sellers to take these challenges head-on and management should ensure pay plans align with current selling realities.

A common issue is manufacturers pay too much for retention revenue and not enough for growth revenue. In basic terms, retention revenue comes from selling the same products/services to existing customers. Growth revenue comes from selling new products/services to existing customers or selling products/services to new customers. Consider the example of a sales representative winning a deal that has a recurring revenue stream (defined or implied) in the following years. Growth revenue is any revenue realized in the current year. Retention revenue is recurring revenue that comes from the deal in the following years. Growth-focused sales roles should earn minimal payment for retention revenue because it requires little or no persuasion.

Pay less for retention, more for growth

Many manufacturers pay for retention revenue by using commission plans that pay a percentage of every dollar throughout the year. Others institute quota-based bonus plans, but fail to set proper performance thresholds to recognize recurring revenue from previous years. When this occurs, much of the variable compensation paid to the sales representative is similar to base salary. The following example illustrates a sales compensation issue known as “salary in disguise”.

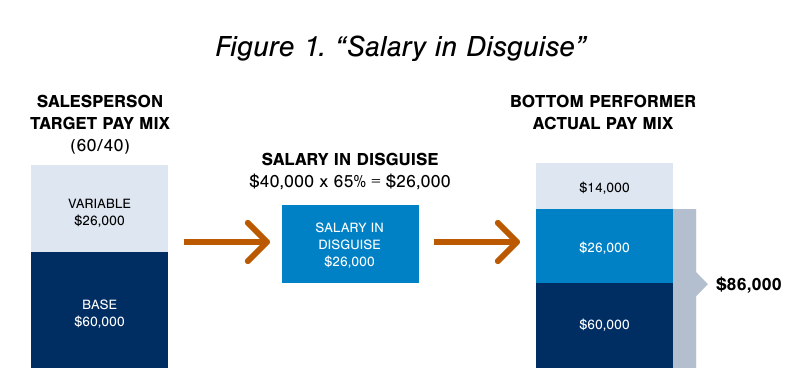

For this example, assume the salesperson has a $60,000 base salary with $40,000 target variable pay. The salesperson may be on a commission plan that pays the same percentage for every sale. Or they are on a quota-based bonus plan that does not have a performance threshold. Both work for this example. Assume the worst performers on the team achieve 65% of their quota (for this example, the commission plan’s “quota” equals the prior year’s sales). This means that even the lowest performers receive 65% of their variable pay, or $26,000. Their effective base salary becomes $86,000 instead of $60,000.

The implication on territory growth is the sales representative may get comfortable with $86,000 and lack incentive to grow beyond a minimum level. They may be satisfied with the compensation received from a reactive, “I’ll take what comes in” approach, rather than putting in extra effort to grow their territory. Compensation plans that pay significantly for retention business foster a culture of complacency.

Manufacturers could spend the $26,000 more wisely. Instead of using these funds to pay for retention business, increase the amount of pay awarded for above-goal performance. Transform the low productivity dollars into high productivity dollars by instituting quota-based plans with defined threshold and excellence points.

Pay less for retention, more for growth—How?

