Are You Paying Enough Attention to Your XaaS Customers?

Avoid customer churn and build a strong platform for expansion.

For many XaaS companies, the most challenging aspect of establishing viability and driving a consistently robust valuation is growing Annual Recurring Revenue (ARR) in existing customer accounts. Customer churn, whether it stems from downgrades of existing contracts or outright defection, is a serious threat to the financial health of XaaS businesses. Further, instability in the customer base can interfere with the ability of XaaS companies to effectively drive expansion via upsell and cross-sell. Because expansion is also the most profitable revenue stream in most companies, the lack of a stable expansion platform due to churn will almost certainly impact profitability. In short, failure to protect and expand the base hits both determinants of valuation: ARR growth and profitability.

Over the last several years, Alexander Group has observed the trend of go-to-market spending shifting to post-land (after the initial sale) resources and activities. In the recently released 2020 XaaS Revenue Model and Productivity Research, the average spending on post-land headcount among our 100+ participants was greater than 50% of total sales headcount spend. To keep pace with industry leaders, XaaS companies need to ensure they are investing in the people and capabilities that can help avert customer churn and build a strong platform for expansion. This article reveals the two trends from the study and through client work about how market leaders are using post-land customer experience as a differentiator.

Trend #1- Maximizing Customer Adoption

Effective customer adoption occurs when a community of users is successfully onboarded onto a new application, infrastructure, platform or other XaaS solution. The importance of adoption has soared in the subscription era, primarily because XaaS solutions tend to be easier to swap out and customer value realization depends on successful deployment and customer usage.

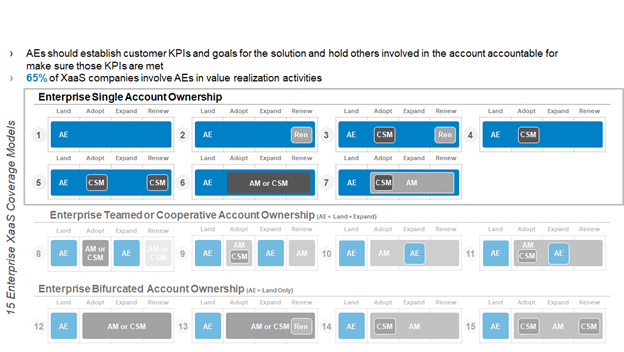

In many XaaS companies, the customer success manager (CSM) role is the primary owner of customer adoption. Alexander Group’s research indicates that more than 90% of companies have CSMs, 83% of whom are primarily responsible for adoption. A far more surprising finding is that in 65% of XaaS companies in the study, account executives (AEs) play a key role in customer value realization during the adoption phase (Figure 1). Conventional wisdom holds that the rise of CSMs would eliminate the need for AEs to be involved in adoption. However, Alexander Group’s data clearly show that XaaS companies, particularly top performers, are embedding AEs into adoption and value realization activities, particularly with enterprise customers. This investment recognizes the importance of investing in the customer relationship from its inception to build a stable foundation for profitable growth.

Figure 1

Trend #2- Maximizing Expansion via Upsell and Cross-Sell

A critical measure that all XaaS companies should track is Net Retention Rate (NRR). NRR is a measure of starting license ARR at the beginning of the year plus license expansion (upsell and cross-sell) minus churn divided by starting license ARR (to express as a percentage). Put simply, NRR is a measure of the value of existing account growth (or decline) over time. Alexander Group’s data indicates that since 2018, XaaS companies have grown NRR by an average of 6%. Top performers have more than doubled that improvement, growing NRR by nearly 13%―achieving on average an NRR of 124%. This type of NRR improvement can only be enabled by robust expansion growth, and XaaS companies are substantially ramping their investment and focus on expanding the existing base to get it.

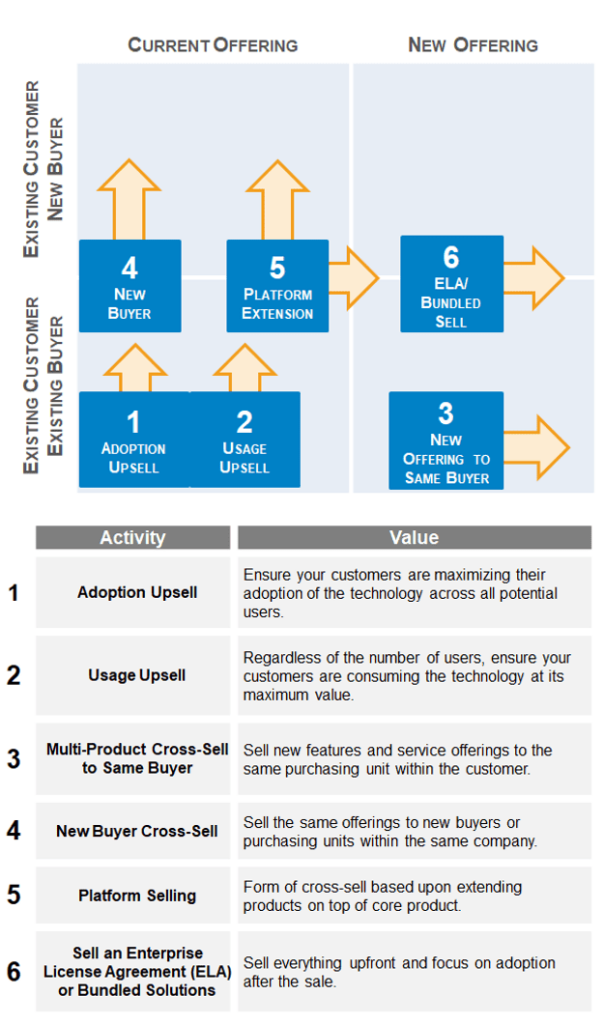

Understanding and quantifying the different types of expansion helps companies structure a definitive plan around which expansion plays will yield the biggest benefits for the organization. Figure 2 identifies six typical expansion plays seen by Alexander Group clients. The categories though simple, straightforward and intuitive can provide powerful insight for organizations seeking to accelerate expansion.

Figure 2

The Alexander Group’s high achieving NRR companies (average NRR 124%+) recommend focusing on two to three expansion plays well rather than trying to drive all possible avenues of expansion. Top performers also recommend planning existing account revenue by expansion category. Account planning is more effective, accurate and actionable if reps can estimate the amount of expansion dollars coming from usage upsell, new buyer cross-sell and platform selling (for example). Based on research and project work, Alexander Group estimates that fewer than 10% of XaaS companies actively measure and manage specific types of expansion revenue and those that do are much more likely to drive NRR growth on a consistent basis.

Gaining proficiency in post-land activities is a necessity in improving performance and valuation for XaaS companies. Tech leaders will continue to shift resources and hone their capabilities and techniques to mitigate churn and drive expansion. The insights shared above barely scratch the surface of the insight contained in Alexander Group’s Revenue Model and Productivity Research. For a readout of the non-participant version of the study please contact a Technology practice lead.