IT Services Trends and Go-to-Market Practices

What Are the Trends and Challenges Driving Change in IT Services?

The IT services industry is rapidly growing with an industry revenue of $623.1 billion across 502,000 U.S. businesses in 2022 (IBIS 2023). As an enabler of product innovation, IT service providers play a pivotal role in driving the introduction and adoption of new technologies within organizations. In recent years, the migration to the cloud has fueled tremendous growth, but there several notable drivers that will propel it moving forward:

- Artificial Intelligence (AI): An exciting frontier with a potential value of $10-$15 trillion globally; $3.6-5.6 trillion in supply chain management and manufacturing alone.

- Blockchain: 76% of senior executives believe that digital assets will serve as a strong alternative to, or outright replacement for, fiat currencies in the next 5–10 years. But blockchain is much more than just cryptocurrency – there’s growing interest in alternative applications for this technology.

- Cybersecurity: Essential to any and all organizations, with global cybercrime causing an estimated $16.4 billion in damage per day in 2021.

- Remote work: The new working norm, with 74% of U.S. companies planning to implement a hybrid work model that places added stress on IT systems and processes.

- Sustainability: Now a top focus and priority for organizational leadership and estimated to be a $4-$6 trillion market by 2030.

These trends highlight growth potential and the need for adaptability in the IT services industry. In this article, we will explore current trends, the three tiers of the industry, and some of the most common go-to-market practices and challenges in this space.

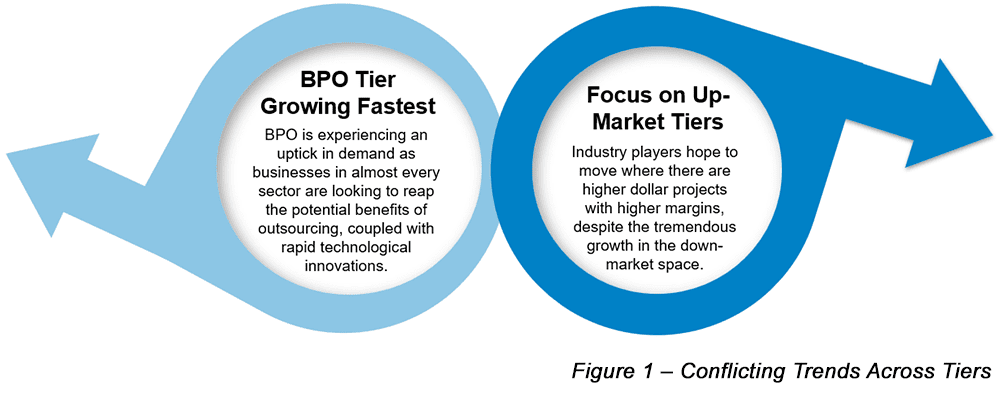

BPO Accelerates, Managed Services Disrupted and Consulting Evolves

The IT services industry is broadly divided into three tiers: BPO, Managed Services and Consulting, with companies offering different products and services based on the tier in which they operate.

- BPO, the first tier, is the largest and fastest growing segment within the IT services industry. This is attributed to organizations seeking the benefits of outsourcing coupled with rapid technological innovations. This tier is comprised of companies executing specific outsourced tasks or functions – e.g., customer service, medical transcription, billing, payroll – with the aid of technology. While BPO companies can serve all industries, they are heavily prevalent in healthcare, manufacturing, retail trade and banking industries. As the space evolves, BPOs are offering more than just outsourced labor. Firms are offering value-added services that reflect an individual customer’s unique needs, goals and strategies. The revenue growth rate for BPO companies is accelerating, with some seeing high-double digit growth.

- Managed Services, the second tier, offers a more permanent or long-term approach to managing a customer’s tech stack and IT function. These organizations offer various products and services, including infrastructure management, data backup and recovery, security and network management. Managed Services providers are experiencing heavy disruption and demand due to the growth of cloud computing. The revenue growth rate for Managed Services is moderate, ranging from 2% to 20%.

- The third tier of the IT services industry is project-based Consulting. This tier is characterized by companies offering computer systems development, IT infrastructure, digital transformation and technical consulting, and custom services. These services help organizations evolve and upgrade their IT strategy and often entail high dollar, multi-year transformational engagements. While the revenue growth rate for Consulting is gradual (typically ranging from 6% to 13%), the allure of higher profit margins continue to drive organizations to focus on this up-market tier of IT Services.

An organization’s mix of BPO staff augmentation, Managed Services and Consulting has a profound impact on GTM operating model.

Two Primary Operating Models

There are two primary operating models in IT Services: 1) the bifurcated sales and delivery model and 2) the partner-led model. The bifurcated model is characterized by separation of the sales and delivery teams, with salespeople responsible for closing net-new business and client services being responsible for the completion and delivery of services sold. The partner-led model relies on senior-level partners to oversee both the sale and delivery of services.