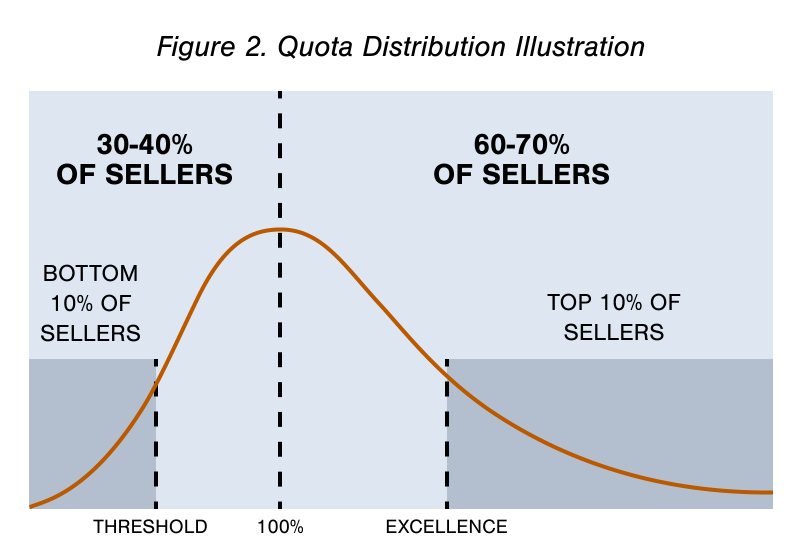

Quota-based plans with defined threshold and excellence points allow companies to utilize incentive dollars more productively. Thresholds minimize the amount of incentive dollars paid for retention business and increase motivation to surpass a defined level of sales. A common approach to setting thresholds is to use historical performance. Set the threshold at the point where the 10th percentile salesperson performs. In other words, the bottom 10% of your sales team should perform at or below this level. Therefore, the bottom 10% performers on the sales team earn no incentive pay instead of earning $26,000 as shown in the example in figure 1. This allows the business to pay high performers more, while still being financially responsible. Develop a target pay level for high performers by setting excellence points.

Excellence points establish a target incentive pay level for the 90th percentile performer on the sales team. Therefore, the top 10% of the sales team should earn incentive pay at or above the excellence pay level [see Figure 2]. Establish the excellence pay level by setting an excellence point and plan leverage. The excellence point should be set at the expected level of quota achievement of the 90th percentile performer. Use historical performance to guide the excellence point decision. Set the pay level earned at the excellence point by establishing a plan leverage. Let’s assume the excellence point is set at 150% of quota. How much should a sales representative earn when they achieve 150% of quota? Leverage answers this question and is expressed as a multiple of target incentive pay. For example, a 3x leveraged plan would pay the sales representative three times the target incentive pay for 150% quota achievement. The excellence point is determined using historical performance and estimated future performance of the team. Leverage is based on the amount of influence the individual sales representative has over the sale (more influence translates to higher leverage) and company philosophy. Establish an excellence point and leverage to set the target pay levels for high performers.

Quota-based bonus plans allow companies to equalize the salesperson’s earning potential across territories with uneven sales potential. Uneven territory sales potential is a reality many manufacturers face. Commission plans can incent growth similarly to the preceding method, but they will not equalize earnings across uneven territories. Create growth focused commission plans by establishing performance thresholds and increasing the commission rate above goal. Like the quota-based bonus plan, the threshold sets a minimum level of performance to earn incentive pay. This minimizes the amount of pay earned for retention revenue. The commission rate above goal should be significantly higher than below goal to motivate growth. Disclaimer: salespeople with greater territory potential will have a higher earning ability compared to salespeople with lower territory potential. While the preferred solution when faced with uneven territory potential is a quota-based bonus plan, commission plans can also drive growth selling behaviors.

When companies pay too much for retention revenue they permit complacency from their sales team. Sales representatives are able to earn a sufficient pay without putting forth the extra effort it takes to grow their territories. Improve the productivity of the company’s incentive budget by shifting underperformer’s payments to high performing sales representatives. Quota based bonus plans with defined threshold, excellence point, and leverage allow businesses to use incentive dollars to more effectively reward growth.

Sales Challenge #2: Expansive Product Portfolio

In years past, the manufacturing sales representative had a simple product focus. Sell the same products that are low in technical complexity and manufactured in a single location. The products had similar features and profit margins, which allowed for simple sales compensation plans. Today, many manufacturing companies cannot afford to have sales representatives handling a single product. Companies expect sellers to sell multiple products that are high in technical complexity and manufactured in different factories. Most importantly, each product in the “basket” has a different profit margin and importance to the company. Yet even with this complicated product “basket” and varying bottom line impact, we still find many sales.

