Advanced Pay-for-Performance Alignment

Most companies are planning for growth. Unfortunately, many of them are also expecting to increase their cost of sales. Thus, they must focus on driving higher levels of productivity via a sales compensation program that pays for performance.

The shift is both widespread and effective. 71% of companies are adjusting their plans to better align pay with performance, with the most popular approach being higher rewards for over-performance (52%). Other solutions include more individual accountability (27% using more individual vs. team metrics), implementing consequences for under-performance (22%) and simplifying plan structures to enhance focus.

The results validate this strategy—companies implementing more pay-for-performance plans achieve 104% of sales targets on average, and those with effectively aligned plans achieve 103% of revenue goals. The trend reflects a fundamental recognition that sales compensation must drive specific behaviors rather than simply reward participation

Consumption Model Integration and Enhanced Route-to-Markets

The traditional sales model is fragmenting as XaaS companies navigate increasingly complex customer acquisition paths. The rise of Product-Led Growth and consumption pricing models alongside more sophisticated partner channel ecosystem creates sales compensation challenges that didn’t exist in simpler transactional models.

Consumption-based pricing adoption continues growing, with 41% of XaaS companies implementing models that require fundamentally different measurement approaches. Unlike subscription models where the committed value and associated revenue is predictable, consumption models have more variability that demands measuring both initial contract value (if use committed funds/credit contract models) and ongoing consumed revenue.

Incentivizing partner sales teams that manage a more complicated partner ecosystem adds another layer of complexity. Organizations must balance direct sales teams against channel partners while avoiding conflicts that damage customer relationships. Companies have to invest in measuring partner-sourced, partner-influenced, resell, number of certifications and other measures to successfully measuring these teams.

Strategic Challenge Management and Organizational Scaling

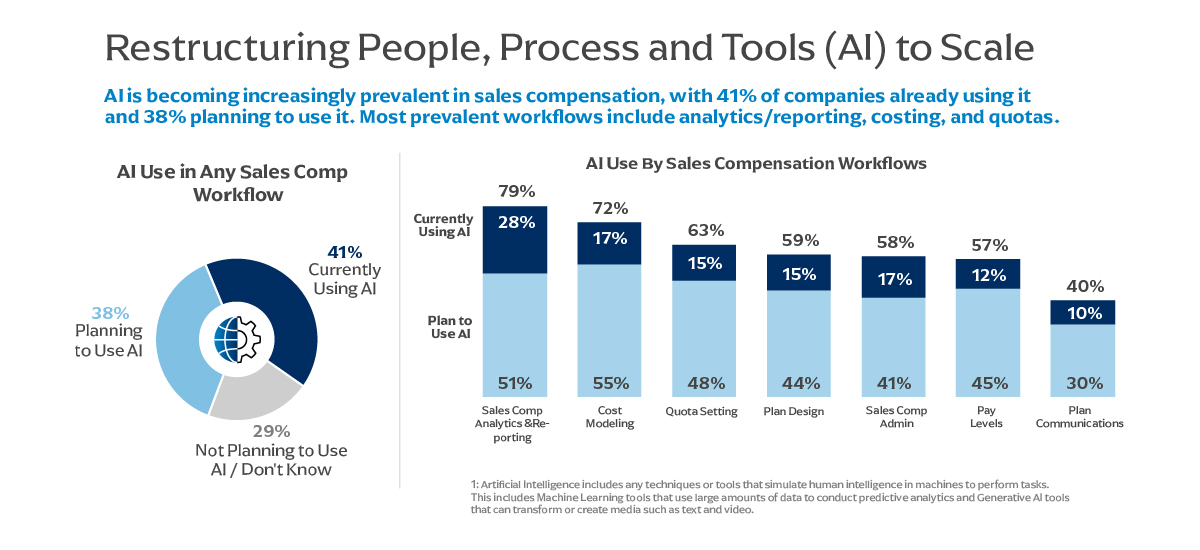

The pace of change in XaaS compensation has accelerated significantly, driven by market pressures and strategic pivots that require continuous plan adaptation. 86% of companies made plan changes in 2025, reflecting the dynamic nature of subscription business models and evolving competitive landscapes.

