Moving from What You Sell to What You Solve

Organizations that successfully shift from data to insights see gains.

While often associated with data visualization software, Business Intelligence is comprised of organizations that offer a combination of data and analytics-related insights, services and tools.

At their core, these vendors will collect, cleanse and publish data; but also provide advanced analytics and consulting/advisory services that build on top of this asset. What’s most exciting about this space is the fact that both the demand for data and the supply of data continue to grow at an exponential rate. From crediting and financial data to business and consumer data, the diversity and pace of capture along with advancements in AI have allowed vendors to develop insights faster than ever before.

This holds true for legacy data providers and has fueled an influx of niche, tech-savvy players to enter the market and fulfill previously underserved needs.

But in this increasingly competitive space, how do organizations successfully differentiate themselves? In Alexander Group’s experience, it’s organizations that successfully shift from selling data to selling insights that gain a competitive advantage and a higher likelihood of sustainable revenue growth.

Alexander Group’s research reveals the most pressing go-to-market challenges, opportunities and imperatives for players in this space, and identifies six go-to-market (GTM) mandates for Business Intelligence providers:

- Refine and upgrade your offerings to reflect customer use cases

- Execute a more omnichannel sales model

- Prioritize recurring revenue streams

- Invest in Customer Success

- Upgrade commercial talent, skills and processes

- Build your digital sales roadmap

While each is critical to long-term success, this article will focus on the three mandates with the most profound effect on “selling insights.”

Pivot from Products to Use Cases

Selling insights can only become a reality when you shift from communicating what you sell to what you solve. For example, a flat-file of consumer data can be used for a myriad of applications by a marketing manager. Any number of Business Intelligence vendors can fulfill the immediate need, set up a subscription and complete the onboarding process. However, that data can easily go wasted and leave a customer questioning the data’s accuracy and ROI. It’s vendors that can speak to the marketer’s objectives, offer best practices, advisory services (e.g., successful digital ABM campaign execution) while providing reliable, well-integrated data and analysis that enter a new paradigm: selling insights.

Prioritizing Recurring Revenue

Recurring revenue growth is highly valued by public and private investors across all industries, and Business Intelligence providers are no exception. Many of the largest data vendors have operated in a “Data-as-a-Service” (DaaS) model for years, offering license subscriptions or usage-based contracts. Recently, we’ve also seen an uptick in the number of analytics vendors shifting from one-off, project-based work to ongoing, retainer-based contracts to build more predictable recurring revenue streams.

While the recurring revenue model is not a new concept, Alexander Group has seen a rapid evolution in terms of GTM investment in these business models.

In organizations’ desire to drive recurring revenue, they are becoming laser-focused on maximizing customer lifetime value (LTV). This mindset forces organizations to think well beyond their customer acquisition strategies and become focused on delivering insights to maximize retention and build a solid foundation for future upsell and cross-sell opportunities.

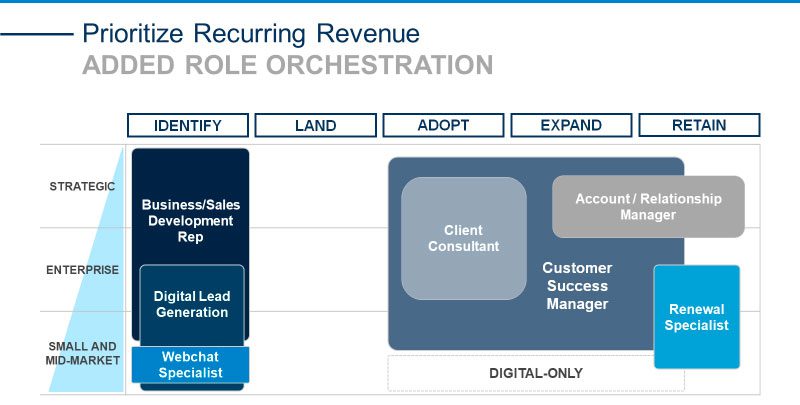

GTM leaders are increasing investment in new logo acquisition and demand generation programs via digital marketing programs and digitally-enabled lead generation and sales development reps. We’ve also seen a rise in the deployment of webchat specialists and free/limited time trials. Tactics that were once reserved for B2C companies are now being embraced and deployed in the B2B space.

We have also seen increased investment in programs and resources responsible for the retention and growth of existing customers. Business Intelligence organizations are deploying customer success managers (CSM) and client consultants to drive user adoption and value delivery. Account managers are collaborating with renewal specialists and CSMs to efficiently secure renewals, as well as identify expansion selling opportunities. In downstream segments, vendors are producing digital-only or digital-first models to provide active customer engagement, but at a lower cost in a one-to-many model.

Investment in Customer Success

Customer Success (CS) is a top investment area for both customer engagement and retention strategies.

Different iterations of the function exist, but at its core, CS is about maximizing LTV via strong adoption and value delivery. Many organizations layer in renewals and limit upsell. In Alexander Group’s experience, as soon as CSMs are tasked with more active involvement in cross-selling, the line between CS and AE or AM becomes blurred. Several organizations are striving to train CSMs to actively identify and qualify expansion opportunities.

Leading practices to maximize value include:

- Create strong collaboration and rules of engagement between seller and CSM.

- Develop a formal Customer Success Plan (CSP) for each customer.

- Use metrics and automation to track and analyze value realization.

- Protect CSM high-value time. Best Practice recommends 56% of CSM time spent on value realization and sales.

- Realign CSM incentives to reflect their level of sales influence.

It is clear that as the demand for data is rising, data providers can set themselves apart to customers by adding insights to their data offerings. And that may not suffice if vendors cannot offer best practice recommendations for the data usage or prove the validity of that data. Active customer training and engagement is an investment that companies cannot overlook if maximizing retention is a goal. Organizations should focus on these strategies to surpass the competition in the data analytics space.

To learn more about Alexander Group’s Data & Content practice, please contact an Alexander Group practice lead.