Banks Alter Strategies due to Rates and Loan Volumes

Interest Rate Hikes and Loan Volumes are Driving Banks to Change Go-to-Market Strategies

The pressure on banks to drive efficacy in their go-to-market (GTM) models has expanded due to increasing interest rates, lower loan volumes and a slower-growing economy. In fact, banking executives were already implementing changes to their customer-facing roles before the fast pace of overnight rate increases and the slowdown began.

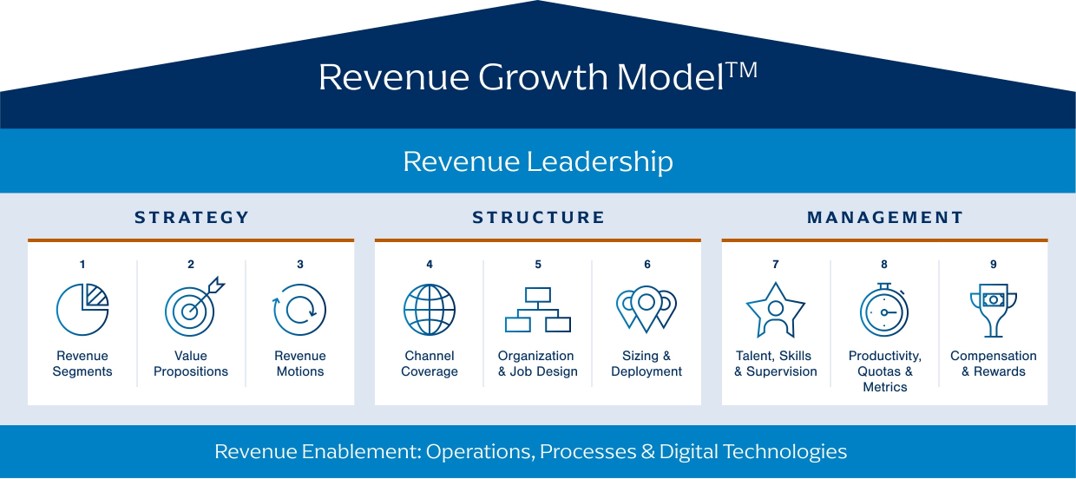

To assess banks’ go-to-market models and recommend future changes to their commercial strategy, Alexander Group uses its Revenue Growth Model™. Based on a survey and interviews conducted by Alexander Group, banking executives are undertaking key GTM initiatives in common key areas across the Revenue Growth Model™ pillars.

Segmentation (Pillar 1) Drives Relationship Manager Focus on the Right Accounts

During these challenging economic times, banking executives are reassessing their segmentation models to determine which customers are being prioritized and targeted by the bank’s customer-facing teams. Traditionally, banks have taken a high-level approach to segmentation, mainly focusing on revenue or vertical-based schemes due to their powerful market position. However, the increase in competition in recent years has led to the need to revisit how a bank’s customers should be segmented.

When formulating segmentation models, Alexander Group recommends several criteria, including a customer’s history, buying behavior and total addressable spend. The latter factor is becoming increasingly critical in how banks should approach segmentation. Questions such as how much a customer spends with the bank, how much more they could be spending through product cross-sell, and how much they are spending compared to competitors will dictate the importance of certain customers and/or verticals to the bank. This, in turn, will determine how relationship managers and other specialist resources are aligned to those types of customers.

