Quota Busters!

How to Address Blowout Sales Comp Payments

Finance poses this question: “Explain again, why the salesperson should get this giant check?” VP of sales response: “This big order blew out the salesperson’s quota!” Finance: “So, how did that occur?”

You know what happened. The seller brought in a mega deal no one expected—including the salesperson! As written, the sales compensation plan pays as a percent of quota achievement. This one deal puts the seller’s quota achievement beyond the moon.

Oops! The quota was set too low. The calculated incentive payment is epic! Now what?

Sound familiar? There are several reasons why quotas are not set “correctly.” The first example is our case here, the unexpected mega deal. However, there are additional scenarios that can cause quota errors: poor quota allocation, unpredictable markets, new product launches, and unexpected economic trends such as the now looming, yes-fortunately, snapback 2021 fiscal year. These scenarios should have policy practices to address each of these occurrences. Rest assured, we provide solutions below. Our suggested solutions do not include capping the sales compensation plan. That has its own negative issues.

Quotas and Sales Compensation

Quotas are an effective tool used by sales management to assign sales goals to sellers. The process begins prior to the start of the fiscal year when the business units and corporate finance develop the revenue growth estimate for the next fiscal year. Once confirmed, this number passes to sales management as next year’s fiscal sales objective. Using one of numerous methods, sales management allocates this objective to sellers through a process known as quota allocation. Each salesperson has an assigned sales goal for the year. Of interest, about 50% of all sales departments “over assign” the sales objective so that the summation of sellers’ goals exceeds the corporate commitment. This over-assignment amount is normally 5% or less.

Sales quotas have an important implication for sales compensation. Most sales compensation programs create a payout rate to achieve target incentive payment for achieving the sales quota. This means territories of dissimilar size will receive the same incentive earnings even though the actual revenue amounts differ. Either using individual commission rates (ICRs) or a payout formula tied to percent of goal achievement, the outcome ensures that similar difficulty (not actual revenue) earns the same payout. A seller with a quota of $2.5 million would earn the same incentive as a seller with a $3.2 million quota.

Goal-based pay programs are typical for sales representatives. However, producers (not sales representatives) are paid a commission on all sales regardless of quota or territory size. Examples of producers include real estate agents, stockbrokers, manufacturers’ reps, and multi-level marketing sellers. Meanwhile, the pay program for sales representatives is a “managed” pay program with low performers earning below target incentive and high performers earning above target incentive.