We find many manufacturing sales compensation plans pay the same rate for all sales revenue. Commission plans pay the same percentage for revenue from all products. For example, the salesperson earns 1% on each sales dollar. Quota-based plans have a single measure, total sales. In this case, the salesperson has a quota of, say, $5,000,000 for the year. Sales from high and low profit margin products retire the quota equally. These overly simple plans leave the salesperson to decide which products to sell. The common result is the company doesn’t sell enough of the high importance products. As any logical person would do, the salesperson focuses on the products that help him or her achieve quota fastest, without consideration for which products are most important to the company.

How do I communicate which products are more important?

Sales compensation plans should clearly communicate which products are most important to the company. For commission plans, an obvious solution is to vary the commission rate by product type. The salesperson earns 2% on product A, but 1% on all other revenue. Product A may be more valuable to the company because it has higher profit margin or the company recently made a large investment in the product line.

However, successfully implementing a variable commission rate plan presents challenges. It is difficult to set the correct rates that align with target pay levels. This can lead to extreme payouts, on the low and high end. The problem is further complicated when sales territories have uneven potential, a common issue in manufacturing companies. The best way to solve for this is to implement quota-based plans with a separate measure, and quota, for the most important product/s.

Pay more for strategic products without paying more in total

An effective way to place emphasis on high value products is a quota-based plan with a distinct measure for the important products This measure can include a single product line or multiple, depending on the objectives of the business. The company can set goals for each territory which communicates clear expectations and provides equitability across salespeople.

This approach carves out incentive dollars for the strategic products. When instituted correctly, it pays a higher rate on the strategic products measure than the than the total sales revenue measure, without paying more total incentive dollars.

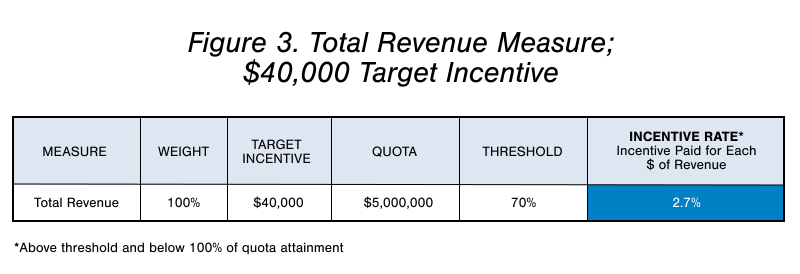

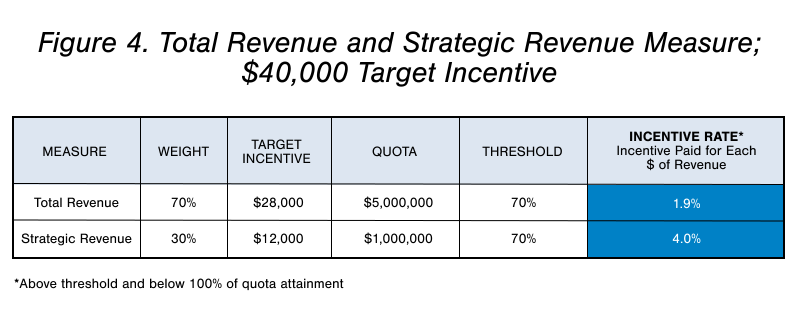

Consider the following example. Figure 3 displays a plan with a single, total revenue measure, $40,000 target incentive, and a $5,000,000 quota. The incentive rate paid to the sales representative for each sale above threshold is 2.7% of the sale price. The example in

Figure 4 adds a strategic revenue measure with a $1,000,000 quota. Maintaining the same $40,000 target incentive amount, the incentive rate for strategic revenue is more than double the rate of total revenue. This approach emphasizes revenue that is important to the company while maintaining focus on all sales, without increasing cost. Manufacturers can adjust incentive rates (by adjusting weighting) to achieve the appropriate differential between strategic revenue and total revenue for their business.

Companies generally give sales representatives the autonomy to decide where to spend their time. When the salesperson wakes up in the morning, they have a choice of calling on customers who buy product A or customers who buy product B. On a compensation plan that values all revenue equally, a rational salesperson determines which customer will bring in more revenue, regardless of profitability or strategic importance. On a sales compensation plan that properly differentiates revenue, a rational salesperson also considers which customer is more valuable to the company.