Defined Value Propositions (Pillar 2), Rules of Engagement (Pillar 5) and Enablement Resources Will Ensure Appropriate Commercial Focus Given New Demand on Sellers

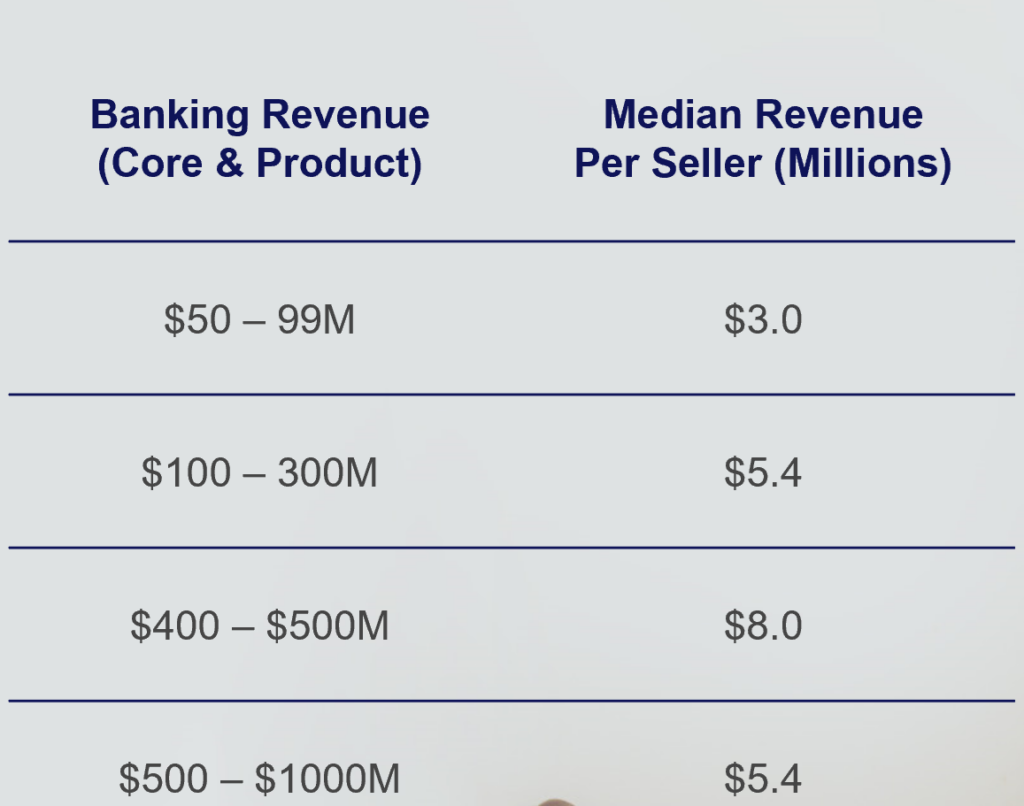

Historically, banks have not been commercially centric, leaving significant areas of opportunity for improvement in their general sales process and coverage models. According to Alexander Group’s recent survey of banking executives, most institutions expect their direct sellers to produce between $5 and $8 million in revenue. To meet these new expectations, banks must provide more support and guidance throughout the sales process to ensure that sellers can meet and exceed their goals.

56% of banking executives surveyed reported a lack of a strong value proposition as a top go-to-market challenge. Providing account managers with a strong value proposition statement will help them attract and retain customers by highlighting key points of differentiation from competitors. The bank’s marketing organization should also incorporate the value proposition into its messaging to further support the sales team throughout the buyer journey.