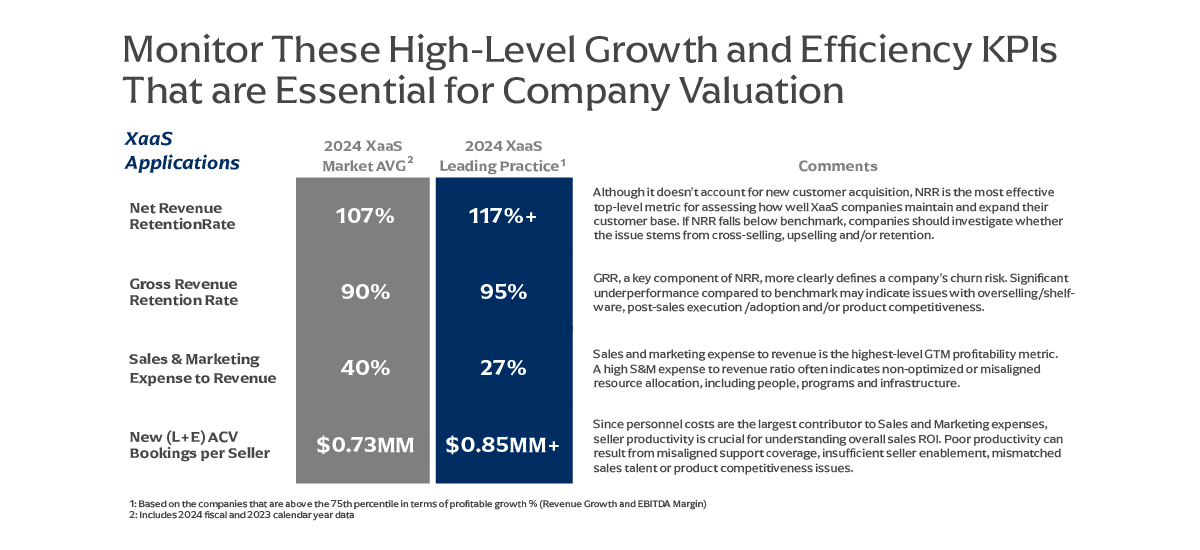

The drivers reveal fundamental shifts in business priorities. Profitability focus leads the list (61%), followed by new product launches (43%) and productivity improvement (40%). These changes occur against a backdrop of continued investment, with compensation budgets rising 8.6%, and 68% of organizations planning headcount increases—the highest hiring rate since 2019.

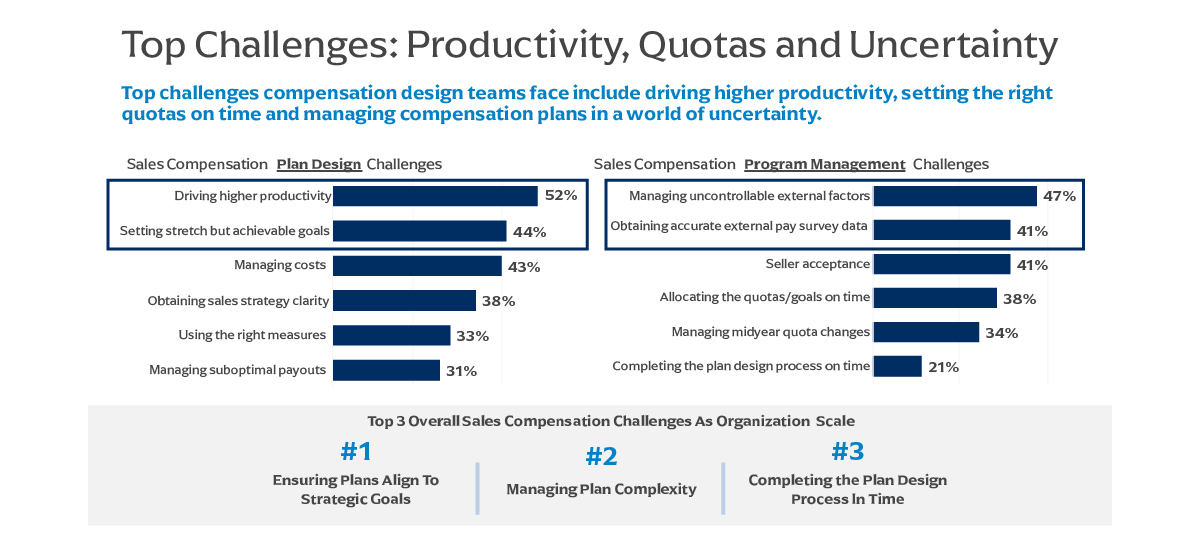

Yet, growth creates its own challenges. The most frequently cited obstacles include driving higher productivity (52%), setting achievable goals (44%) and managing external factors beyond organizational control (47%). As companies scale, ensuring strategic alignment remains the primary challenge, requiring sophisticated program designs that maintain agility while supporting larger, more complex operations.