Building the Right Sales Quota Program for Your Business

Establishing an annual sales quota is one of the most important ways to boost the effectiveness of your sales compensation incentive program and, by extension, propel your business toward its goals. However, many businesses struggle to enact successful sales quota strategies. Year after year participants in Alexander Group’s Sales Compensation Trends Survey©₁ rank quotas as their number one sales effectiveness challenge.

What Is a Sales Quota?

Sales representatives thrive on competition. Having a set goal in mind drives individuals and teams to succeed so they can outperform competitors, feel a sense of pride and rack up the rewards.

A sales quota allows executives to track performance based on the company’s objectives for one or multiple metrics. The measurable standards are usually centered around sales activities completed, total sales generated, and deals closed or won.

Salespeople are encouraged and incentivized to reach benchmarks by a specific deadline. Performance metrics are usually tracked in annual, quarterly or monthly increments. Aiming for the goal encourages employees to monitor their progress and stay accountable.

Typically, success is higher when sellers have incentives to meet the benchmarks by a deadline. Some rewards may include commissions or monetary prizes, complimentary lunches, celebrations, awards and recognition. When the sales team increases its output, a chain reaction causes other departments to collaborate toward a shared, companywide mission.

Why Are Sales Quotas Important?

- Creates a common strategy. Emphasizes a common strategy and a “shared destiny” between sales personnel and field management.

- Links sales to business plan. Quotas link the sales force to the overall business plan by signaling a company’s marketing direction, selling priorities and performance expectations.

- Generates dialogue. Communication around quotas promotes dialogue between sales managers and salespeople about the most effective way to execute sales strategies.

- Motivates sellers. Quota setting and allocation provide a direct link between performance, compensation and ongoing motivation for salespeople

- Differentiates performers. Appropriate quotas help differentiate between high and low performers.

Quotas are set to achieve the organization’s business objectives, and Sales and Finance play important roles. What about the actual sales representatives? Field sales involvement in the quota process is indeed important, especially in cases where sales representatives have few accounts, and thus extensive knowledge about customer buying patterns. However, even as the number of accounts per salesperson increases and knowledge of specific customers decreases, the sales representative’s input is still quite useful. They provide quality forecast data. Participation in the process often boosts confidence in achieving quotas. Involving sales representatives also facilitates transparency which can further reduce angst around how the “number” is calculated. However, Alexander Group surveys indicate only about one-third of participants use sales representative-based inputs for sales quotas.

There are many different inputs that can be used to set meaningful quotas. The capability to set quality quotas depends on the level of data availability and accuracy. Thus, the best practice is to invest in market and potential data to develop more accurate quotas. It is important to ensure variables used to allocate quotas are consistent with market dynamics. For example, a year-over-year increase in quota is not applied to products whose market size is shrinking.

Whether stated explicitly or implied, every sales organization determines the degree of difficulty of their sales objectives. The following quota setting principles are foundational to a healthy quota-based sales compensation program.

- Motivational. Quotas are fair, achievable and based on sales potential; 50-60% of incumbents should achieve their quotas.

- Aligned. Quotas align with the sales strategy and the sales compensation plan’s metrics/crediting rules.

- Consistent. A uniform process and timeline for setting sales quotas is employed across the organization.

- Transparent. The sales force understands how their quotas are set.

- Understood. Managers conduct one-on-one meetings with direct reports to explain how quotas are set and how they can achieve their goals.

- Timely. Quotas are introduced at the beginning of the performance period.

Connection between quota allocation and compensation should provide stretch goals for each Rep based on respective territory opportunity. Allocation cascades corporate objectives to the individual Sales Reps based on market opportunity.

Misalignment between quotas and opportunities will mask true performance, inappropriately compensate and potentially demotivate sellers. It is critical to consider territory opportunity when setting quotas. Standard year-over-year increases create a discrepancy between actual and perceived performance and can leave revenue on the table. Avoid under-allocation. Quota over-allocation should be limited (typically less than 10%) and dependent on factors that reduce quota setting confidence (e.g., company size, growth rate and salesforce turnover/open territories).

6 Types of Sales Quotas

Whether sending out marketing emails, cold calling or inviting people to join webinars, numerous activities can contribute to achieving sales and meeting benchmarks. Executives may create several types of sales rep quotas for individuals and teams to strive toward.

1. Sales Volume Quota

A sales volume quota is determined by the number of units sold at certain prices during a specific period. Executives may measure the units sold by categories such as locations or regions, office branches, product ranges, and lines or salespeople.

The quota for sales volume is ideal for forecasting and monitoring rep activities. Representatives often receive a commission for each item sold during the time period and may receive a bonus for meeting the quota.

For example, a representative could have a sales volume quota of selling five cars monthly. The rep may receive a commission for each car sold and earn a bonus for selling five vehicles or more in a month.

2. Revenue Quota

A revenue quota describes the total revenue each salesperson needs to hit during a specific time. Executives choose the targeted revenue based on the company’s long-term goals.

To determine the revenue quota, the targeted revenue is divided between the number of sales teams and allocated to each individual salesperson. The quotas may vary based on years of professional experience and skill level.

