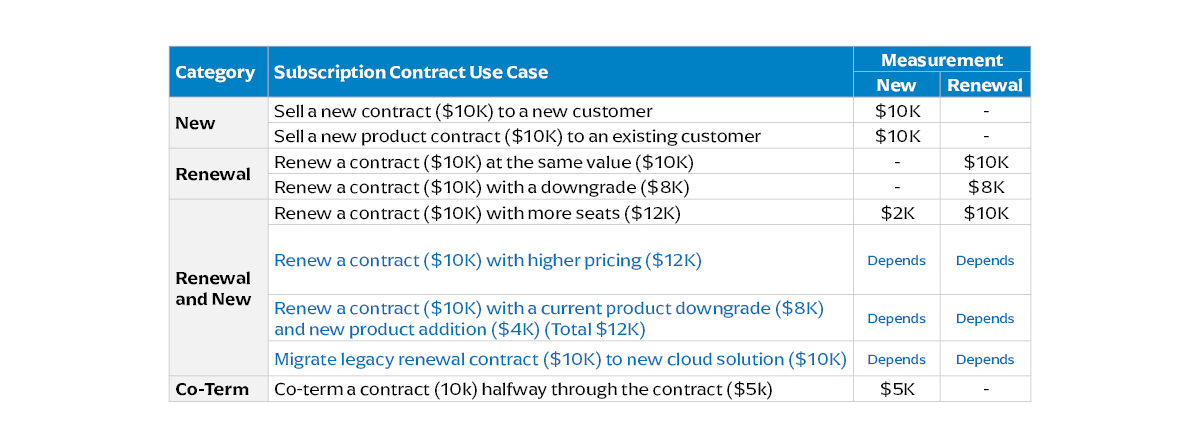

Three of the above use cases in blue font have multiple options. The rest of this article will discuss them in more detail.

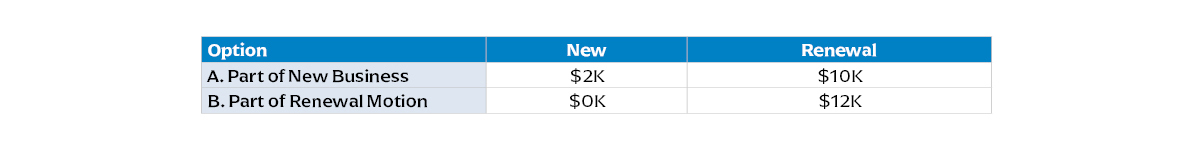

1. Renewal Contract with Higher Prices

Scenario: Renew a contract ($10K) with higher pricing ($12K)

Options: Part of new business or renewal as shown in the table below:

The level of required persuasion, strategic priority of raising prices and desire to measure true churn will dictate the right solution. If moving a customer to a new, higher pricing structure is easy to accomplish, some companies will assign this responsibility to a renewal rep and count the price increase in the renewal measure. However, most companies need the core seller to justify the higher price and thus count it as new business. Including price increases as a new business motivates sellers to assist with the renewal process. It also prevents an artificial boost to gross revenue retention and deters sellers from using that budget for expansion.

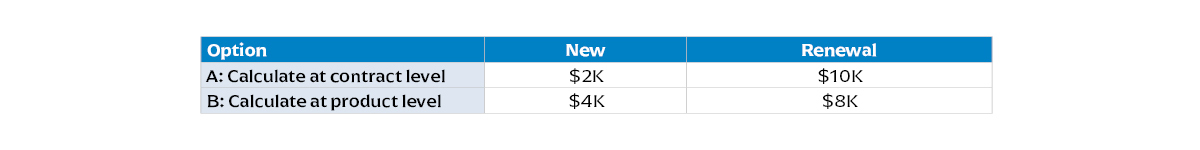

2. Product Switch During Renewal

Scenario: Renew a contract ($10K) with a current product downgrade ($8K) and new product addition ($4K) (Total $12K)

Options: Calculate at contract or product level as shown in the table below:

How companies calculate new vs. renewal credit when products are switched will depend on their desired sales focus (contract value vs. each product), systems/tools and complexity tolerance. Some, generally early-phase, companies will analyze new and renewal business for each product line. Most companies calculate new vs. renewal at the contract level to prioritize overall contract growth and limit sellers from shifting business to maximize their pay. In fact, many companies calculate new and renewal at an account level. They track total account spend over a period, such as three months before and after a renewal, and offset any churn with new expanded business during that time. Measuring at the contract level also makes sense for platform solutions with many use cases, since it is generally challenging to accurately measure each use case.

