Healthcare On Target to Grow Revenue in 2021 In the Second Half

What actions and investments are Healthcare leaders taking to accelerate the COVID recovery?

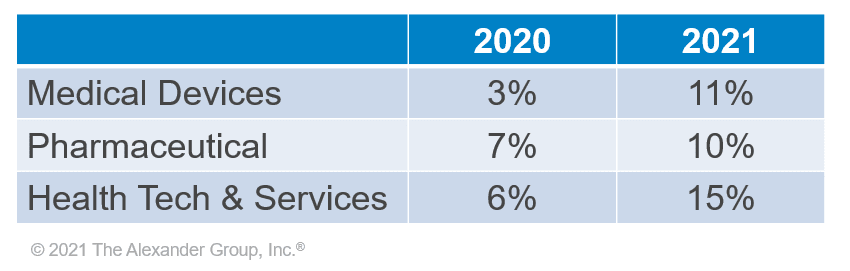

Healthcare organizations expect higher growth in 2021

Initial findings of Alexander Group’s Healthcare Commercial Trends and Benchmarking Study reveal that healthcare leaders expect higher growth fueled through new buyer acquisition. Results by sector show significant growth for 2021 compared to 2020.

This year’s study incorporates insights into how executives are updating their commercial models and investments in response to lasting changes anticipated from the COVID disruption. In some cases, customer expectations may have been “reset.” In speaking with clients, we hear that in-person expectations might only return to ~ 70% of pre-COVID norms. In a recent roundtable, participants spoke about physicians anticipating three times the amount of support compared to pre-COVID. Clearly, the specific needs and norms of customers will vary based on many factors (e.g., site of care, sector of healthcare, nature of product or service, etc.), however, what will not vary is the importance of understanding your customers buying needs and norms along the entire buyer journey.

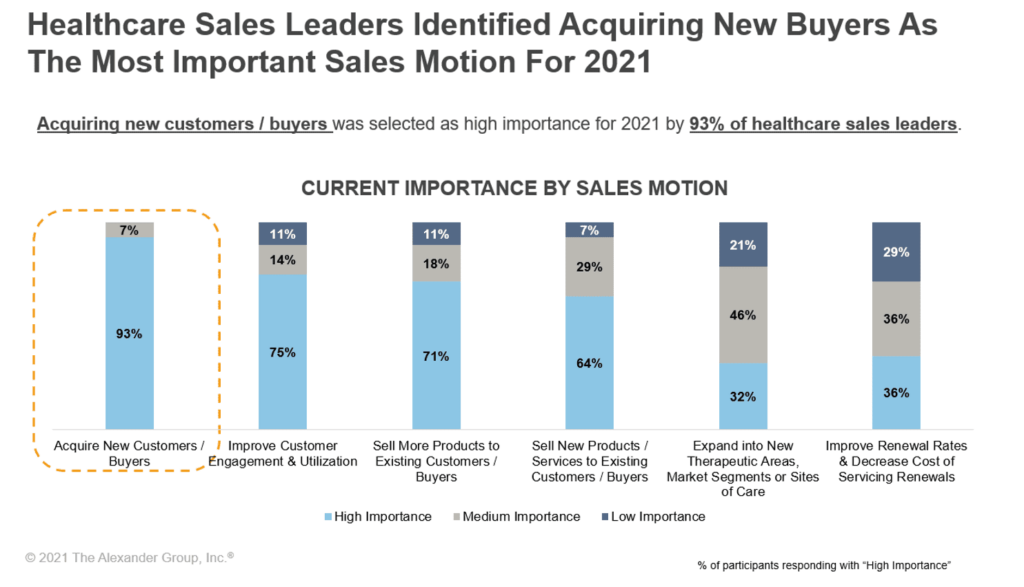

While existing customers became the main focus for most Healthcare organizations in 2020, sales leaders are looking to expand market share in 2021 through the identification and acquisition of new buyers/prescribers/patients. “Improving customer engagement and utilization” and “selling more products to existing customers and buyers” round out the list of top efforts to grow revenue in 2021.

Industry leaders see sales pipelines opening back up, but challenges remain. Capital investments were severely cut in 2020, limiting customer acquisition and implementation initiatives. Other industries, like dental, were completely shut down during the pandemic and are now dealing with pent-up customer demand, including difficulties in filling incoming orders. Shortages, like computer chips, are affecting other sectors, who must pay top-dollar if they can secure chips at all. Customers and selling organizations are emerging from the “pandemic fog,” coping with new difficulties that affect sales and order fulfillment.

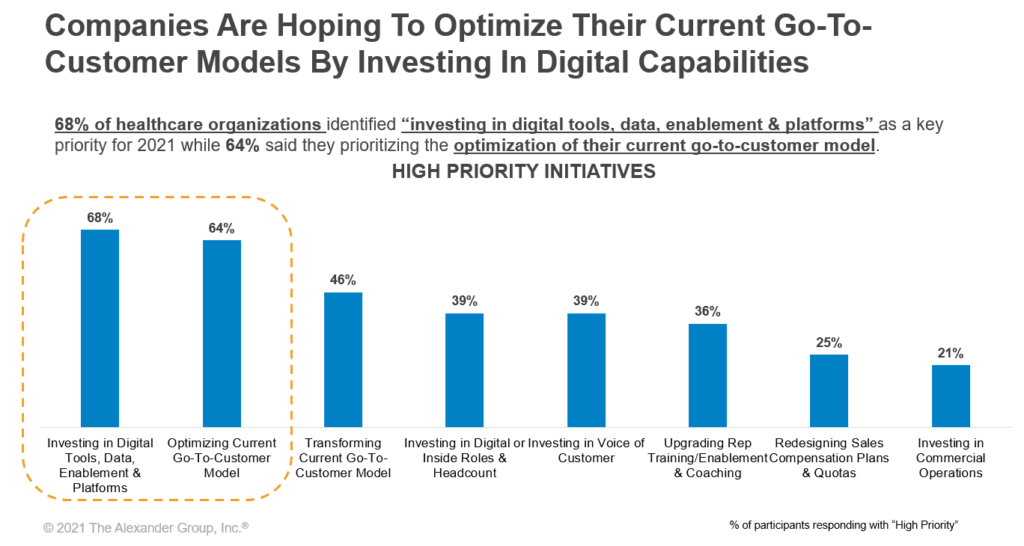

Digital investments are a top priority

The pandemic was a wake-up call for the healthcare sector, forcing them to quickly pivot to digital enablement tools to support existing customers and acquire new ones. This imperative still exists in 2021, as 68% of healthcare organizations believe that investing in digital tools, data, enablement and platforms is a key priority. Optimizing the current go-to-customer model is also a primary focus as 64% of firms consider it a high-priority initiative.

Do these initiatives align with physician preferences? Digital and virtual touchpoints are now an integral part of go-to-market strategies, but our findings indicate that physicians prefer emails and in-person visits. Currently, early findings suggest that the optimal ratio is three emails and two in-person contacts per month, with demos, calls and trainings as less preferable. Digital capabilities are necessary, but personal interactions are still highly desired. Determinizing the proper mix, and where best to apply virtual along the customer journey, will be an ongoing challenge requiring agility and a bit of trial-and-error.

Healthcare providers who are heavily invested in digital tools must now learn to use them effectively. Organizations are learning how to integrate these tools into their operations and effectively analyze results. For instance, email automation is critical, but customers get inundated with emails each day, reducing email effectiveness. The focus is now on optimizing digital tools and learning where personal interactions, digital or a hybrid of both are most effective.

Much like omnichannel retail, sales organizations have new digital options to learn from and optimize. Many customers prefer using e-commerce that offers a self-serve “Amazon-like” buying experience for routine purchases, while others want in-person visits. Now that multiple sales channels are in place, companies must validate the customer journeys associated with each digital, e-commerce, in-person and hybrid option. Make no mistake, executing on the “amazon-like” experience will require commitment and investment in a multi-year journey.

Sales headcount and compensation

Our findings showed that 50% of companies plan to increase their Inside Sales headcount, 46% are growing Field Sales headcount, and only 26% are adding to Field Marketing. Clinical specialists are also essential, with 41% investing in these roles.

What does this mean for compensation? Only 41% of companies increased their Field Rep compensation for 2021 compared to their initial 2020 plan, with the remaining 59% keeping their sales compensation plan intact. The average increase in base compensation was 0.9%, while incentive compensation grew by 3.3%. These increases represent a slight but insignificant change.

Are travel budgets coming back? Our executive roundtable attendees shared that 80% of their previous travel budgets will remain cut, focusing only on essential customer-related travel. Hospitals have implemented gatekeepers that reduce onsite visits, forcing sales to interact based on the customer organization’s preferences. In-person sales calls are starting to increase, but sales organizations must optimize the right mix of personal, virtual and digital interactions to meet revenue goals That said, 2020 taught us that re-opening can be difficult to predict. It’s quite possible we see a resurgence in travel in the last quarter of 2021, as restrictions decrease and vaccination rates reach a positive tipping point.

Learn what’s working

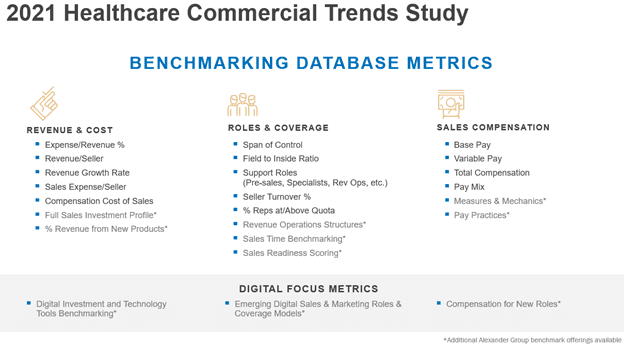

Data tells a story. As a Healthcare leader concerned about achieving your organization’s growth expectations, the Alexander Group’s exclusive study offers a baseline for comparison based on current trends from your industry peers plus the added context of leadership interviews. The complete Healthcare Commercial Trends and Benchmarking Study provides participants with a customized report comparing their plans to their industry peers, as well as key trends and Alexander Group observations that can be applied to FY22 plans. Contact an Alexander Group program manager today to participate.

For more information

Alexander Group is committed to bringing the latest research and trends in the healthcare industry so that you can quickly react to the changing business environment.