Benchmarking Analysis Uncovers Revenue Uplift Opportunities for Software Company

Situation:

Situation:

For several years, this software company had been focusing on growth through acquisitions. Despite a steady revenue growth rate, the company continued to miss management’s optimistic sales goals. Facing increased pressure from the company’s new owners, leadership felt it was time to re-evaluate the key drivers to sales growth.

Challenge:

The company asked the Alexander Group to identify key inhibitors to sales growth and assess its salesforce function and effectiveness.

Solution:

The Alexander Group’s comprehensive assessment included a sales time benchmarking survey given to sales personnel, a sales cost and revenue benchmarking, and a pay for performance and pipeline and forecast analysis. The assessment found:

• Hunter and farmer roles spent too much time on low-value back-office activities, decreasing their available time to prospect, which subsequently led to limited pipeline creation. The company had also made a significant investment in sales management (2.5 reps per manager versus the benchmark of 8 reps per manager). The increased investment did not translate to improved selling competencies or process effectiveness. Furthermore, managers were spending too much time selling and not enough time coaching reps.

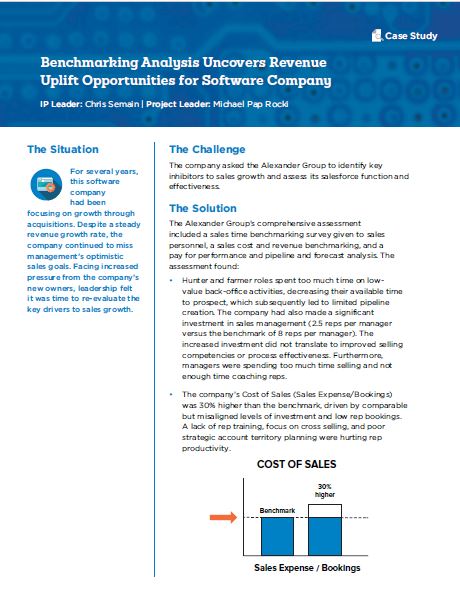

• The company’s Cost of Sales (Sales Expense/Bookings) was 30% higher than the benchmark, driven by comparable but misaligned levels of investment and low rep bookings. A lack of rep training, focus on cross selling, and poor strategic account territory planning were hurting rep productivity.

•The company’s sales compensation plans lacked substantial earning potential for above-goal performance. Upside of 2x – 3x target incentive was the benchmark range for software hunter plans; this company’s hunter rep plans had upside of only 1.25x. Alongside unattainable quotas, compensation design failed to provide the proper motivation for higher productivity.

• Ineffective CRM governance led to incomplete and inaccurate data, which drove a forecasting methodology that was more of an art than a science. Rep-selected close probabilities had loose guidelines, were not tied to stages, and did not agree with historical results. Sales forecasts rarely aligned with actual results. Combined with bad data, the flawed forecasting methodology led sales management to overestimate performance.

Benefit:

The assessment resulted in the company recognizing their four key sales growth inhibitors. AGI helped management plan and design new jobs, rules of engagement, competency models for core sales roles, a new territory selling and quota setting methodology, and improved CRM governance rules. Born out of the learnings from the comprehensive assessment, these programs set the company on a path toward consistent sales growth.

Download a PDF of this Case Study »

Learn more about Alexander Group’s Commercial Analytics practice.