For example, a new salesperson may have a revenue quota of around $30,000, while a senior sales rep may have a target of $70,000.

3. Profit Quota

A profit quota requires sales representatives to earn a certain amount of revenue selling products or services. The profit quota works well for companies with several target markets and price points.

To calculate the profit quota, the costs of expenses are subtracted from the revenue earned. Management must track variable expenses such as rent, phone usage and advertising costs to monitor the metrics.

For example, a hairdresser may need to rent a chair in a studio and order hair products monthly. After the cost of expenses is subtracted from the revenue, they may determine that they need to book 25 hair appointments weekly to earn a profit of $3,000 monthly.

4. Activity Quota

An activity quota is based on the sales-based actions a representative needs to perform during a specified period. The activity may include submitting documents, sending follow-up emails, making contact via phone, scheduling consultations or conducting demos.

Ultimately, the activity quotas may contribute toward a larger sales process. Rather than only counting the closing deals, the activities aim to move potential customers down the sales funnel.

For example, a sales rep may have a weekly activity quota of six demos, 40 follow-up emails and 20 phone calls. Sales managers and executives can track the activities to see how reps meet their quotas.

5. Forecast Quota

A forecast quota is calculated based on historical performance. Executives indicate the forecast quota a team, branch or region is expected to achieve.

Forecast quotas help executives evaluate the origins of revenue sources. These metrics can indicate how teams, branches or regions influence the success of the company as a whole.

For example, a credit union may make $100,000 annually. The next year, executives may target an annual goal for the branch to make $125,000. The forecast quota indicates the expectation of achieving a 25% profit increase.

6. Combination Quota

Sometimes a sales rep may follow multiple strategies to close sales. A combination quota features attainable milestones toward a larger objective. The quotas may combine activity, volume, revenue, profit or forecast to help salespeople improve various skills.

For example, a sales rep may have to host five webinars and make 50 calls to earn a profit of $3,500 monthly. In this scenario, the sales rep has a combination quota of sales activity and profit.

How to Set a Sales Quota

So what is the best methodology for quota allocation? There are many from which to choose. A good place to start is knowing that the best methodologies include both top-down and bottom-up territory-based inputs.

Too often, quotas are spread evenly across territories except for a few qualitative management adjustments. In general, stable territories, those with longstanding recurring revenue customers, require less rigor. Newer territories will require more attention, more market-based analyses, as well as increased rep collaboration.

Formulating the optimal methodologies for your environment should consider several factors such as:

- Rep’s previous year’s share contribution to the aggregate territory

- Rep’s territory growth potential

- Funnel potential (especially applicable for long sales cycle environments)

- Sales rep workload capability

- Competitor Influences

- Rep tenure and/or time in territory

- Mix of recurring vs. new growth revenue expectations

- New product/service introductions

Building Your Sales Quota Program

A sales quota program is the strategy your business uses to establish, monitor, update and communicate actionable quotas. Building a sound quota program is an important part of the planning cycle to ensure quota effectiveness.

However, few sales leaders and their organizations devote enough time to building and maintaining a systematic quota program that effectively supports achieving these results on a consistent basis.

Setting correct quotas does not need to be bureaucratic or complex. Know and apply the five key elements to doing it right.

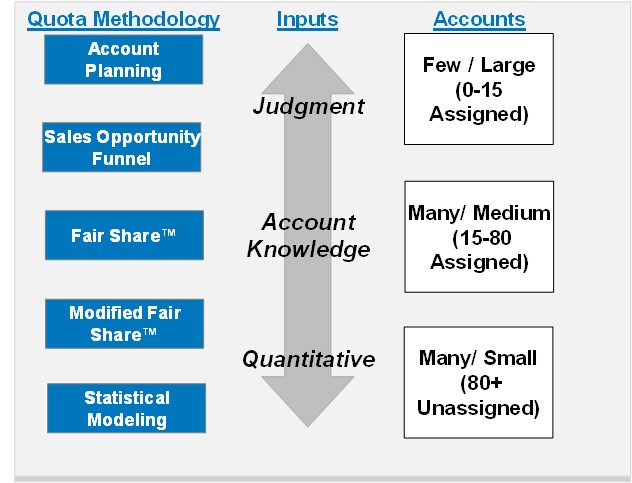

1. Quota Methodology

Effective quota programs begin with a sound methodology. Your quota methodology or formula defines the primary basis for calculating quotas.

There are many factors to consider when developing quota methodology—type and quantity of accounts, historical performance, territory potential, funnel potential, competitor threats, market share and other factors. Choosing the right methodology is very important, and equally important and critical is applying the methodology consistently across territories.

Below is just one illustration of methodology selection:

2. Process

The quota process is the who, what and when of quotas. It sounds easy, but in our experience, many companies do not have a simple calendar or comprehensive guidelines around process. For example, data from our Trends Survey indicate that only 33% of respondents use any form of field sales force inputs (bottom-up) in their processes.

The root of the process challenge lies in the need for cross-functional involvement. Sales leadership, sales ops, field sales, finance and HR all need to be involved in some capacity. Also, cross-functionality helps address auxiliary issues related to quotas such as alignment to new compensation measures, account transfers, ramps for new hires, terminations and other issues.

