Financial Pressures and Investment Focus

Providers expect patient volumes to rise in 2025, but financial pressures are mounting. Hospital leaders project about an 11% increase in total expenses, versus only a ~3.6% increase in reimbursements. This ~7 percentage-point gap squeezes margins significantly. It’s no surprise that cost inflation is a top concern – roughly 80% of hospital executives cite rising costs as having a major impact on performance. Staffing shortages and policy shifts are also worries, but cost pressure leads the pack.

With this caution, budget increases are slowing down. Fewer hospitals plan to boost their 2025 budgets compared to the previous year. Capital investments that do happen are very targeted, mainly in areas that sustain operations or drive efficiency. In fact, the top areas seeing increased capital spend are IT tools and maintenance/replacement of equipment (each cited by more than half of the executives). In other words, providers are investing in digital infrastructure and keeping the lights on, rather than launching expansive new projects.

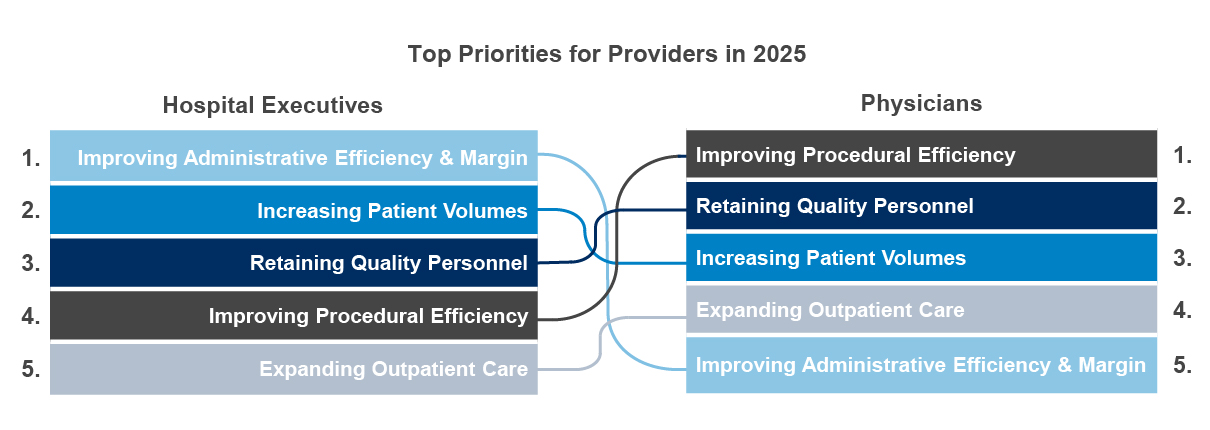

Staffing Challenges and Efficiency Needs

Workforce shortages and labor costs are major concerns. Many hospitals plan to increase headcount for clinical roles (nurses, lab technicians, physicians in key specialties) to meet patient demand, but one-third of providers also plan to decrease administrative/back-office staff. This reflects a push to eliminate inefficiencies and focus resources on frontline care. As admin roles decrease, technology is expected to fill the gap.

Providers often feel stretched thin on support staff. As one cardiologist noted, they feel “strained in not having adequate nursing support and clerical support,” highlighting how even physicians notice the lack of support staff. Digital tools that automate or streamline administrative work (scheduling, documentation, billing, etc.) can help hospitals maintain efficiency with a leaner staff. By offloading routine tasks, these tools free up medical professionals to focus on patient care.

Likewise, improving clinical workflow efficiency is top of mind for physicians. Time is money in healthcare. Solutions that shorten procedure times, reduce errors, or improve care coordination directly contribute to efficiency and better patient outcomes. Analytics, AI-driven decision support, or workflow management tools can play a key role here. When crafting your value proposition, tie your solution to tangible efficiency gains – for example, “reduces average appointment waiting time by 20%” or “saves nurses an hour of paperwork each shift.” This directly addresses provider pain points.

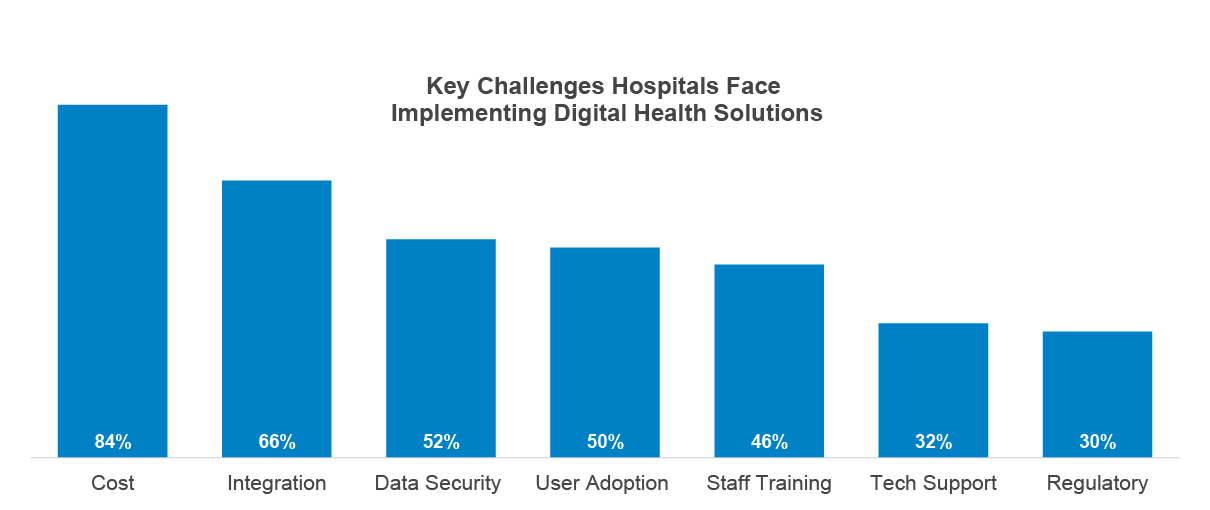

Technology Adoption and Tech Stack Maturity

Hospitals have invested in a lot of new technology in recent years (especially post-COVID), but many feel their tech stacks are still not fully optimized. Only about 12% of hospital leaders would call their systems “optimized,” and 0% describe them as cutting-edge. Most consider their environment somewhere between developing and moderately advanced. In practice, many hospitals run a patchwork of systems (some 5–10 years old, plus newer additions from the last few years), which leads to integration headaches. Interoperability – getting different vendor platforms to work together seamlessly – remains a thorny issue.

The encouraging news is that providers are open to improving their tech situation. About one-third of hospital executives say they are open to switching to a new digital health system if the need arises. Openness is highest for categories like telehealth platforms and patient engagement tools, but even core systems like EHRs have a notable minority willing to consider change.

However, hospitals often invest in new technology only when triggered by specific events rather than on a regular review cycle. Common triggers include expansion to new facilities or services, a merger or acquisition, new leadership coming in with a different vision, forming a strategic partnership or reacting to a major issue like a data breach or regulatory change. In fact, only 28% of execs say they review digital solutions periodically without a specific prompt – most wait until something forces the issue.