Building a Higher-Value Broker Engagement Model

Health insurance carriers depend on their broker network to drive a significant portion of their business, particularly when it comes to new customer acquisition. Despite the emergence of private and public exchanges as important new channels of distribution, brokers are still the dominant distribution channel for most health insurance carriers. And as competition in the health insurance market heats up, carriers are increasingly challenged to gain access to new customers. Winning broker mind share has never been more critical to carrier growth. Carriers can still stand out from the crowd through better provider networks, product innovation, claims management or member services, and of course, better pricing. However, the combination of more carriers in each market, more brokers keeping renewals off the market, and increasing broker consolidation is raising the pressure on carriers to more effectively gain broker mind share.

What is a Broker Engagement Model?

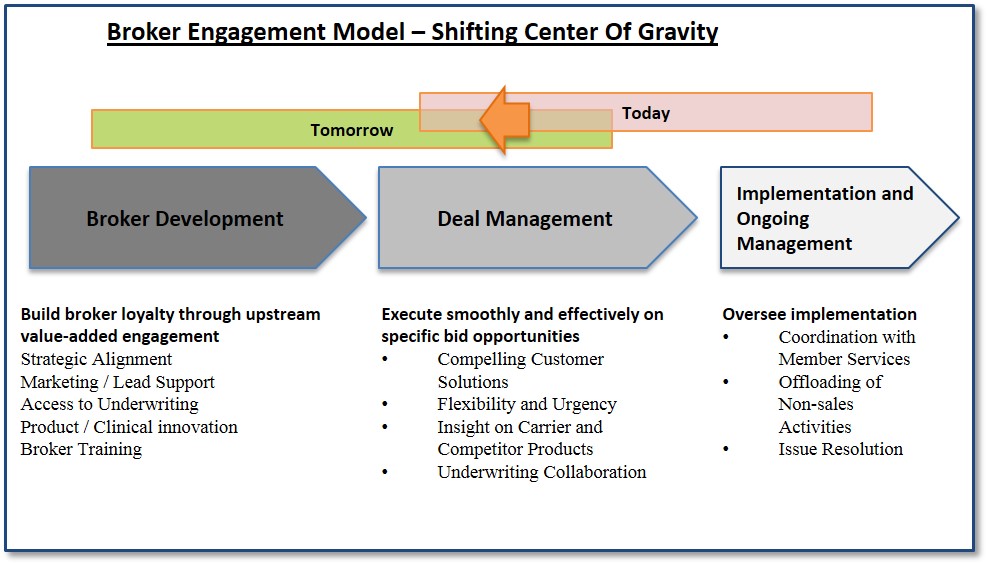

To win in this environment, carriers must focus their Broker Engagement Models around a broader, accurately targeted set of value creation activities. Today, the carrier New Business Reps are primarily focused on deal execution and customer ramp-up. Going forward they must place more emphasis on upstream value creation. Brokers want a reliable partnership with their preferred carriers – one that enables them to add value for their customers. This partnership needs to start upstream from deal-making, or “well before the bid,” to quote a broker in our research.

In our work with carriers to optimize sales strategies and execution, we have identified and developed a set of best practices to enhance the carrier’s Broker Engagement Model. Some of our carrier clients have already seen significant results from this work. Developing a systematic understanding of what different brokers really value and aligning sales processes around it leads to increased quote volume, close rates and market share.

Refocusing Broker Engagement Models

Here are the four best-practice steps carriers must take to refocus their Broker Engagement Models:

- Broker Segmentation

- Broker Management Process

- Training and Communication

- Tracking and Monitoring

Broker Segmentation

The goal of this step is to develop a systematic understanding of the broker types in your market, how they add value for customers, and what they really value from carriers. Group brokers into segments using not only the usual criteria like revenue, number of accounts, customer type and number of employees, but also your knowledge of the broker’s unique positioning, offerings, partnership goals and aspirations. More than data analysis, this level of insight typically requires sales leaders to conduct structured broker interviews to understand what brokers truly value and how they see their future. Based on this type of understanding, carriers can determine their optimal broker segments and then assign their targeted brokers to those segments.

Broker Management Process

The goal of this step is to create a higher-value, well-enabled and repeatable sales process for New Business Reps. However, it will also need to vary in certain ways to align with each segment’s broker needs and with your strategy for that segment. The key here is for reps to understand how and when to deploy the upstream value levers against the right brokers. These levers include:

- Clearly communicating where the carrier wants to do business (i.e., its sweet spot)

- Providing co-Marketing and lead gen support

- Giving brokers access to Underwriters to understand objectives and build trust

- Facilitating broker participation in product and clinical innovation (which helps both parties)

- Providing broker training on how to succeed in the changing marketplace

Training and Communication

The goal of this step is to provide New Business Reps with the ability to understand and consistently execute the higher-value broker engagement model. This often involves getting them out of strongly-entrenched “comfort zones” around deal management and issue resolution activities. Training is crucial, but successfully driving this type of change typically requires coordinating a broad range of sales transformation levers including: sales compensation, manager coaching, performance management and leadership messaging. A common weak spot is first-line manager inability to coach this approach which may differ from their previous experience.

Tracking and Monitoring

The goal here is to determine the key metrics and associated governance process to provide management visibility and to ensure these upstream value creation activities are actually happening. This involves looking at traditional metrics in a new way, such as quote volume, close rates, member growth and products per deal. But it also requires looking at new metrics that help track milestones and the perceived value of the carrier to the broker. This visibility gives management the ability to adjust and refine the new Broker Engagement Model over time.

Alexander Group Helps Create High-Value Broker Engagement Models

To win in this increasingly competitive health insurance market, carriers must refocus their Broker Engagement Models. Developing and sustaining broker mind share will be harder and harder to achieve for carriers. Carriers that create higher-value Broker Engagement Models where Sales focuses on key broker loyalty drivers, and Market Management, Underwriting, and Clinical provide the needed support and collaboration will enjoy major competitive advantages.

We hope you have found this overview of the four best practice steps a useful starting point for thinking about your Broker model. What are you doing to adapt and differentiate your Broker model? Learn more about Alexander Group’s Health Insurance practice.