Net Revenue Retention and Advanced Segmentation Drive Customer Expansion Opportunities

Customer Attributes Hold the Key to Sizing Customer Expansion Opportunities

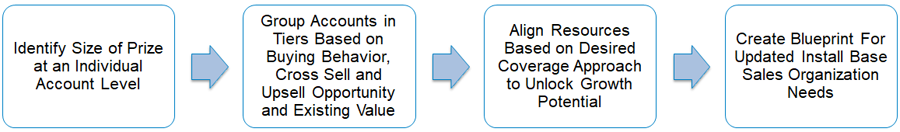

Companies look to maximize revenue from current customers, but how much opportunity exists in current accounts? Deploying resources to customers with low revenue potential hinders productivity; meanwhile, not properly covering high-revenue potential customers leaves money on the table. So, how do leading organizations optimize their sales resources to maximize customer expansion? By determining the size of the market, segmenting customers, aligning coverage and determining the necessary resources per segment.

Customer Potential is the First Step to Choosing an Optimal GTM Model

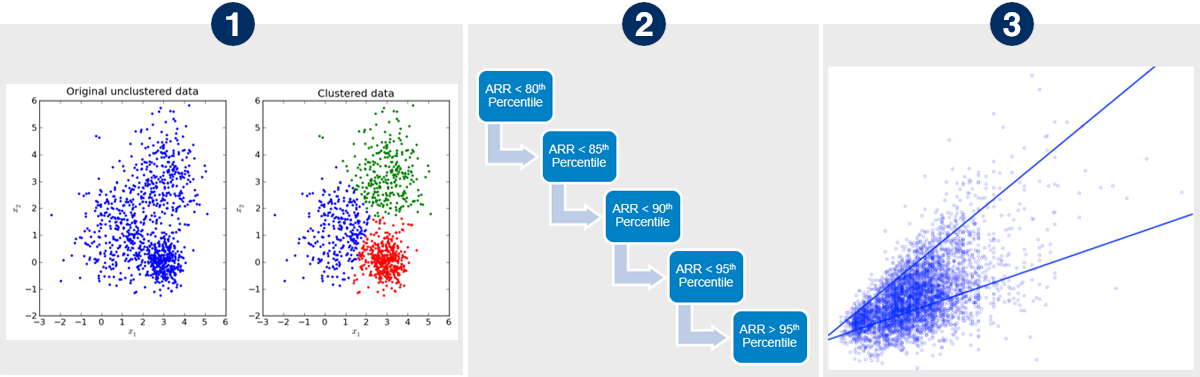

Sizing the available market starts with analyzing current account spend. Data scientists are getting more granular as they model opportunities at an individual account level. This means moving beyond an overall opportunity score to an individual business unit or product-level assessment. It also means incorporating multiple factors into the opportunity models to create a more robust output. More simplistic models typically struggle to differentiate opportunity levels within similar accounts, creating many phantom targets. These multi-factor models can match an account to the best comparable grouping, resulting in an estimate that better reflects the true opportunity for a given product. Data quality and factor validation are key inputs into this effort, requiring collaboration between sales and commercial operations for a successful outcome.

- Active accounts are assigned to “look-alike” groupings on multiple variables

Accounts assigned to grouping on buying & sales characteristics - Within group, accounts are partitioned by most recent year spend

Within group, 5 distinct sub-groups are created by spend - Statistical analyses assign potential by product by account using historical data

Regressions partition spend by platform type within account

Not All Revenue Opportunities are Created Equal

Net Revenue Retention (NRR) measures how much revenue a company retains from their existing customers over a given period, after accounting for churn and expansion. NRR is a key indicator of customer satisfaction, loyalty and growth potential. Companies with poor NRR often struggle to diagnose the root cause since there are multiple factors that impact the metric.

NRR can be calculated by subtracting revenue churn (the lost revenue from cancellations and downgrades) from expansion revenue (the gained revenue from upsells and cross-sells) and dividing it by recurring revenue (the revenue from customers at the start of the period, not including one-time sales). A NRR above 100% means that you are generating more revenue from your existing customers than you are losing, which implies that your product or service is delivering value and meeting their needs.

