Building a Unified, Yet Flexible Governance Model

Despite the structural complexity of financial services, a unified governance model is essential. A strong framework enables firms to design plans more efficiently, administer them more consistently and better support growth strategies across the corporate structure.

A successful governance framework typically includes the following components:

- Design Guiding Principles: A common set of principles that are aligned to corporate strategy and pay philosophy should be created and used. This is to design and monitor compensation plans across the business units.

- Business Model-Specific Guidelines: Beyond high-level principles, it is key to create business model-specific guidelines that tailor governance to different models and sales motions. These guidelines provide direction and guardrails to help business units align with shared standards while maintaining operational relevance.

- Assessment Framework: An evaluation tool should be developed to measure how well existing plans align with the guiding principles. This should be tailored to each business unit by creating archetype-specific guidelines, ensuring the review reflects each model. The tool also allows for a consistent, objective view across different models, while preserving the necessary flexibility in market-specific practices.

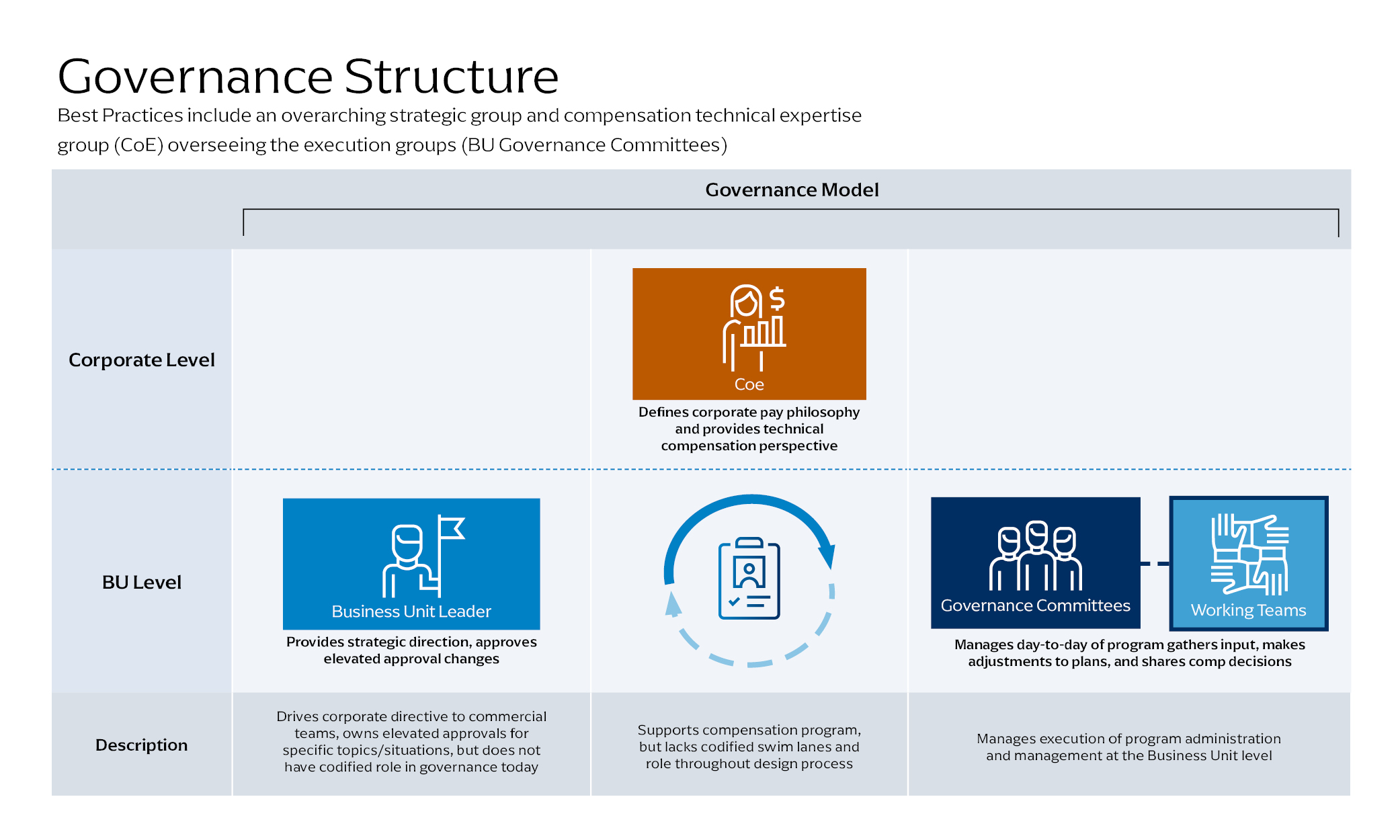

- Governance Team Structure: A tiered governance model should be established, including both a central corporate committee and business-level teams. Roles and responsibilities must be clearly defined for decision making, documentation and approval processes. It is important to ensure balanced representation from both businesses and HR across all governance levels, including corporate and individual business units.

- Standardized Processes: Governance should be embedded throughout the compensation planning and management cycle across design, administration and evaluation with standardized processes and timelines.

- Proactive Review Cadence: Regular review cycles should be enforced to ensure alignment with guiding principles and prevent the need for reactionary plan changes. Input from sales, HR, finance, product and compliance should be included.

Unifying financial services organizations is achievable with intentional compensation governance that reflects the industry’s complexity. By combining corporate-level structure with business unit flexibility, firms can create strategically aligned, efficiently administered and responsive compensation plans.

Treating compensation governance as a strategic enabler, rather than an administrative task, helps drive performance, manage cost risks and support scalable growth. Firms adopting this approach will be better positioned to execute commercial strategies across all business units, reinforcing sales strategy, streamlining decision-making and building trust in compensation programs.