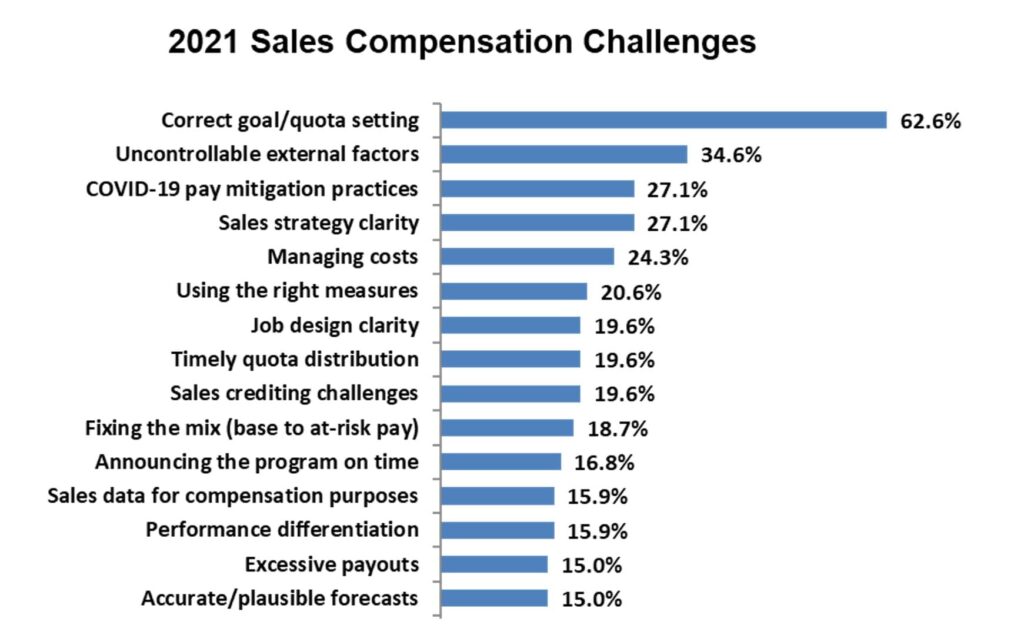

But goal setting is not easy. Companies struggle with this inexact process each year. The Alexander Group’s annual sales compensation trends survey confirms that quota allocation is the most challenging element of sales compensation management. It has been the No. 1 challenge for 19 years running; the full history of the survey.

Quota Challenges and Solutions

Knowing that the pay program is linked to the quota system, sales management should anticipate and address the following known quota challenges.

- Poor Quota Allocation Process. There is no excuse for a flawed quota allocation process. It needs to be timely, disciplined and accurate (as possible). Solution: Invest in the quota allocation process. Work with product management and finance prior to setting the fiscal year number to ensure soundness of the fiscal year forecast. Involve field personnel to help estimate revenue growth. Use external data to estimate market growth potential by territory. Have field management vet the numbers. Do not use last year’s performance plus a universal percent increase for all territories. This approach will cause distortions. Don’t grossly over assign the number.

- Unpredictable Markets. Some markets have unpredictable revenue performance. In such cases, a one-year quota might be as good as a random guess. New markets are particularly hard to estimate. Solution: Shorten the quota period to half year or quarterly when future revenue performance has better visibility. Another solution uses rolling quotas—the last three months of trending performance equal next month’s quota—for markets that change based on factors outside the company’s control, like commodity markets.

- New Product Launches. Often, the prospects for a new product do not always conform to product management’s estimates. Including the new product in the annual quota could skew results either positively or negatively. Solution: Unless product management has a proven record of accurately predicting new product release dates and first-year performance, keep the new products out of the annual quota. Use contests/spiffs/special incentives to reward new product selling. Only after the sales team confirms the market’s appetite for the new product, include its revenue in the annual quota.

- Unforeseen Events. Sometimes, management’s assigned quotas are made meaningless by an unexpected event such as a recession, pandemic or product recall. These events could render the quotas meaningless. Solution: Adopt a defined policy of what could cause quotas to be reset midyear. Use trigger performance levels to delineate when quotas will be modified across the sales force. “If average quota performance falls below 85% to quota or exceeds 125% to quota, sales management will close the current program and make pro rata payments; new quotas will be set for the remainder of the year.”

- Unexpected Mega Deals. Most sellers and their managers have good insight into what business will occur during the quota performance period. The quota was set using these understandings of territory potential. However, occasionally an unexpected mega deal appears that simply dwarfs the current quota. When calculated, the pay program will create an unanticipated blockbuster payment. Solution: Include a mega deal policy in the pay program. These policies limit the amount of revenue that is applied to quota achievement with the excess being paid a lower, more modest payout. An alternative approach is to have all pending deals “registered” in the CRM system. These deals will be part of the quota. Non-registered deals are paid under the mega-deal policy.

2021 Fiscal Year

At this point in 2021, revenue performance for some companies is growing at a greater rate than anticipated. The post-pandemic economy is picking up speed. Maybe you work for one of these companies. Congratulations! However, what does this unexpected revenue success mean for sales compensation payments at your company? It means rich payouts! As many sellers exceed their quotas, expect payouts to be higher than anticipated. Is this considered bad? More incentive pay for more revenue seems like a fair bargain. However, this is not how the sellers’ pay plan was supposed to work. The simple truth is sales management did not set tough enough quotas at the start of the fiscal year. Who could blame them? Few expected such a robust revenue year.

Now What?

Maybe you have the mega order situation we began with. Or your results are going to exceed your 2021 quotas. Let’s assume (unfortunately) you do not have policies in place to protect the quota/pay system. The results are unintended high payouts. What do you do? The answer: You and your lawyers will have to think this through. My lawyers told me to keep my suggestions to myself.