Impact of Outpatient Procedures on Commercial Models

Notable differences between Hospital Outpatient and ASC procedures.

Successful commercial models depend on understanding the unique attributes of the customer. However, one of the sellers’ most common mistakes is confusing Outpatient Procedures for an Ambulatory Services Center (ASC). What are the notable differences between Hospital Outpatient and ASC procedures, and how do they impact your commercial model?

Commercial Model Implications in Healthcare

Technology, cost and convenience are all driving factors for consumers to get the care they need from outpatient providers. Therefore, understanding how your go-to-market (GTM) strategy aligns with HOPD and ASC sectors is critical for revenue growth.

For instance, the Pharma sector is adept at outpatient services and reimbursement since their products are primarily in outpatient setting. This maturity can help them align with outpatient growth, targeting providers and appropriate decision makers in each setting.

Medical technology is also positioned for growth, given the increasing dependency on technology in both HOPD and ASC settings. However, as Medicare becomes an increasingly important factor for consumer choice, they must increase their understanding of reimbursement rules that drive revenue for each sector.

Takeaway: The growing transition to outpatient care and growth of management-owned ASCs is advantageous for all healthcare sellers, especially for those that strategically align their commercial model with customer needs.

Increased Demand for Outpatient Services

The AHA reported that there are nearly 6,100 hospitals in the U.S. for 2022, with almost 790,000 staffed beds that support over 33 million admissions annually. However, as hospital resources become more constrained, they are shifting more invasive, higher acuity procedures to outpatient settings.

Medicare reimbursement rates for outpatient services are increasing, making these procedures more attractive for hospitals. Outpatient volume is also rising, partly due to patients who postponed elective procedures during COVID returning to providers.

Takeaway: Increased demand now presents opportunities for all providers of outpatient services and the companies who sell to them.

What are Hospital Outpatient Departments (HOPD)?

Inpatient services are classified as emergent services or care requiring more than a 24-hour stay. For emergent care that does not require admission, hospitals turn to outpatient services to provide quality care at a lower cost.

According to the AHA, HOPDs provide more extensive services, including those not found in a traditional physician’s office, such as specialty services (burns, trauma, neo-natal), backup for the Emergency Department and medical complications and uncompensated care. The Kaiser Family Foundation’s definition of outpatient services includes wellness, rehabilitation, diagnosis and treatment such as surgery or chemotherapy.

Outpatient services are typically less costly than inpatient services, making services more affordable. While Medicare patients are some of the primary users of HOPDs, private or employer-based insurance costs for outpatient care are more affordable but are approximately 222% higher than Medicare.

Outpatient growth has increased substantially with the total number of visits nearly tripling from 1990 to 2019 and the percent of surgical procedures increasing from approximately 50% to 69% (CDC). While technological advances accounted for part of this growth, the primary focus has been to increase patient volume while better managing the quality and cost of care for patients. As a result, inpatient and outpatient revenue now provide nearly equal shares of overall hospital revenue.

Takeaway: Hospitals will increasingly rely on HOPD revenue but must control costs as they stretch their resources across a broad spectrum of services.

What is an Ambulatory Services Center (ASC)?

ASCs have distinct characteristics from HOPDs. For example, according to CMS, a Medicare-certified ASC must:

- Have a written agreement with CMS to provide services.

- Provide services for patients who do not require hospitalization, and the services received are not expected to exceed 24 hours post admission.

- Not mix functions and operations, nor have a shared space and do not conduct overlapping operating hours with a similar provider (ex: an adjacent physician’s office).

- Not share space, even temporarily, with a hospital or critical access hospital outpatient surgery department or with a Medicare-participating independent diagnostic testing facility.

The total number of Medicare licensed ASCs is approximately 5,800. ASCs typically save money for both Medicare and consumers since CMS pays ASCs about 50% of the HOPD rate for the same procedure. According to the ASC Association, ASCs saved over $28 billion in Medicare payments from 2011-2018 and are projected to save over $73 billion from 2019-2028.

