Investing in Customer Success

Where should you place your bets?

In the XaaS world, investing in customer success resources has become an increasingly important piece of recurring revenue models. As we covered in a previous video, customer success helps to drive usage, value realization, customer satisfaction and renewals & expansion. But at the end of the day, customer success is still meant to produce a certain amount of ROI. The assumption on achieving ROI is that with a higher level of post-sale coverage, customers will have better adoption & usage, churn less and take advantage of expansion opportunities. That said, with limited resources, XaaS companies need to think about customer success manager (CSM) deployment thoughtfully to maximize ROI back to the company.

Not all customers have equal needs, and not all customers provide the same ROI on an investment of CSM resources. So, which accounts should XaaS vendors invest in CSM headcount?

There are three primary account types where companies can assign customer success coverage:

- High revenue accounts – biggest spenders where the company has the most to lose if they churn.

- High potential accounts – small spenders today with a high potential for future spend if they can realize the value and your company lands the expansion.

- High churn risk accounts – accounts with poor health (low usage, poor adoption) and are not realizing the value and therefore have a high risk of churn.

Currently, most companies deploy CSM resources based upon a simple philosophy of assigning them to the highest revenue accounts (as measured by ARR). In fact, the most common method for determining CSM headcount is a simple calculation of dividing the total ARR of the install based by a predetermined ARR per CSM.

However, this method is overly simplified and misses out on the true potential ROI which needs to be based on a combination of all three account types. XaaS companies should aim coverage both toward large revenue and high potential accounts, especially those with churn risk in order to maximize ROI.

Conceptually, maximizing ROI means maximizing value the customer receives from the solutions. True value realization for your customers comes down to three primary factors:

- What is the business value that the customer is expecting to receive (in raw dollars)?

- How much of the solution (product or service) have they adopted?

- What’s the quality of the adoption toward achieving the business case?

These are questions that a good customer success manager should know in detail about their customers, but for this situation, let’s assume there are no customer success managers. It’s not easy to measure the true value realization with scale across your customer base. If it was, companies could just start by covering those customers with the biggest gap between expected value and value actually extracted.

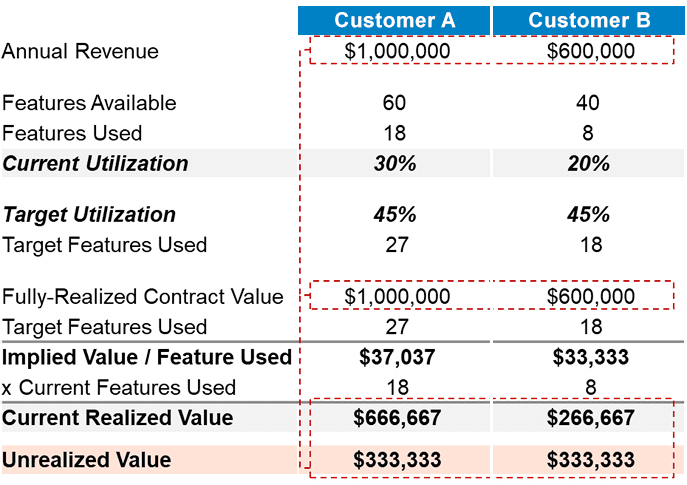

So, let’s take a minute to think of the inverse of value realization – unrealized value (i.e., what are customers paying for that they aren’t getting?). For a simple example, let’s assume a). that value is primarily based on utilizing as many features of the product as possible, b). the company’s solution has a target utilization of features where when a customer achieves target utilization, they’re getting the expected value out of the product (from a usage & adoption standpoint) and c). the target utilization in this case is 45% of all features.

The unrealized value metric allows companies to quantify the relative value and/or revenue risk of low-utilization accounts. Here’s how it works:

- Customer A spends $1M annually and realizes 67% of their value (30%/45% of features available) and thus does not realize 33% of the value they pay for ($333,000).

- Customer B spends $600k annually and realizes 44% of their value (20%/45% of features available) and thus does not realize 56% of the value they pay for ($333,000).

Unrealized value in this example is the “lost” amount of value in dollars for the “cost” equal to the utilization delta between current utilization and target utilization. In other words, if a customer isn’t using enough of the product, they may not be getting enough of what they paid for.

All things equal, you consider these two customers equally attractive for CSM coverage because they have the same “unrealized value” which can be thought of as “at-risk” revenue. The company’s CSMs can work to protect against revenue churn by driving utilization up towards the target utilization level for these customers. Let’s also assume that there are other features “to be unlocked” that represents expansion potential. This methodology allows one to truly understand and quantify potential ROI.

While the example is fairly simple and makes assumptions about feature value, the key takeaway is deploying CSMs to maximize ROI needs to account for a combination of factors beyond the existing ARR of the customer – adoption levels, churn risk and expansion potential.

Visit our Technology practice or contact us to learn how the Alexander Group can help your organization.

___________________________________________________

Recommended Insights:

Video: Deploying Customer Success Roles

Article: Deploying the Right Customer Success Role

Article: Demystify Sales Leadership and Management Compensation Plans