COVID-19—Save the Sales Force

COVID-19 has brought sales declines to commercial enterprises. Likewise, the COVID-19 crisis is impacting sellers’ incentive pay. In some cases, the loss of sales has been substantial.

Since sellers’ pay is linked to sales performance, sales compensation payouts are facing similar declines. What are sales leaders attempting to do? Save the sales force.

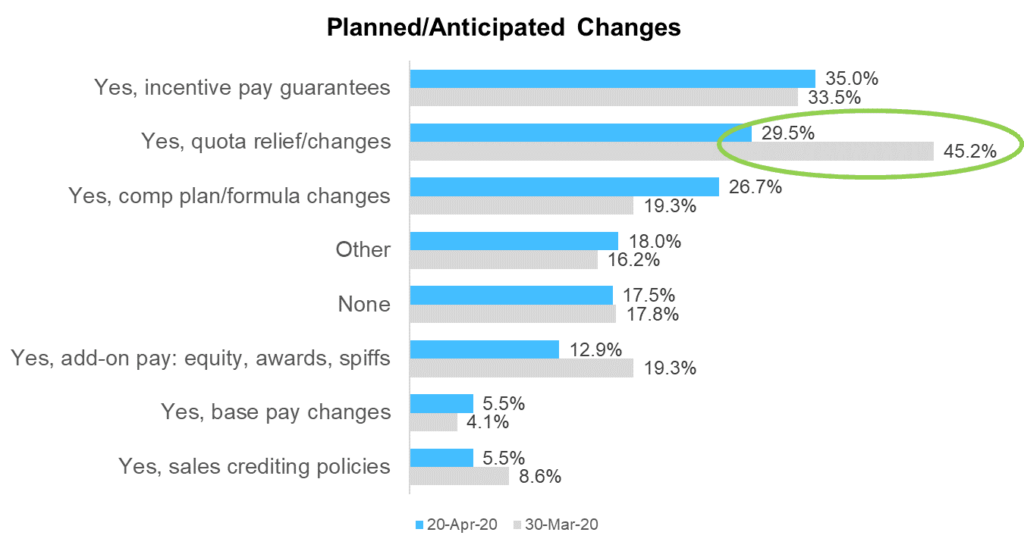

The Alexander Group’s COVID-19 Impact on Sellers’ Pay 3-Day Update Survey reveals sales leaders are looking at a variety of pay replacement methods, including guarantees, quota changes and payout formula modifications. The survey featured 219 companies that provided their perspectives on how to treat the loss of sellers’ incentive pay. (Survey responses were collected during the week of April 13 and published on April 20.)

The pressure is building on sales leaders. Executive management is asking their sales leaders to restart the revenue acquisition engine. Protecting the sales force from losing focus and turnover are key challenges. Seller pay protection is at the top of the list of intervention efforts to save the sales force.