How companies calculate new vs. renewal credit when products are switched will depend on their desired sales focus (contract value vs. each product), systems/tools and complexity tolerance. Some, generally early-phase, companies will analyze new and renewal business for each product line. Most companies calculate new vs. renewal at the contract level to prioritize overall contract growth and limit sellers from shifting business to maximize their pay. In fact, many companies calculate new and renewal at an account level. They track total account spend over a period, such as three months before and after a renewal, and offset any churn with new expanded business during that time. Measuring at the contract level also makes sense for platform solutions with many use cases, since it is generally challenging to accurately measure each use case.

Note: even when companies measure new and renewal at the contract or account level for sales compensation, they should also continue to measure it at the product level to truly understand product-level churn and expansion.

3. Migrating Solutions During Renewal

Scenario: Migrate legacy renewal contract ($10K) to new cloud solution ($10K)

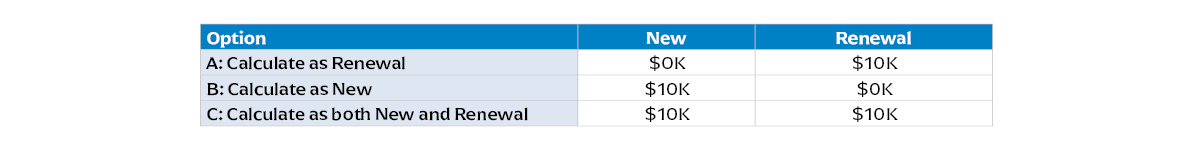

Options: Calculate at renewal, new or both as shown in the table below:

The right credit solution is contingent upon several factors, including the strategic importance of migrating customers and level of sales persuasion required. If the new product solution is materially superior (e.g., better features, GUI, support, pricing) and/or the legacy solution is being discontinued, many companies will take one of two approaches. They either assign the renewal rep to manage the migration or create a new job—a migration rep—to focus on this activity. However, if migrating the customer requires persuasion, most companies will assign the core seller to complete this activity and thus credit it as new business. If there is concern that the renewal rep will sell against the migration, fail to collaborate with the seller on the migration and/or need ongoing quota adjustments, it is best to double credit in both the new and renewal measures. Usually, migrations are typically temporary, and double compensation is only a short-term solution.

The right credit solution is contingent upon several factors, including the strategic importance of migrating customers and level of sales persuasion required. If the new product solution is materially superior (e.g., better features, GUI, support, pricing) and/or the legacy solution is being discontinued, many companies will take one of two approaches. They either assign the renewal rep to manage the migration or create a new job—a migration rep—to focus on this activity. However, if migrating the customer requires persuasion, most companies will assign the core seller to complete this activity and thus credit it as new business. If there is concern that the renewal rep will sell against the migration, fail to collaborate with the seller on the migration and/or need ongoing quota adjustments, it is best to double credit in both the new and renewal measures. Usually, migrations are typically temporary, and double compensation is only a short-term solution.

How to Decide Which Measurement is Right

Determining how best to measure new vs. renewal business requires assembling a cross-functional team to analyze each use case and decide on a crediting solution that meets the company’s needs. To complete this effort, the team must align on the firm’s growth strategy, desired behaviors and rules of engagement for each job, risks/unintended consequences and what they can track and measure. After decisions are made, the company should update systems, reporting, quotas and communications accordingly.

Use Both Sales Comp and Other GTM Levers to Drive Higher GRR

Sales compensation is a strategic lever that companies can use to drive better GRR results. However, it is not the only solution. Best-in-class companies invest in other go-to-market (GTM) efforts to improve customer value realization and GRR results.

Examples include articulating ideal customer profiles/target customers, outlining sales engagement process and rules of engagement across process steps for different sales motion use cases (e.g., renewal with expansion, renew with churn), using customer success plans to ensure customers are set up to realize value upfront and creating early warning churn tools to inform teams on how to proactively address issues.