What Every Executive Must Know to Drive Sales Compensation ROI

A company’s largest and most impactful sales expense is compensation.

Executives are responsible for three core business goals: revenue growth, cost management and risk mitigation. To accomplish these goals, leaders monitor their company’s business practices and identify improvement initiatives that will have meaningful impact. Sales compensation is a critical focus area since it is the largest sales expense for most B2B companies and one of the strongest levers for driving top-line growth. Are companies realizing the greatest return on investment from their sales compensation spend?

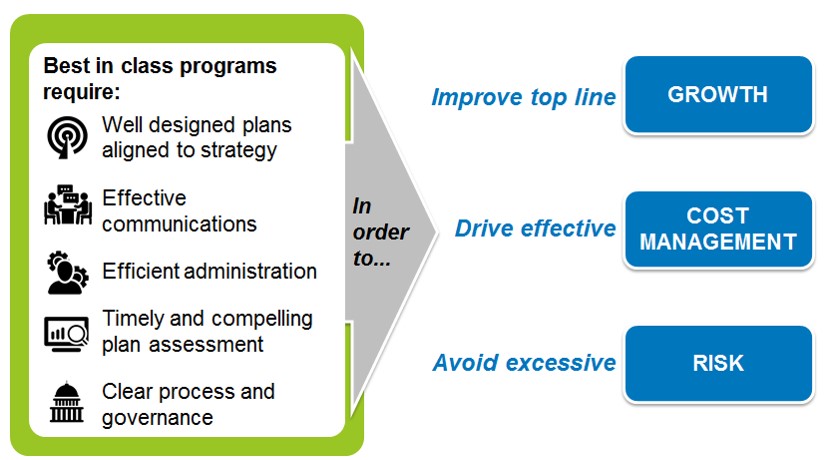

Sales compensation consists of two key elements: design and program management. Executives who understand the interplay of both elements are better positioned to be successful. Unfortunately, company leadership primarily focuses on design and does not give enough attention to program management. As described in previous posts, sales compensation program management includes the combination of platform jobs, principles, goalposts, governance and process. Consider the following characteristics of best-in-class programs. A company isn’t maximizing the return on sales compensation investment unless all five criteria are met, most of which rely heavily on effective program management:

- Well-designed plans aligned to strategy: Plans successfully guide sales professionals towards prioritized activities that will drive the business forward.

- Effective communications: Sales leaders clearly and consistently explain plans to the frontline in face-to-face forums using a cascading communication approach.

- Efficient administration: Sales professionals receive timely and accurate payouts without plan administrators spending countless hours calculating and distributing incentives.

- Timely and compelling plan assessment: Analysts consistently evaluate plan effectiveness to support and guide future plan improvements.

- Clear process and governance: All constituents have clear marching orders. Resolution pathways exist to handle disputes and compliance concerns.

Growth, cost management and risk mitigation

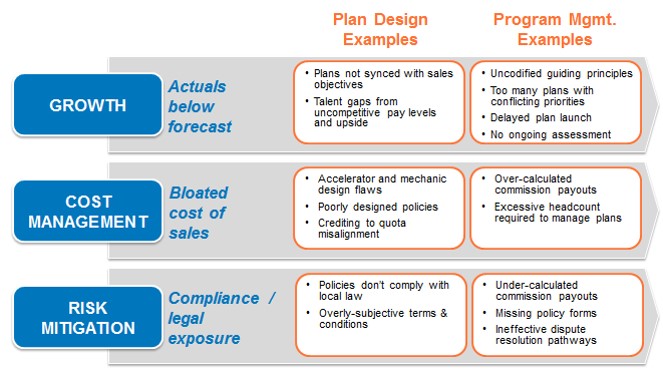

An effective way of assessing a company’s sales compensation return on investment is by inspecting both design and program management within each business driver in isolation.

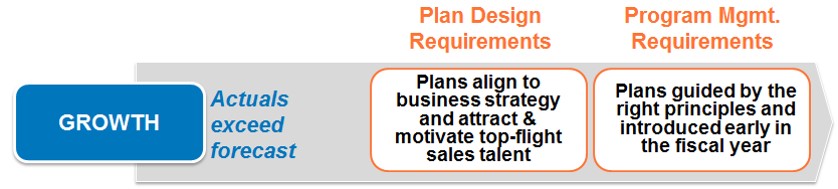

Start with Growth:

Money is the prime motivator for most sales professionals. The ability of sales organizations to attract and direct good talent lies deeply in its ability to create lucrative and motivational plans. Underpinning effective plan design is the adoption of guiding principles that reinforce the company’s pay philosophy and codified processes that allow the organization to launch plans early in the year. Management should avoid directing the sales force without concurrently rolling out sales plans or implementing sales plans that have gone live but don’t reinforce company strategy or drive the right behaviors.

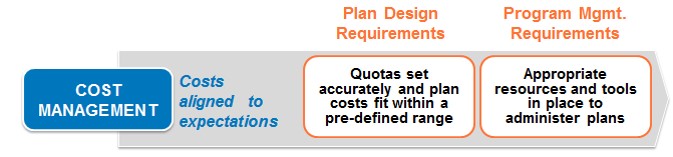

Now consider Cost Management:

Sales leaders may have heard the sayings, “Sales compensation plans are only as good as our ability to set reasonable quotas,” or “Good plan design is meaningless unless the sales force believes quotas are realistic.” These statements are true within most sales organizations, but company leadership must also grapple with the opposite risk: setting quotas too low which leads to cost of sales inflation and compensation expense surprises. The key is finding the right quota-setting balance and correctly forecasting expected incentive costs using different performance/distribution scenarios. Executives should also consider hidden program costs, including the thousands of hours plan administrators spend setting up plans and calculating payouts. Huge opportunity costs (not to mention employee fatigue) exist without the right tools and processes in place to drive efficient sales compensation operations.

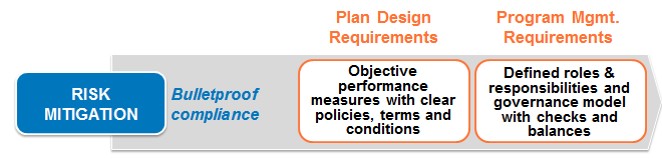

Risk Mitigation is the final business driver to consider:

Every sales organization, particularly those operating in multiple geographies, must consider compliance and litigation exposure within their sales incentive plans. Managing this exposure is no small task considering that every country has different employment laws with many operating works councils that can quickly negate plan designs and regularly rule in favor of the employee. Organizations that fail to design policies (e.g., new-hire policies, windfall policies, territory transition policies) within the bounds of the law will unnecessarily expose themselves to legal risk. This risk is often exacerbated when companies don’t incorporate the correct dispute resolution policies and/or introduce governing bodies capable of resolving issues before they metastasize.

Avoid the following plan design and program management pitfalls

Taken collectively, sales compensation design and program management is one of the few company initiatives on which a company can collectively address revenue growth, cost management and risk mitigation. Treating it as an afterthought can materially impact a company’s financials and force executives to address large problems that more proactive oversight could have mitigated. Examine the following pitfalls the Alexander Group has observed through years of sales compensation consulting.

Do any of the preceding pitfalls sound familiar? Are you interested in learning more how best-in-class sales compensation programs drive growth, manage costs and mitigate risk? Please visit the Alexander Group’s Program Management practice page or schedule an in-house briefing.

Contributing authors: Rachel Parrinello and Ted Grossman are co-leaders with Chris Semain for Alexander Group’s Sales Compensation Program Management practice.