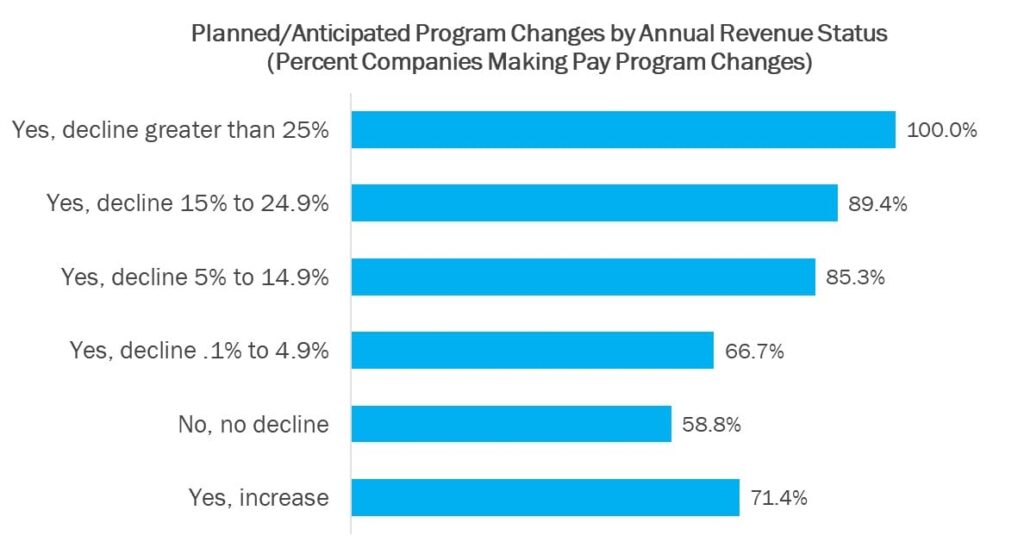

However, not all companies are experiencing the same level of revenue loss. Some more than others. Not surprisingly, some suppliers critical to the COVID-19 health effort have seen sales balloon. As expected, pay replacement efforts are driven by the degree of revenue loss. As the chart demonstrates, 100% of the companies reporting sales declines of greater than 25% plan to provide pay protection to sellers. So are most of the other companies.

Here are the most popular actions sales leaders are taking by sales level decline:

- Decline greater than 25%: compensation formula changes (66.7%)

- Decline 15% to 24.9%: incentive pay guarantees (34%)

- Decline 5% to 14.9%: quota changes (35.3%)

- Decline .1 to 4.9%: no adjustments (33.3%)

- No decline: no adjustments (41.2%)

- Increase in revenue: varied practices (42.9%)

Our initial survey (featuring 203 participants) published on March 30 found similar practices. One noteworthy exception is a preference to provide pay guarantees and formula changes rather than making quota changes, which fell from 45.2% preference to 29.5% preference from the first survey to the second.

Good News

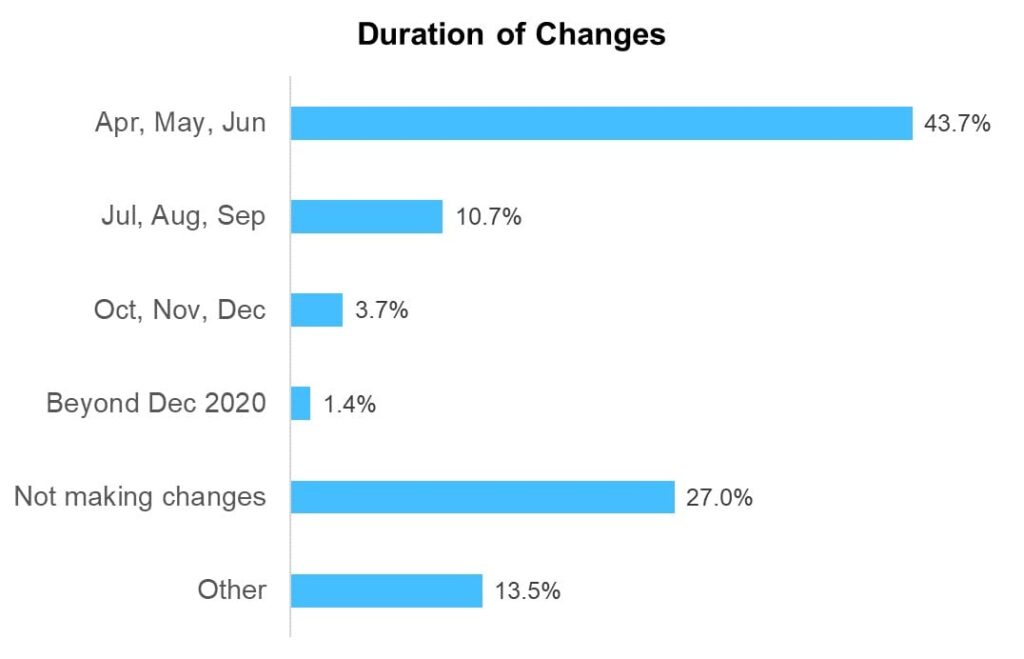

Many sales organizations (43.7%) believe the need for pay adjustment modifications will end by June meaning economic activity will return. That’s good news.

Get Ready

The COVID-19 crisis has been a shock to sales departments. Sales leaders have stepped forward to protect the loss of sellers’ incentive earnings. However, sales expectations will not wait. Executive management wants sales leaders to begin producing sales results, the sooner the better. Having an incumbent sales team will make this possible. Sales volume needs to return. The sales department is ready to meet the challenge. Our view? Watch for the emergence of kick-start incentive programs such as contests/spiffs, recognition and formula accelerator rates.