ASCs offer an estimated 59% price reduction per procedure, saving consumers over $680 per procedure, according to United Healthgroup. In addition, quality is improved, with surgical site infections reported to be much lower at ASCs. Per 1,000 patients, the CDC reported that 8.95 hospitalized patients experience infections as opposed to only 4.84 who develop infections from ASC surgeries.

According to Forbes Business Insights, the ASC surgical center market size will reach $58.85 billion, with a market value of nearly $37 billion in 2021. Surgical centers offer increased quality, lower costs and technological advances, such as cloud platforms to share patient information, which consumers like.

Estimated to grow 15% by 2028, ASC surgical centers now perform half of all U.S. surgical procedures. Consumers are showing their preference as ASC surgical volume is expected to grow 25% but only 18% at hospitals and physician offices. For instance, an average hospital gall bladder surgery would cost $12,000 but only $2,200 at an ASC surgery center.

The Bureau of Labor Statistics projects employment growth to reach 35% in outpatient care centers alone, making it the second fastest growing industry, eclipsed only by home healthcare services.

CMS issued a payment growth projection of 2.4% for C.Y. 2021 for ASCs. CMS is following efforts to align ASC payments with hospital outpatient rates. CMS is also pursuing quality reporting standards for ASCs to ensure the quality of care. CMS estimates total ASC payments for 2022 to increase by $40 million over 2021 to an estimated $5.4 billion.

Source: https://www.ascassociation.org/advancingsurgicalcare/asc/whatisanasc

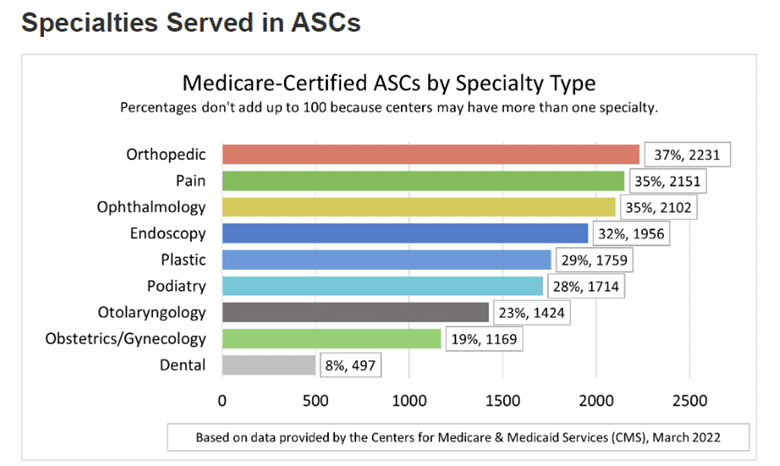

ASCs may offer more than one type of outpatient service. The top Medicare-certified ASC specialties for 2022 include:

- Orthopedic – 37%

- Pain – 35%

- Ophthalmology – 35%

- Endoscopy – 32%

- Plastic surgery – 29%

- Podiatry – 28%

- Otolaryngology – 23%

- Obstetrics/Gynecology – 19%

As of 2020, 72% of ASCs are privately owned, with increased consolidation activity during 2021. As of 2021, the top five management companies own 1,185 locations, or approximately 20% of the total 5,906 Medicare Certified ASC Centers. Multi-site operators account for an additional 10% or 567 locations. Management company consolidation represents a 4.76% compound growth rate since 2011.

Takeaway: ASCs are a smaller market, focusing on specialties that consumers want, at a lower cost and are poised for growth.

Understand Unique Attributes of the Customer

Companies that develop their commercial model around unique services, reimbursement rates and growth potential are poised for growth. These markets expect sellers to understand their unique attributes and serve them accordingly.

Alexander Group’s experts align commercial models and GTM strategies for sellers across healthcare sectors. For more information, please contact an Alexander Group Healthcare practice leader.