Sales Challenge #3: Global Customers

Many of the highest value customers for today’s manufacturer have global locations and make dispersed buying decisions. Frequently, the buying decision in one location affects the purchasing action in another location. For example, the customer is a large national or global business with headquarters, procurement, operations, engineering and sales functions scattered across the country or globe. Business leaders at headquarters select a supplier for a certain product line and procurement at the factory writes the purchase order. Or the applications team at the west coast sales office partners with a supplier to win a project bid. The purchasing department at the Midwest factory places the order a few weeks later. These types of customers require a team sales approach in order to earn a successful share of their purchase volume. Typically, a strategic account manager is responsible for driving global strategies while regional salespeople execute at the local customer offices. A sales compensation plan that drives this team approach is required.

The sales compensation issue is businesses don’t always incent team selling behaviors. Companies split credit between the strategic account manager and regional account manager on deals they win together. Or the company pays the strategic account manager like an executive, with little or no pay tied to the specific account performance. These sales compensation methods do not motivate the desired collaborative approach. When splitting credit, the more one salesperson earns, the less the other earns, which incents the salespeople to do more individually to increase share of credit. All team members must be rowing in the same direction at the same pace for optimal results. Splitting credit incents can cause friction and incent the wrong behaviors. Paying the strategic account manager like an executive fails to motivate strong account focus. They don’t develop growth strategies or fail to drive rigorous implementation. Success may occur but happens more by chance than due to a flawlessly executed strategy.

How do I incent a team approach effectively?

For successful global account performance, tie strategic account manager’s variable pay to the global performance of the account. Assign the strategic account manager a quota for the global account performance. Allocate quota to the regional account manager for the account location in his or her territory. Strategic and regional account managers will receive full credit for each deal and will willingly work together. The strategic account manager will have appropriate compensation incentive to develop and implement valuable global growth strategies. Manufacturers are often hesitant to implement this type of strategy due to the increased the cost to serve each account. However, the payback can justify the cost if the company selects the correct accounts and strategic account managers. For example, consider a customer with historical sales volume of $10 million and a total purchase volume of $100 million. Current share is 10%. Can you increase share to 12.5% by implementing an effective strategic account manager structure? If yes, the incremental annual revenue is $2.5 million. Assume the increased all-in cost (salary, variable pay, benefits, and expenses) is $250,000 for the strategic account manager. The ROI is 10x ($2.5M in incremental revenue / $250,000 headcount cost). Further, assume the gross margin on the incremental $2.5 million is 30%. This yields $750,000 incremental gross margin dollars, or 3x the cost of the strategic account manager. Keep in mind that this example assumes the Strategic Account manager only has one account. If the company assigns two or three accounts, the cost per account decreases and the ROI increases (assuming the same results).

A strategic account manager strategy can be a very effective way to increase share at large global accounts. The sales compensation program must reflect the team selling approach that is required for success. The cost to serve is higher but the ROI can be lucrative if the manufacturer selects the correct accounts and salespeople.

Conclusion

The manufacturing industry can be a challenging environment for a sales team. There are many competitors, product differentiation is minimal, and sales resources are usually limited. Successfully growing the business requires much more than a new sales compensation plan. However, companies can take sales compensation actions that increase the probability of success. These actions help address some of the key issues manufacturers face today. Shift incentive pay from retention revenue to growth revenue to stimulate territory growth.

As products have become more complex and technical, the importance of using incentive pay to focus sales representatives on a subset of products has increased. Use quota-based bonus plans with differentiated measures to drive this behavior. Lastly, motivate an effective team approach at global accounts. Allocate individual quotas and provide full sales credit to both the strategic account manager and regional account manager. While sales compensation is not the only tool used to drive growth, addressing these key challenges is extremely difficult without the appropriate sales compensation plans in place.