Mining for hidden sales growth opportunities

Sales leaders are tasked with growth, but investment in the sales organization is not keeping pace with growth expectations. Consider these 2014 statistics from Alexander Group’s Sales Pulse Survey and Sales Compensation Trends Survey:

Planned Sales Growth – 9 percent

Total Sales Cost Increase – 5 percent

-3-4 percent increase in average sales compensation

-1-2 percent incremental investment in new sales resources

Assuming the sales investment story remains the same in FY15, sales leaders are in a bit of a bind. To achieve growth that outpaces investment levels requires sales leaders to realize higher levels of productivity. They must focus their measured sales investment at areas of greatest opportunity. In essence, they must mine for hidden pockets or veins of growth. Having worked with hundreds of clients over the years, we have learned that nearly every company possesses several “hidden” growth opportunities for the sales organization to exploit. Put together, these opportunities can represent 4-6 percent incremental growth or more. Quite often these growth opportunities can be unlocked with existing resources and limited to no incremental sales investment. How can sales leaders find and mine these seemingly hidden areas of growth?

Start in Your Backyard. Current accounts typically offer a wealth of growth opportunities. To find these growth opportunities, savvy sales leaders conduct segment level and account level analyses. Sometimes the analysis alone provides the sales rep with the insights and motivation to know where to go for these pockets of opportunity. This analysis should take into consideration a wide range of factors including industry, company size, previous purchasing patterns, customer usage patterns and more. Increasingly, sales leaders must learn to manage sales enablement resources with competencies in data science to help conduct this analysis and discover the pockets of growth. Reps might easily overlook certain growth opportunities in an existing account, particularly if it comes in the form of new products or solutions with which the rep may be less familiar or comfortable selling, or if the opportunities lie in different business units within the account. Some reps are constantly mining for these growth pockets, while others might benefit from data analysis and examples from other accounts or reps to show how and where these additional sales might be found.

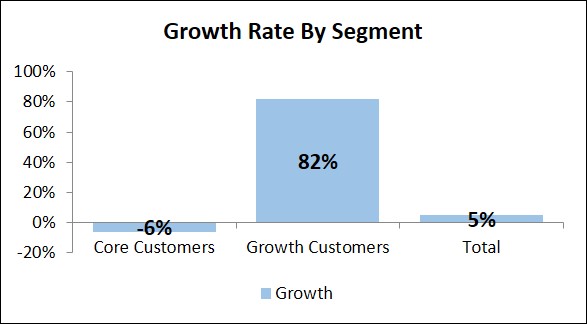

Shift Rep Selling Focus. In other cases, a shift in selling focus is required to go after and capture these growth opportunities. It is the sales leader’s job to monitor, understand and direct selling focus to realize the highest growth. Consider a recent engagement where the client’s sales team focused 80 percent of their sales effort on growing new customers. The strategy was working — they generated 82 percent growth in their new customer segment. On the surface, sales leaders were ecstatic with the results. However, the company’s core customer segment, which represented 85 percent of the business, had shrunk by 6 percent. The decline in core was wiping out the growth in new and dragging down overall growth to just 5 percent.

In the above example, the sales reps needed to increase focus on core customers. While the time reallocation might weaken continued sales increases in the growth segment, it would be more than offset by improving performance in the core customer segment. While a simple reallocation of time might not yield 12 percent growth, it could very realistically improve overall growth to 8-9 percent, a very meaningful improvement over 5 percent growth especially considering that no additional sales investment is required.

By simply eliminating the core customer revenue decline, the company could increase growth from 5 percent to 12 percent. The easiest way to increase growth was to place more focus on retention selling.

Specialize Roles. Taking it one step further, the sales leader can create specialized roles that split new customer and retention selling responsibilities. In the example above, the sales leader could create an Account Manager role to focus exclusively on retention selling to the most worthy current customers. The role would be funded by redeploying some of the current sales reps to this role. This approach keeps the cost structure the same while potentially expanding the selling footprint. In fact, over time it could lower cost of sales. Retention sellers are typically 25 percent less expensive than new customer sales representatives.

As illustrated above, hidden growth opportunities can be uncovered from careful account and segment analysis. If there is one area to invest your limited sales dollars, it might be best spent on data science, as opposed to more rep headcount. Given the growth mandate with limited additional funds, this can be a highly effective strategy to produce greater levels of sales focus and productivity. With this intelligence in hand, the thoughtful sales leader can place selling focus and assign specialized roles to the areas of greatest opportunity. In some cases, this greatest opportunity might be right in your backyard. In other cases, more focus needs to be placed on new customer selling. In most cases sales leaders can pursue and realize these hidden growth opportunities with limited to no incremental cost. So even if the FY15 budget does not allow for additional sales investment, sales leaders can unlock growth by optimizing selling efforts.

How effective is your sales organization at the practice of sales data science? How will you uncover the hidden 5-7 percent growth opportunities for your business in the coming year?

Learn how the Alexander Group can work with you to mine for growth opportunities by visiting our website.

Contact an Alexander Group Revenue Growth leader for additional information.