Death of the Generalist: The Move to Specialized Commercial Roles

This is an exciting time for healthcare. MedTech companies are expanding beyond traditional products and boundaries. Value is moving from a physical product to the information the product collects.

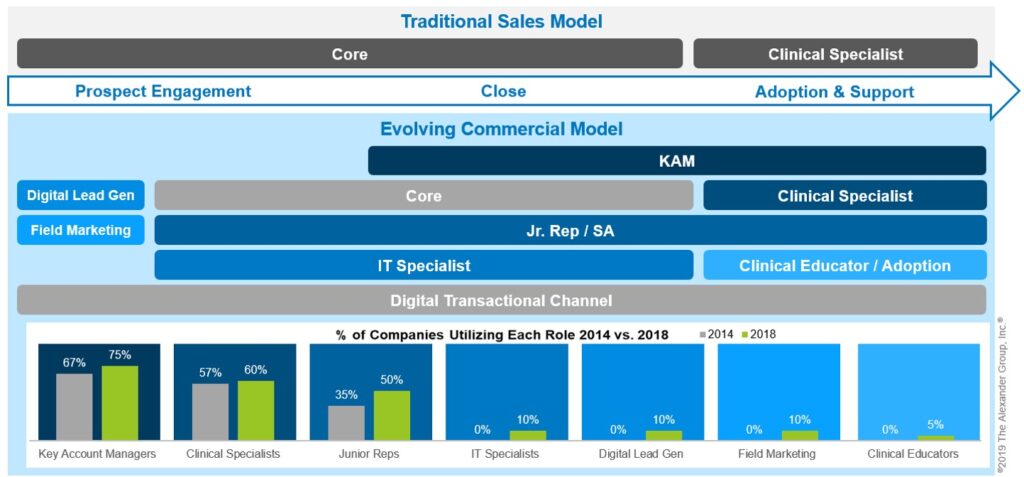

Alexander Group’s ongoing healthcare research suggests a return of historical growth levels and increased sales force productivity within the MedTech industry, despite a continued downward trend in gross margin percentages. In this growing market, companies are shifting budget dollars away from traditional front-line sales headcount and towards specialized commercial roles, such as junior reps, clinical specialists and IT/technical specialists.

More complex buyers and solutions require innovative approaches to serving customers. Commercial models must evolve to keep up with the customers’ needs. MedTech companies are augmenting traditional selling roles with functions such as clinical specialists, key account managers, junior sales representatives, IT specialists, digital lead generation, field marketing and clinical educators.

In discussions with 50+ sales and marketing leaders across the healthcare ecosystem, some recurring themes emerged about priority investment and opportunity areas:

- Patient support and clinical support roles: Adding more muscle to support cases, patient reimbursement and economic buyer stories

- Strategic Accounts: Dealing with consolidation and the importance of properly meeting the needs of more complex/complicated key accounts (e.g., IDNs, GPOs)

- Digital Emergence: Investing in new IT resources and digital capabilities to better service customers and enable field resources

To confront significant changes in the industry, companies are deploying agile go-to-customer models that intelligently specialize and deploy the right job roles at the right resource levels in the right places. Sales deployments are shifting from simple generalist to complex pre-sales roles and customer success roles to drive greater demand and improved account expansion at lower SG&A expense.

Does your organization have the necessary clarity of coverage, capabilities and enabling support programs to sustain your revenue growth engine? Contact an Alexander Group Healthcare leader today!

Learn more about the Alexander Group’s ongoing healthcare research efforts aimed at providing insights around the strategies, roles and investments across the buyer journey.

_______________

RELATED RESOURCES

MedTech Leaders Sustain Growth Using More Complex Commercial Models

Read the companion blog