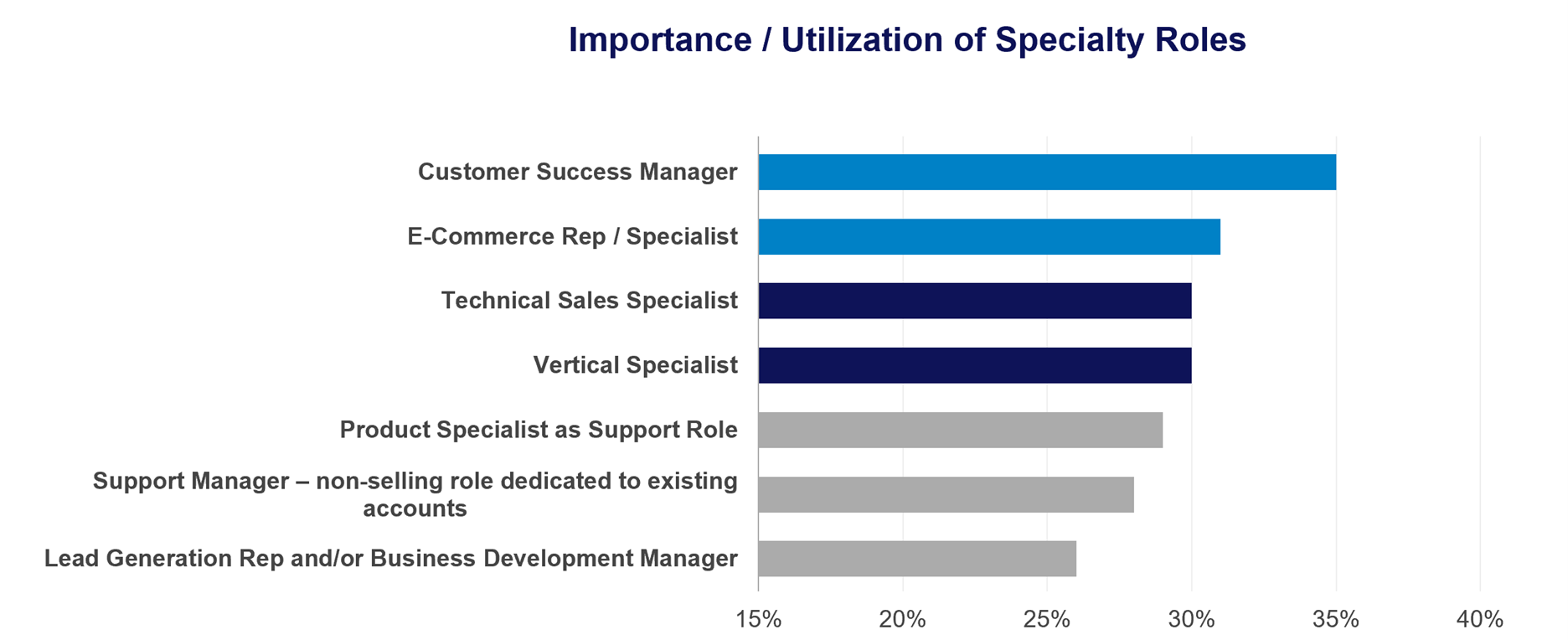

In addition to solidifying value propositions, banks should consider clarifying seller teaming and rules of engagement throughout the sales process. In recent years, specialist roles such as customer success managers and e-commerce specialists have gained popularity in changing coverage models. These roles support core sellers with closing or retaining business with specific types of customers and at specific points in the sales cycle. To ensure the success of these roles, clear definitions of each job, their role in the sales cycle, and hand-offs between roles must be defined.

Aligning Incentive Plans (Pillar 9) to Go-To-Market & Job Strategy

Once the bank establishes a clear segmentation model and defines value propositions and rules of engagement, it can design sales incentive plans for each of its sales roles. The incentive plans should drive and reward the behaviors required as part of each job’s responsibilities. However, today’s banking sales incentive plans tend to stray from commercial norms. They often have complicated scorecards, multiple add-ons and non-competitive plans that detract from the power of incentive compensation. Banks should consider reviewing their sales incentive plans to better align with best-in-class practices and job strategies. They should use straightforward plans that incentivize growth while balancing regulatory requirements. This balance is critical.

During times of economic change, identifying gaps in your GTM model and prioritizing investments can be a particular challenge. Redesigning aspects of your GTM model now will ensure that your institution is ready to capitalize once loan volumes hold steady or increase.

Why Alexander Group?

Alexander Group offers expertise and innovative solutions to financial services organizations of all types, helping them efficiently achieve their revenue growth goals and position themselves for future success. To learn more about addressing compensation challenges or evaluating your GTM model, please contact an Alexander Group Financial Services practice lead.