We recently engaged with a high technology company that had several different quota approaches across the Americas, Asia and Europe. The global sales leader complained, “I really don’t know how they come up with regional goals.” Each region had developed their own methodologies and process.

To achieve alignment, Alexander Group conducted a simple exercise of mapping processes and methodologies. Then, working with a cross-region team, we agreed upon a uniform two-page set of guidelines that outlined a simple, transparent process and timeline for releasing individual and team targets. The result—The VP of Sales and the individual reps all had much better clarity on how their quotas were set.

3. Accountability

Who should own the process? Sales management owns and leads it. However, in our experience, many sales leaders wait for finance to give them final goals before they kick off the process.

Finance delivers the top-down based on shareholder expectations and corporate strategy. But the sales leader shouldn’t wait for this to get the process started. The sales leader can begin building goals based on a bottom-up approach. That way, when the top-down numbers are ready, the sales leader can quickly and confidently reconcile the numbers and allocate quotas for the coming year.

4. Communication

It probably goes without saying that quotas should be communicated by sales leadership. It’s helpful to communicate any related changes to roles, territories and compensation plans at the same time.

Ideally, quota communication is done on the first day of the new fiscal year. However, , most individual sales goals are delivered late, after the start of the new fiscal year, and sometimes very late, even months into the new year. You’re probably thinking, “Yes, and I have seen even worse.”

Obviously, waiting months to communicate quota information is a bad practice. It’s not fair to the reps, and it’s unnecessary. Sales leaders can avoid interdepartmental confusion or frustration by developing a sound sales quota program that includes a well–thought–out methodology, process and timeline.

5. Audit

Track attainments and analyze drivers of distributions during the year. You will be well informed to make adjustments to methodology and to the overall quota program, too. However, do not change quotas mid-year.

Most companies (72% of respondents from our Trends Survey₁) change fewer than 10% of incumbent quotas. Changing more than 10% of incumbent quotas likely reflects a quota program that is poorly functioning. If you’re in this group, you may need an urgent and complete overhaul of your program.

Communicating Sales Quotas to Sales Team Members

Sales leaders should quickly build confidence in sellers that the quota development process was fair, balanced and based on a sound, quantitative input. Good communication enables constructive one-on-one conversations about individual goals. Here are a few productive ways to communicate quotas to sellers:

- Assure sellers the quota-setting process is sound: Communicate how both historical and potential data modeling—with manager input in some cases—supports the current quota.

- Communicate improvements to quota setting: Explain the formal process and how that process has improved from last year. Let sales team members know that leadership is striving to improve.

- “Pre-communicate” quota expectations: Communicate general expectations for the coming year right away. This alleviates stress and keeps sellers focused on getting off to a fast start.

- Schedule the one-on-one meetings: Ensure that all managers have a date and time with their subordinates before the annual sales kick-off meeting so they can focus on strategy and enablement of selling.

- Have a plan for HOW to communicate quotas: Ensure managers prepare thoroughly and communicate consistently. The ultimate objective here is to promote confidence and a pathway to success. Communication should cover new accounts, new measures, transparency of process around the number and other supporting elements.

Sustaining Success After Delivering the Sales Quota

Delivering actionable sales quotas on time will empower your entire sales team for success. Here‘s how you can take advantage of a timely, well-crafted quota:

Check-in With Front-Line Sales Managers (FLSMs)

Confirm that the serious one-on-one sit-down quota meetings did occur. Ensure sales managers delivered the quotas as planned and in a consistent way to all. Understand any feedback and concerns from sales representatives about hitting numbers. Sellers should understand company goals, sales strategy and associated go-to-customer motions. This is a critical starting position for the sales team.

Targeting

With new quotas in hand, verify that sellers have basic enablement components such as prioritized target lists and an understanding of the selling, service or marketing motions against those targets.

Playbooks

Another basic enablement check is the use of sales playbooks. Make sure sellers understand activities, tools and processes that ensure optimal engagement with key decision–makers. Make sure they have the right compelling messages for opportunities within their revenue segments.

New Products or Services

Ensure that any new metric in the sales compensation plan and corresponding quota gets seller attention. Getting out of the blocks in 1Q is critical here. Sellers often ignore new product quotas in Q1 as they focus on selling the familiar first.

To-Date Performance

Collect midterm attainment data. Plot the attainment curves. If weakness exists, get ahead now with further enablement levers. For many clients, 1Q is often a weaker performance quarter. A sober look early, based on comprehensive quota diagnostics at the midpoint of 1Q, can be quite beneficial. Surprisingly, only about 40% of Alexander Group’s survey participants actively track attainment distributions by quarter throughout the year.

Partner With Alexander Group for Quota Development and Communication

Alexander Group is ready to use industry knowledge and data-driven insights to inform your sales quota program. Our team will expand your company’s growth potential by helping you establish and communicate benchmarks that drive seller performance.

To get started with Alexander Group’s quota program development services, contact us today.

Need Help?

Contact one of our Business Services practice leads to see how we can support your efforts.