Are Sales Compensation Costs Variable for the Company?

Here is the short answer: For income producers, the answer is yes. For sales representatives, the answer is no. However, what about the sales personnel themselves? Regardless of seller category—income producer versus sales representative—the answer is yes. Sales compensation is a variable pay plan for the participants. Wait, what?

To begin, we have to confirm there are two types of sellers: 1) income producers and 2) sales representatives. Income producers are (or should be) paid full commission. They create value by nurturing buyer relationships and connections. Often, the products are a commodity and ubiquitous. Producers split income transactions with the house. Think real estate agents, financial advisers, traders, mortgage origination personnel, manufacturing reps, stock brokers and life insurance agents. Their costs are fully variable for the company: The more the producers sell, the more they are paid; the less they sell, the less they are paid. Note: While the payouts are variable, the payout rate is the same for all sellers.

Meanwhile, sales representatives are employees who sell their company’s unique configuration of products. Management defines sales objectives. They are paid for persuasion success. Sales representatives have a target total pay amount. This amount is split between a base pay element and a target incentive amount. This ratio is known as the pay mix. The total of the at-risk target incentive amounts creates the budget of incentive payments. As such, sales personnel are funding their own incentive program. The low performers are paying the high performers. Correctly assigned quotas ensure costs to the company are not variable. At the end of the year, the total payouts should approximate the total of at-risk target incentive amounts. The overall costs to the company are not variable.

However, payouts are fully variable to the individual seller. For both seller categories, the better sellers earn more than the lower performing sellers do.

Are sales incentive costs variable for the company? For income producers, yes. For sales representatives, no. For all sellers, (ouch) yes.

A Recent Question

Question: It takes us a long time to get sales data on indirect transactions. Is there a best practice between crediting upon receipt or crediting before shipment? We currently do this and it is very process intensive and inefficient; however, we do not know if there are other options out there.

Answer: Pay on sales-out data! Yes, it takes a long time to get accurate data from channel partners. However, you have no other choice. You would not want to pay on sales-in data to the partner…this can cause “loading of the channel”—not a desirable outcome. Sorry, no easy solution around the time delay for this information. There are companies that gather this information from distributors and sell it back to manufacturers.

From the Sales Compensation Survey Database

The Alexander Group has been conducting sales compensation trends and practice surveys since 2003. Here we look at select interesting findings.

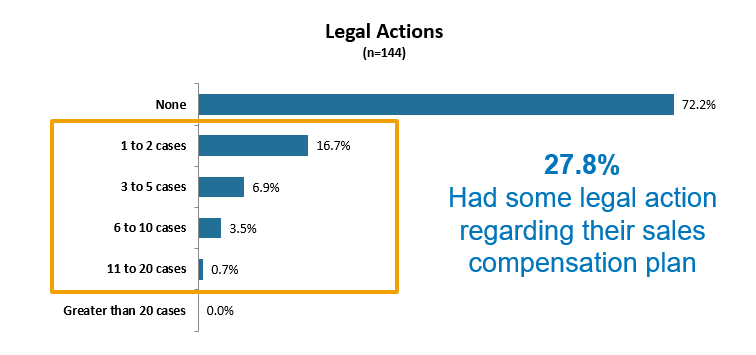

What percent of companies have a legal issue with their sales compensation plan?

This question defines the threshold of a legal issue as follows: A lawyer has written a letter on behalf of a seller claiming unfair treatment. This question has been asked five times over the last 20 years, and the answer is remarkably consistent:

Not What You Were Looking For? Explore More…

Article: Pending Recession Leads to Modest Increase in 2023 Seller Pay