Analytics in Action: Customer-Centric Segmentation Spurs Growth

Despite new offerings and a long history of year-over-year revenue growth, a digital marketing company struggled to improve its top line. After an assessment of the company’s sales force, Alexander Group discovered a misaligned sales model impeding growth. The solution: a segmentation and coverage overhaul to decrease churn, increase sales productivity and reinvigorate growth.

Churning away existing customers

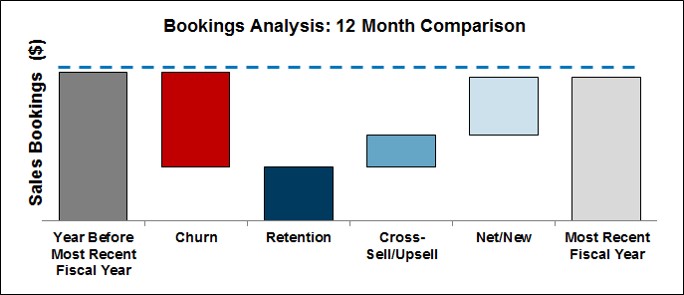

As part of the assessment, Alexander Group conducted a “CPR” (conversion, penetration, and retention) bookings analysis. The analysis focused on new, cross-selling, upselling and renewals bookings and revealed an astounding 65 percent bookings churn rate (Figure 1). In effect, the company was failing to retain two-thirds of its business from the prior year. The churn rate increased just over one-half from the year before. The high churn rate reflects customers’ dissatisfaction with their overall experience.

The business also experienced a sharp decline in total new customers (a 10 percent drop year-over-year), further impacting its ability to make up for the lost renewal bookings. In short, this company was driving away two out of every three existing customers, and adding just one new customer for every four that were lost.

Figure 1

Lack of customer segmentation and sales plays leads to rep underperformance

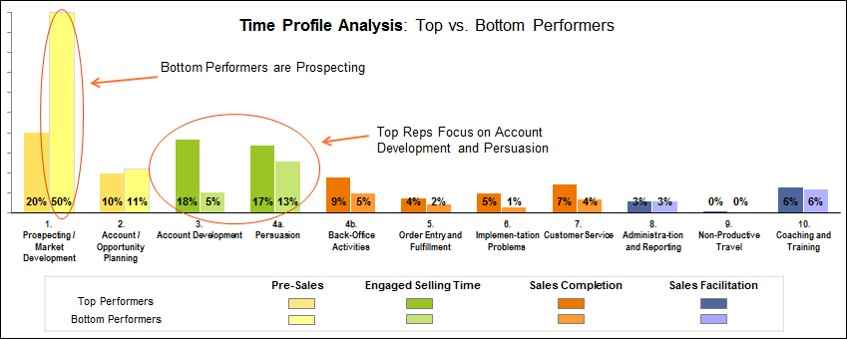

A sales rep survey highlighted the clear lack of customer segmentation and associated sales plays. The difference in sales time profiles between top- and bottom-performing reps showed that bottom-performing reps were on more difficult missions, received fewer renewal leads, and weren’t equipped with the necessary selling execution skills to access both small and large customers (Figure 2).

The majority of reps reported prospecting new clients as their primary inhibitor to getting more selling time. This led the project team to posit that lead saturation was an underlying cause for the excess time spent prospecting. In the survey, reps also complained of poor communication and inadequate alignment between value messaging and customer needs. Communication breakdowns resulted in multiple reps calling upon the same customers, sometimes at the exact same time.

Figure 2

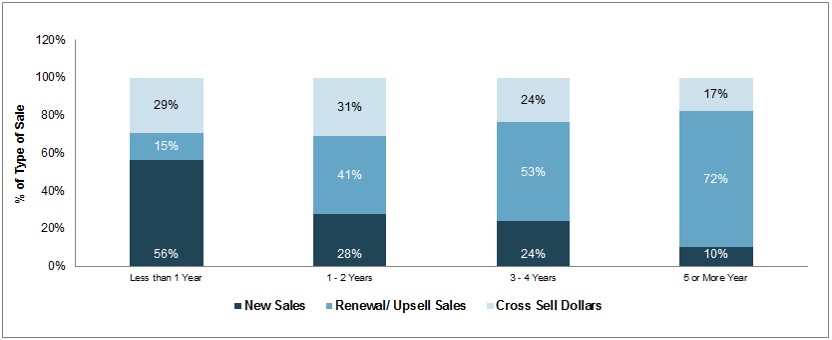

Annual sales performance data showed that high-performing reps were able to develop a book of renewal business, whereas low-performing reps struggled to do so. On average, about 60 percent of high-performing reps’ bookings came from renewals, compared to 40 percent for low performers. Furthermore, reps with more years of experience had higher renewal and cross-selling bookings as a percentage of their total bookings. The most tenured reps (>5 years) closed 90 percent of their total bookings in renewals and cross-sells. (Figure 3)