For obvious reasons, the bifurcated model allows sellers to dedicate more time and focus on business development and selling motions (compared to the partner-led model). However, since sellers are a step removed from the day-to-day client interactions, they are heavily reliant on strong communication with delivery teams to ensure ongoing client satisfaction and identify ongoing growth opportunities. Many BPO and Managed Services organizations operate in a bifurcated model due to the structured and repeatable nature of the services being rendered. But as service offerings become more bespoke or consultative in nature (e.g., designing a multi-year digital transformation strategy), the bifurcated model can become strained if sales and delivery become misaligned regarding what is sold versus what can be delivered.

By contrast, the partner-led model creates a closer connection between sales and delivery via experienced partners that oversee both the sale and delivery of services. This model is popular in consulting-centric organizations where bespoke client needs require deep subject matter expertise and first-hand experience to drive successful outcomes. The partner-led model is renowned for building strong client relationships, where clients work with a joint sales and delivery team that – when done well – leads to deeper trust and loyalty between the two parties. However, this comes with its own set of obstacles. This model requires a different talent profile – an individual that possesses the IT subject matter expertise, as well as the ability to sell and manage accounts. Even with the desired skillset, partners must appropriately balance their time between selling, account management and delivery otherwise the business will struggle to scale and achieve sustainable growth. For this reason, organizations work tirelessly to maximize delivery efficiency and enable senior partners to reserve time for generating new business.

As demand continues to grow and IT Service firms evolve their mix of BPO, Managed Services and Consulting offerings, there are important considerations to make regarding the organization’s GTM operating model. As lower-tier BPO or Managed Services firms move into more bespoke consulting engagements, there is often a shift in expectations regarding a seller’s subject matter expertise and the role that senior leaders play in delivery. Likewise, as up-market firms seek to join the high-growth BPO space, they require a GTM operating model that can dedicate the sales time and resources required to successfully close new business at a faster pace. It’s the subtle difference in sales and delivery motion of these service offerings that should not be overlooked as IT service firms evolve their GTM model over time.

Blended Accountabilities for Growth and Profitability

In either GTM operating model, the interlock between sales and delivery is critical to the organization’s success. But this strong connection can often breed debate…

Who truly owns growth?

- The client relationship owner?

- The subject matter expert that closes the deal?

- Or the client services team that delivers, deepens the client relationship, and tees up the growth opportunity?

Who owns profitability?

- The seller that establishes pricing?

- Or the team responsible for delivering on-time and on-budget?

While the academic answer is that sales should own growth and delivery own profitability, its more nuanced in reality. Sales must establish well-scoped and well-priced service agreements that set delivery up for success, and delivery has to provide quality and cost-effective results that unlock future growth opportunities. The reality is that sales and delivery share the accountability for growth and profitability in this environment; and it’s this shared impact on growth and purchasing decisions that can make it a challenge for leadership to define clear responsibilities and accountabilities among the combined customer-facing team.

Shared Accountability Breeds Compensation Challenges

This shared accountability can present various challenges from an incentive compensation standpoint. First, there is often a lack of clear guidance on which customer-facing roles should be eligible for sales compensation and upside given their share of “influence” over the buyer’s purchasing decision (e.g., should delivery teams be compensated for account growth?).

In addition, organizations end up juggling a mix of metrics in their compensation plans – e.g., TCV (Total Contact Value) bookings, revenue, profit/margin, MBOs (Management Business Objectives) – in an effort to address the pressure to secure long-term contracts, while also delivering strong in-year revenue and healthy profit margins. Since each metric is important, organizations struggle to keep incentive plans simple and motivational while selecting the right measures and weight that will align with overall business objectives.

Lastly, the lack of a sales compensation philosophy and guiding principles often leads to a proliferation of roles receiving sales incentives and misalignment regarding the role that incentives play in performance management. This can lead to difficult questions.

- Should a seller receive commissions for a large TCV deal even if it becomes unprofitable to the business?

- Should sellers be rewarded for long-term deals that fail to help deliver near-term revenue?

- What about team members that ignore or fail to push strategic offerings?

Perhaps more than in other industries, we see a wide array of philosophical approaches to these questions given the blend of operating models that exist within IT Services (e.g., a BPO with deal-based commissions versus a traditional consulting firm with year-end bonuses based on the client partner’s contribution to the firm’s overall bookings, revenue, profitability and market standing).

Stay Competitive in Rapidly Evolving Industry Trends

The IT services industry trends are ever-changing, and it’s essential to keep up with them to stay competitive. Alexander Group can help IT services companies stay informed about the industry trends, insights and frameworks. Contact an IT services practice lead to receive a well-rounded view of the industry and learn best practices.

_______________________________________________

Not What You Were Looking For? Explore More…

Business Services Leaders: How We Help

Recommended Insights:

Article: Quota Concepts, Best Practices and Expected Outcomes

Article: Sales Compensation Plan Redesign

Whitepaper: Business Services Go-to-Market Trends and Mandates Summary