A low NRR can be the result of poor customer retention, a lack of account development or both. Improving NRR can have a significant impact on overall revenue growth and profitability. By retaining and expanding your existing customer base, you can reduce customer acquisition costs, increase customer lifetime value and create a stable source of recurring revenue. Additionally, satisfied customers are more likely to refer new customers, creating a positive feedback loop of organic growth.

The product of these advanced techniques is greater insight into the type of opportunity that exists at a given account. Companies can use these models to assess sales effectiveness metrics. Understanding the total account opportunity provides insight into initial deal size compared to incremental deals after the initial new account conversion. These insights allow companies to dynamically adjust their sales process to address pain points that lead to lost revenue. Additionally, a company with revenue opportunity in a current product needs different coverage than an account with cross-sell opportunity. Use case based account expansion has become a more prevalent practice as organizations evolve. This opportunity modeling approach creates alignment between use cases and the potential for revenue growth.

Refine Account Coverage to Reflect the Needs of Each Segment

As a sales leader, you know that different segments of your customer base require different levels of attention and service. But are you assigning the right sales roles to each segment? Companies should assess their account coverage strategy as a part of their annual commercial planning process to ensure alignment with evolving strategies. Leveraging improved account opportunity analysis can help leadership make more informed decisions on the needs of each segment.

- High-Growth Potential Segment: These are accounts with significant additional opportunity, where you want to maximize account spend from current products and cross-sell additional products to create greater customer stickiness. For this segment, deploy higher-cost sales resources, such as account executives or account managers, who can build strong relationships with key decision-makers and influencers, understand their pain points and goals and offer tailored solutions that add value.

- High-Current Spend Segment: These are accounts that have high spend but little room for growth. The focus here should be on account intelligence, product utilization and value realization. For this segment, assign customer success or renewal support roles who can monitor customer satisfaction and retention, ensure product adoption and usage, demonstrate ROI and impact, and identify upsell or renewal opportunities.

- Transactional Account Segment: These are accounts that have low current spend and moderate potential for growth. There is often revenue potential spread but only across a larger number of these accounts. For this segment, leverage digital tools and low-cost sales resources, such as inside sales representatives or digital customer support roles. They can use data analysis to identify the most likely products for cross-sell and accounts that are below full utilization. They can also use email marketing campaigns or chatbots to engage prospects and customers at scale.

- Low Spend and Potential Segment: These are accounts that have low current spend and low potential for growth. The primary goal here is revenue retention at a low cost. For this segment, rely on digital tools as the primary customer interaction channel. Use lead response reps or renewal reps roles to handle inbound inquiries or outbound calls for renewals.

By refining your account coverage strategy based on these segments, you can optimize your sales performance and customer satisfaction while reducing your cost of revenue.

Seller Capacity and Tools Need to Be Able to Support the Strategy

Each of these different customer segments will have an engagement model with distinct levels of interaction. As companies assess their coverage model, it is important to understand seller capacity to ensure successful execution. Conducting a time study of the current sales team can help quantify available seller bandwidth and hours needed to manage relationships and navigate through the sales process. These inputs should be considered when allocating headcount so there are no gaps in account coverage.

As companies consider their coverage model, it is important to assess the capability of their current technology to support a low-cost coverage strategy. This means prioritizing investments in sales and marketing tools necessary to create a primarily digital engagement model. Finally, any transition from the current coverage model should be executed consistently. Companies should plan the timing and key messages carefully to ensure that accounts do not feel devalued.

Overall, companies are increasing the prioritization of more efficient coverage models. By sizing the prize and segmenting accounts according to their opportunity and use cases, businesses can better align resources to the right opportunities. This approach can help maximize revenue from current accounts while minimizing the costs associated with low-potential customers.

Alexander Group designs GTM strategies that provide value, reduce costs and incentivize behaviors that drive growth. Join our upcoming virtual roundtable to address the latest trends and best practices in developing productive commercial teams.

Contact Us

For more information on how to assess your go-to-market strategy, optimize your current coverage model, increase customer retention and reduce customer acquisition costs, please contact an Alexander Group Business Services practice lead.