Rule of 40-Quota Targets and Incentive Compensation

Exhibit 1: Cloud Business Impact on Quota and Comp

One of the most important fiscal year planning activities is designing next year’s sales incentive plan and corresponding quotas. Why? 1) The sales incentive plan is often the most significant lever revenue leaders have to drive sales behavior and strategy. 2) The sales incentive plan represents the largest cost line item in their budget. And 3), unlike other programs, the sales incentive plan has an expiration date and needs to be recommunicated each year. Quotas are also important and are a key tool to ensure the company meets its ever-growing productivity expectations and revenue goals.

One of the most important fiscal year planning activities is designing next year’s sales incentive plan and corresponding quotas. Why? 1) The sales incentive plan is often the most significant lever revenue leaders have to drive sales behavior and strategy. 2) The sales incentive plan represents the largest cost line item in their budget. And 3), unlike other programs, the sales incentive plan has an expiration date and needs to be recommunicated each year. Quotas are also important and are a key tool to ensure the company meets its ever-growing productivity expectations and revenue goals.

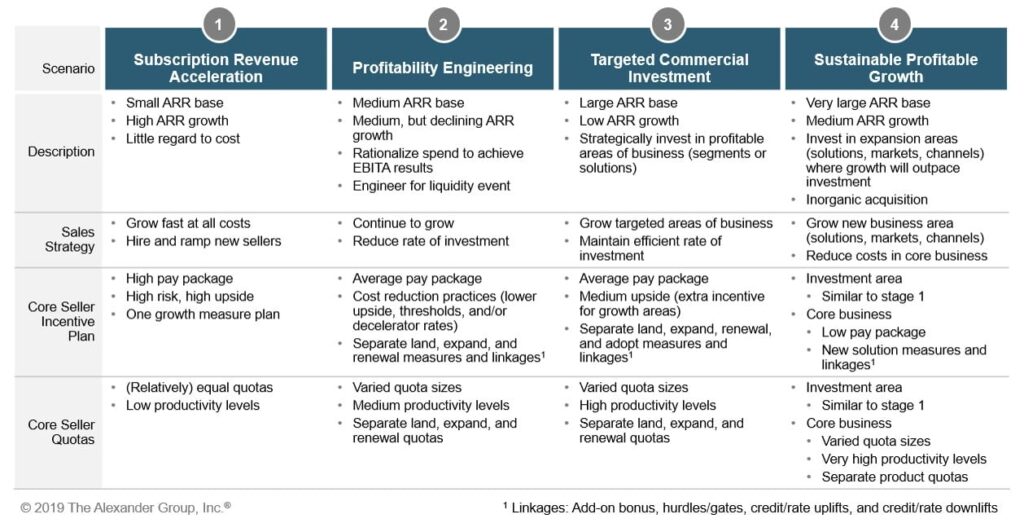

How does Rule of 40 impact quota targets and incentive compensation plans? As referenced in “Why XaaS Revenue Leaders Should Care About Rule of 40,” XaaS companies will fall into one of four key scenarios: a) Subscription Revenue Acceleration b) Profitability Engineering c) Targeted Commercial Investment and d) Sustainable Profitable Growth. Each stage will drive a different quota target and incentive compensation solution.Scenario 1 – Subscription Revenue Acceleration: Small Annual Recurring Revenue (ARR) base and high ARR growth with little regard to costs characterizes this Subscription Revenue Acceleration scenario. Revenue leaders in this phase are driving accelerated revenue and need to add and ramp new sellers as fast as possible. To attract high caliber talent, many companies provide lucrative pay programs, whether it be high target pay levels or medium target pay levels coupled with lucrative equity. The hunting nature of the job requires high risk, high upside plans. Plans usually are simple with one growth measure focused on new and expansion business. Quotas are generally the same size across different sellers due to large territories with equally significant potential; however, productivity levels are generally low due to ramping sellers and one-product shops.

Scenario 2 – Profitability Engineering: Companies in the Profitability Engineering scenario have a medium ARR base and medium but declining ARR growth. To achieve Rule of 40, they must rationalize their spending to achieve EBITA results. They often ‘engineer’ their model to prepare for a liquidity event. Revenue leaders in this phase are continuing to focus on growth; however, they must do so with reduced investment rates. Pay packages are still lucrative to recruit and retain talent, but they are generally not as lucrative as in Scenario 1. Sellers still need to hunt, so pay mixes are still aggressive. However, total payouts are curtailed via lower upside, threshold and/or decelerator rates. Plans may be more complex as they include multiple measures or mechanics to differentiate paying for land vs expand vs renewal. Quota sizes will vary depending on assigned territory opportunity and must reflect different plan measures (land, expand, and/or renewal). Leadership looks to increase productivity levels in this phase.

Scenario 3 – Targeted Commercial Investment: Companies in the Targeted Commercial Investment scenario have a large Annual Recurrent Revenue base with low ARR growth due to competitive pressures. Hence, these companies need to target and invest in specific profitable areas of their business in order to increase revenue growth and achieve the Rule of 40 goal. Revenue leaders must grow targeted business areas. Pay packages are generally average, however, but the upside may be more lucrative to pay extra incentives for growth areas. Companies still use more complex plans (measures and mechanics) to differentiate land vs expand vs renewal. They may also add adoption as a metric. Quota sizes still vary depending on assigned territory opportunity and must reflect different plan measures (land, expand, and/or renewal). Productivity levels should be relatively high at this stage to reflect a consolidated core business.

Scenario 4 – Sustainable Profitable Growth: Getting back to double-digit ARR growth with a large ARR base characterizes the Sustainable Profitable Growth scenario. Companies do this by investing in expansion areas (new solutions, markets, channels) where the growth outpaces the investment. Companies also invest in inorganic acquisitions during this phase. Revenue leaders must grow the new business areas, while reducing costs in core business. Sales incentive practices and quota practices will vary by area. Investment areas will most likely employ somewhat similar practices as Scenario 1, Subscription Revenue Acceleration companies, but without the equity. The core business’s practices will include relatively low pay packages. These farming jobs will have less pay at risk. Plans will include various solution measures/linkages to drive the new solution set. Sellers will have varied quota sizes dependent on territory assignments and potentially a strategic solution quota. They will also have a very high productivity level to reflect the maturity of the core offering.

Is your company looking to your quota and incentive program to help achieve your growth and EBITA goals? Learn more about how Alexander Group’s Technology practice can help design the strategy, structure and management of your commercial organization to maximize company performance and valuation.

_________________

RELATED RESOURCES

Why XaaS Revenue Leaders Should Care About Rule of 40

Rule of 40–Implications for Fiscal Year Go-to-Market Planning

Rule of 40–Capacity & Deployment Considerations

Rule of 40–Coverage Models and Roles for 2020

Rule of 40 – Account Prioritization and Segmentation