Figure 3

Overpaid reps in low-level roles drive high Compensation Cost of Sales

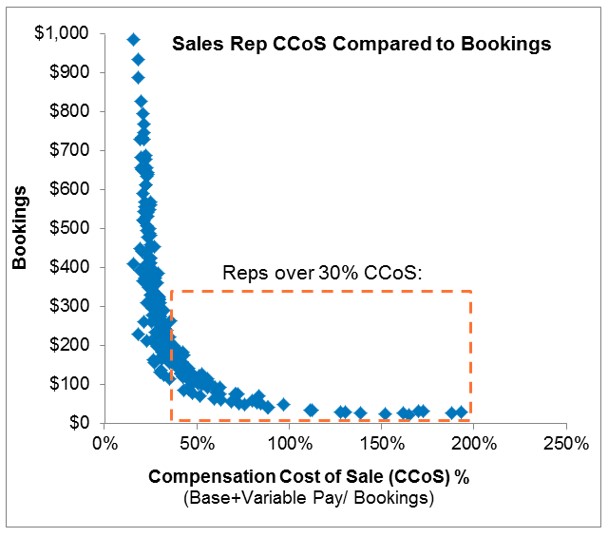

The assessment also found that many unproductive, high-cost sales reps contributed to a high Compensation Cost of Sales (CCoS). CCoS for the highest headcount roles was almost 50 percent, which was 2-3x benchmark (Figure 4).

A well-designed segmentation and coverage strategy should produce relatively predictable bookings results for different levels of sales roles. Companies with strong coverage models should reasonably expect a productivity ramp-up time of 3-6 months for new hires. Reps failing to perform after the introductory period should be managed out, and those who meet and exceed goals should be promoted to the next level, where they’ll be expected to achieve higher productivity.

At the digital marketing company in this case study, a misaligned coverage model contributed to the high CCoS. The highest headcount role, originally intended as a transitional stepping stone for new hires, had a remarkably high CCoS (~60 percent). Upon further analysis, the project team found incumbents were staying in the role for up to five years with low bookings productivity. They earned significantly more base and incentive pay than their peers, without a corresponding increase in productivity.

In a well-designed coverage and rep advancement model, rep CCoS should decrease substantially following the initial ramp-up period. But CCoS was actually increasing following ramp-up, highlighting a pressing need to reduce headcount in the role, while revisiting the profile of reps across roles.

Figure 4

Shift to customer-centric segmentation

To combat the high churn, lack of defined customer segments and sales plays, and poor return on compensation, the project team recommended a new customer-centric sales model. A successful segmentation and coverage overhaul would lead to an improved customer experience (decreased churn), improved sales productivity (better return on compensation), and increased sales growth (new customers and penetration within existing customers).

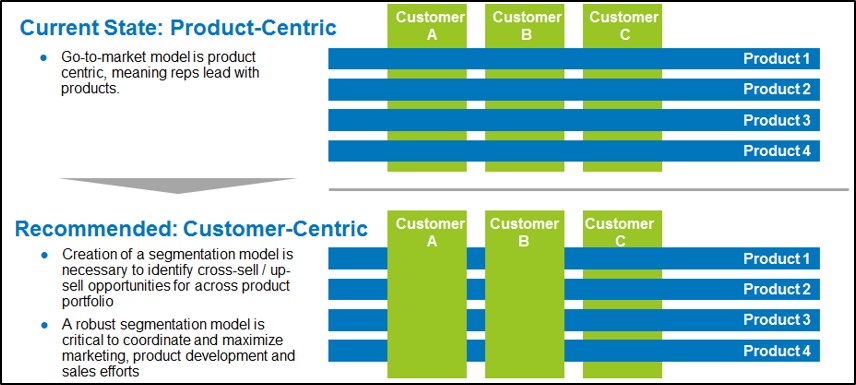

The current segmentation model was product-centric, meaning reps were leading with products rather than tailored solutions to customer needs. Transitioning to a customer-centric model would result in more cross-sell and up-sell opportunities (Figure 5).

Figure 5

The new segmentation approach aimed to improve retention rates and develop longer-term relationships with customers. It involved scoring customers based on preliminary qualifications (e.g., customer’s annual spend), adding additional opportunity criteria to refine the segmentation model, developing a formalized annual segmentation model review and implementing new sales motions. Accounts were reassigned to align with various sales roles and new allocation rules were developed.

For the largest accounts, Alexander Group recommended that each have a dedicated rep. For the mid-tier accounts, the team recommended aligning reps based on vertical groupings of accounts, with a dedicated set of overlay product specialists assigned to the groupings. Leadership reacted well to the new approach, with all key stakeholders on board. Stakeholders indicated they had been looking for a solution like this for quite some time.

Interested in learning more about Sales Analytics and customer-centric segmentation? Contact the Sales Analytics team at Alexander Group.

Original author: Greg Ketchum.