Media Ad Sales Leaders Share 5 Key Growth Mandates for 2020

To win in 2020, media sales organizations must evolve their go-to-customer models to meet changing buyer needs. As marketers require more complex solutions to drive customer behavior, publishers are investing in new and expanded products, platforms, roles and capabilities. To identify the key paths to growth, Alexander Group interviewed executives and collected sales performance data from 40+ leading Pure Play Digital, Integrated Broadcast, Integrated Print and Ad Tech companies. The study identified five key leadership mandates.

1. Reap the Benefits of Solution Selling

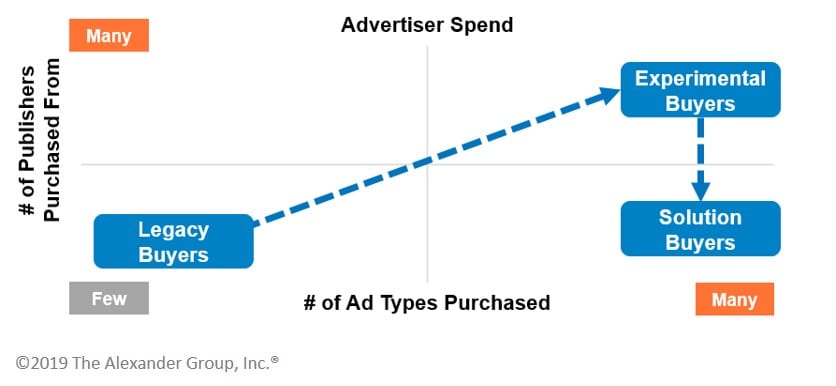

As advertisers move from legacy to experimental to solution buying, they tend to purchase a greater number of products, but from a fewer number of publishing partners. This phenomenon is consistent across media sales. Digital publishers are shifting away from display and moving towards video, mobile and sponsored content. Print publishers are offsetting their declining legacy business by building in-house agency capabilities. Broadcasters are monetizing streaming and addressable views. Given this reality, executives confirm that innovative solution selling is the only viable long-term growth strategy for media sales. To that end, solution-invested1 organizations achieve 35% higher revenue growth, as well as more revenue from new products and new customers.

2. Balance Transactional and Solution Sales

While solution selling is a must for future growth, it is important to balance it with transactional (legacy) business. Why? Publishers and their core clients still heavily rely on transactional sales. Organizations need to match their coverage investments with growth opportunity on an account-by-account or deal-by-deal basis. Media leaders stated that it is especially important to allocate resources strategically, as support and coverage required for solution sales results in 17% higher cost per head. As one chief commercial officer put it, “Transactional buyers need sales people; solution seekers need media consultants.”

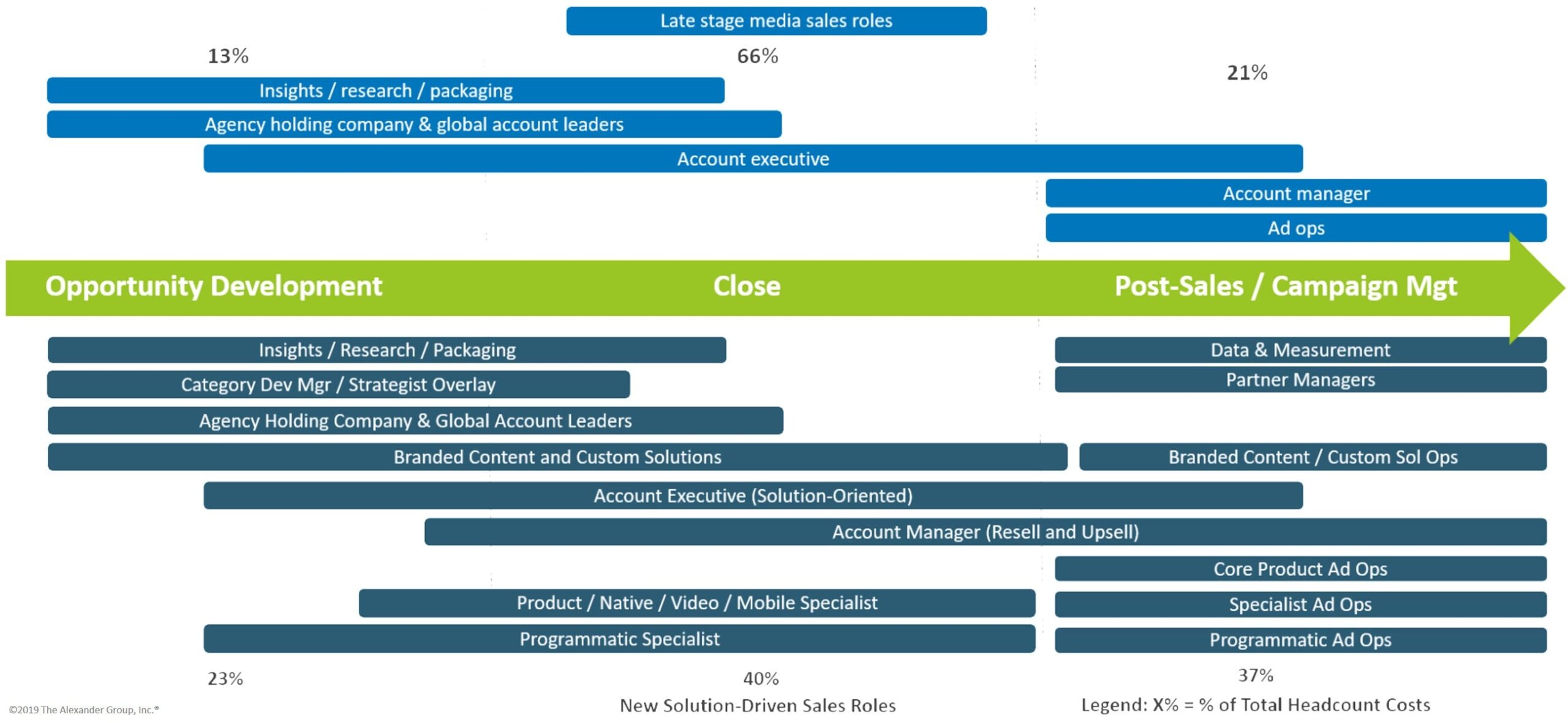

3. Increase Pre- and Post-Sale Support Investment

Account executives and account managers are becoming more involved before and after the sale. Specialized support roles are emerging across key functional areas, including Insights/Research, Custom Creative Content, Ad Ops, Partner Management, Measurement and Customer Success. “More and more often, responsibilities bleed across roles and sales cycle stages,” said one Media sales leader. This proliferation of roles and evolution of responsibilities drives, on average, 30-50%+ of coverage budget to pre- and post-sales, in large part to promote solution adoption up front and customer success and renewal on the back end.

4. Incorporate Programmatic Into the Core

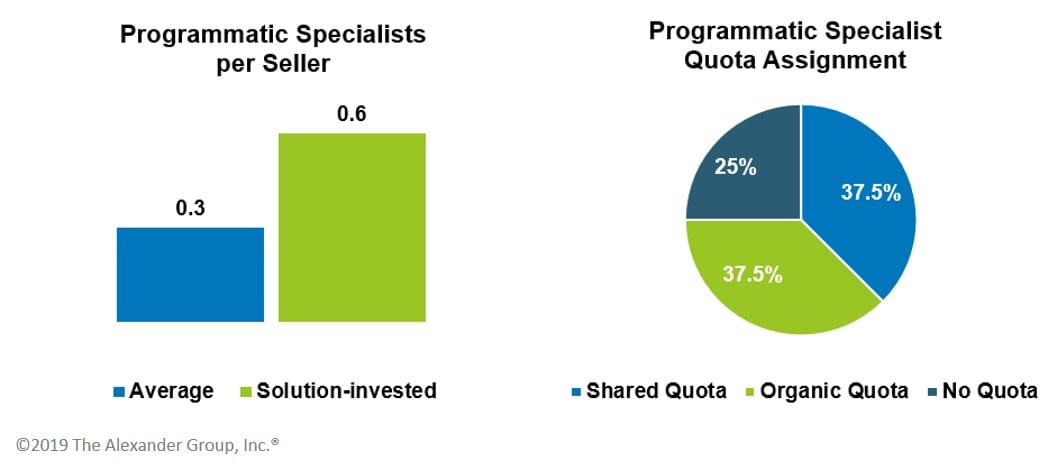

It’s no secret that the automation of media planning and buying is a disruptive trend with negative consequences for Ad Sales organizations, including increased commoditization and decreased overall profitability. However, many leading organizations have found ways to drive profitability through the programmatic channel. One common characteristic of those firms that have been successful is their ability to not only design the right programmatic offerings but to also go-to-market via the right sales roles. “We assumed programmatic sellers could transition from open to PMP/PG sales,” recalls one operations leader, “but we found that different skills and talent profiles are required.” Other leaders harp on the fact that the programmatic job is not over after the initial sale. “Revenue maximization post-sale is key,” a head of Ad Sales observed. “Any seller can set up a Deal ID, but you need hands on the keyboard to grow programmatic.” Accordingly, solution-invested organizations are staffing more programmatic specialists and assigning them revenue quotas.

5. Leverage Data To Drive Trust and Retention

The rise of the data-driven marketer has created the data-driven publisher. As one CRO explained, “Connecting the data and building insights platforms is challenging, but getting the team to replace traditional selling tactics with more data-driven messages is just as difficult.” To justify the high cost and complexity of modern media solutions, the sales force must make the business case to the advertiser in the proposal stage, during the campaign and post-campaign by demonstrating ROI against client success metrics. Interviews with media sales leaders revealed that they have identified campaign measurement and reporting as their #1 investment area for 2020. A head of sales finance who is currently engaged with Alexander Group on a sales model transformation project stated, “My VPs are willing to trade sales talent budget for more measurement and analytics resources.”

Leadership Mandates Drive Path to Sustained Revenue Growth

These five mandates are critical to remaining competitive in today’s challenging media sales landscape. One key theme carries consistently throughout the mandates: solution-invested organizations are better positioned for growth. How does your organization stack up against the leaders in the industry? Where are you under/over-invested, and what are your key improvement areas as you strive towards growth in 2020?

1Solution-invested organizations are those reporting 1) strong multi-product selling focus and revenue diversity, 2) significant investment in key sales support resources, and 3) effective execution of solution-driven account service.

To learn more about Alexander Group’s Media Ad Sales Research and to benchmark your organization, please contact a Media Sales practice lead for a complimentary briefing.

_____________________

RELATED RESOURCES: