Solution Selling Aligns Buyers and Sellers

The onset of Industry 4.0 will reshape business tools and processes so that manufacturers and buyers can capitalize on intelligent, interconnected computer systems. These systems will support a new level of personalization that fuels solutions to specific and complex challenges.

Some businesses will be quick to adopt an Industry 4.0 framework, while others hold to the Industry 3.0 systems that provide value through raw features, capabilities and price. Adopting Industry 4.0 technology requires buyers to recognize the value inherent in customizable, solution-oriented tools. Conveying this value to buyers will require sellers to adopt solution-based sales strategies.

What Is Solution Selling?

Solution selling is a way to frame sales tactics—a sales methodology that describes the principles, practices and strategies that guide selling roles. The strategy puts customers’ needs front and center. Sellers will express how products will address specific pain points.

Solution-Based Sales: Driving Toward Industry 4.0 Capabilities

Solution selling is again gaining popularity primarily because it aligns with buyers’ evolving needs and the competencies sellers adopt to meet them. These dynamic shifts coincide with the dawn of Industry 4.0, the Fourth Industrial Revolution. Thus, solution selling is critical to a widespread Industry 4.0 transition.

Industry 3.0 Product Selling Vs. Industry 4.0 Solution Selling

The solution-selling framework deviates from traditional product-selling methods. Understanding this deviation is essential when selling Industry 4.0 technology.

Under Industry 3.0, buyers and sellers agreed that the most impactful reasons to purchase a product were its features and capabilities relative to its price. Industry 3.0 facilitated this dynamic, as technological systems were powerful but rigid—tools like Programmable Logic Controllers could provide one type of automation, so sales departments would build strategies that highlighted that capability and target buyers who could use it.

Under Industry 4.0, tools are more sophisticated and adaptable. Their features and capabilities are subject to the buyer’s needs. Product selling struggles to encapsulate the value of such versatile systems. Solution selling allows sellers to highlight the outcomes a product will produce rather than the features it offers, which is necessary when discussing a tool’s need-based customization capabilities.

Moving From Product Selling to Solution Selling Under Industry 4.0

Solution selling requires a sales department to evolve. Beyond simply investing their time in learning the customer’s business needs, sellers, with the help of a more robust digital toolkit, can and should offer custom solutions to existing challenges. Buyers benefit from practical solutions to pervasive problems, while sellers leverage enhanced relationships that set the stage for future sales. Overall, solution selling addresses a core issue: Buyers need their problems solved, not the latest product in the seller’s “bag.”

A Collaborative Shift to Industry 4.0

Industry 4.0 challenges manufacturers to create intelligent systems that provide real-time data about processes. The systems that help them monitor, diagnose and solve problems with a minimal time lag have improved manufacturing processes. Now, they seek to make the solutions available on the market. Manufacturers depend on sellers to convey solution-based value to buyers.

As solution-based sales tactics take root, the need for interconnected Industry 4.0 core capabilities will drive both buyers and sellers to work together more closely. Buyers and sellers must develop a mutual understanding to deliver outcomes to end users who are often not the buyers. This requires both parties to transform their expectations and evolve their relationship.

What Are the Pros and Cons of Solution Selling?

There are numerous advantages to solution selling, but also some challenges that come with its implementation.

Benefits of Adopting Solution-Based Sales Strategies

Solution sales strategies allow sellers to benefit in the following ways:

- Improve seller insight: Reframing sales tactics around solutions causes sales teams to invest in the collection and analysis of buyer data. Sellers become more familiar with the challenges buyers face and the strategies they can use to learn more about prospects.

- Enhance sales strategies: Collecting and analyzing specific customer data breeds greater sales success. Sales departments that use solution-based strategies when selling Industry 4.0 solutions drive revenue by employing refined sales tactics.

- Strengthen customer relationships: Prioritizing buyer-specific solutions helps sales departments earn trust throughout the market. As buyers acclimate to solution-oriented valuation, they will appreciate the seller’s understanding of their needs.

- Build manufacturer confidence: Shifting to Industry 4.0 will cause manufacturers to seek sales partners capable of conveying the value of personalized intelligent systems. By displaying an aptitude for solution selling, sales organizations can strengthen manufacturer relationships.

Challenges In Adopting Industry 4.0 Technology and Solution Selling

As with any new approach, there is a learning curve. Buyers and sellers must recognize a few challenges in order to embrace the Industry 4.0 possibilities that manufacturers provide.

First, not all buyers are ready to embrace solution selling, especially if they have not identified (or been illuminated to) the value of outcomes-based results (i.e., they still just want to buy the best widget at the lowest cost).

Alternatively, not all commercial teams have coordinated their internal efforts to offer advanced solutions that buyers require. Moreover, many sellers lack the competencies to sell at a higher level. This “selling the carpeted hallways” means sellers must adapt a C-suite business acumen to help identify problems and provide solutions.

Optimizing Solution Selling in Industry 4.0

Buyers need assistance to address underlying problems. But how do sales organizations effectively identify buyer challenges so they can offer valuable solutions?

One common issue is that the buyer may not be the user of the product or solution and need to be made aware of existing problems. As a result, the customer organization may miss out on improved productivity, enhanced sales or potential cost savings. However, this gap opens opportunities for sellers to identify the growing needs of users, buyers, stakeholders and associated challenges that stall growth.

Industry 4.0 Capabilities for Manufacturing and Sales Optimization

Selling organizations need to understand the foundations of the Industry 4.0 model as manufacturers integrate optimization and automation into their core capabilities. For instance, manufacturers have been using AI to remotely monitor product usage, diagnose potential issues and reveal underlying causes. Sellers can use this information to create unique solutions that assist in landing, expanding and supporting these customers.

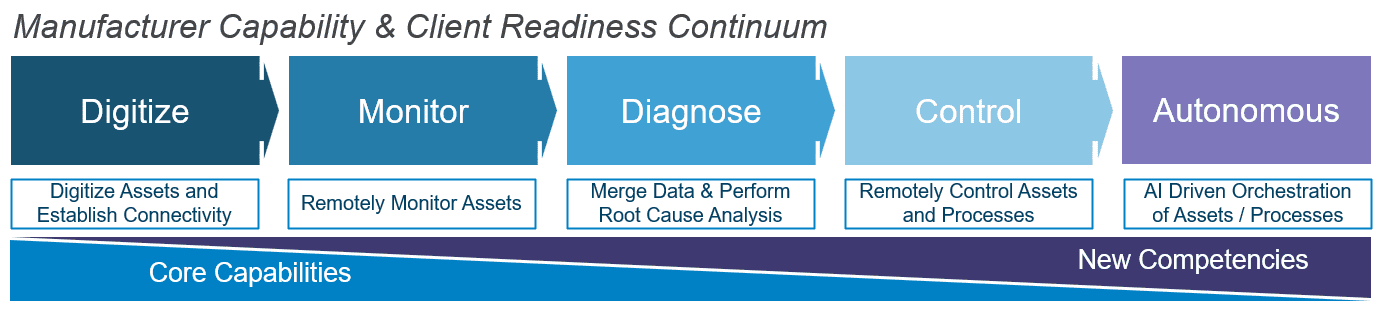

Manufacturers and sales teams can leverage five core Industry 4.0 capabilities to further their understanding of buyer needs and ways to satisfy them. The five core Industry 4.0 capabilities are based on the Manufacturer Capability and Client Readiness Continuum, which will allow manufacturers to achieve world-class performance.

- Digitize – Digitize assets and establish connectivity

- Monitor – Remotely monitor assets

- Diagnose – Merge data and platform root cause analysis

- Control – Remotely control assets and processes

- Automate – Employ AI-driven orchestration of assets and processes

Advanced manufacturers are rapidly integrating this model for real-time identification of potential issues. Consequently, sellers must also adapt their selling motions, creating a non-linear sales model that does not push products but develops a continuum of solutions based on ongoing problem-solution scenarios within the customer organization.

Aligning Product and Solution Capabilities

Are buyers and sellers prepared for the capabilities required to support the Industry 4.0 model?

Currently, there is a commercial gap between buyer readiness and seller awareness. However, many manufacturers have taken steps to both Digitize and Monitor their operations, improving oversight of potential gaps to secure their competitive standing. As manufacturers move through the spectrum to Diagnosing root causes, Controlling assets remotely and Automating with AI solutions, they will require selling partners that can offer solutions from this advanced perspective.

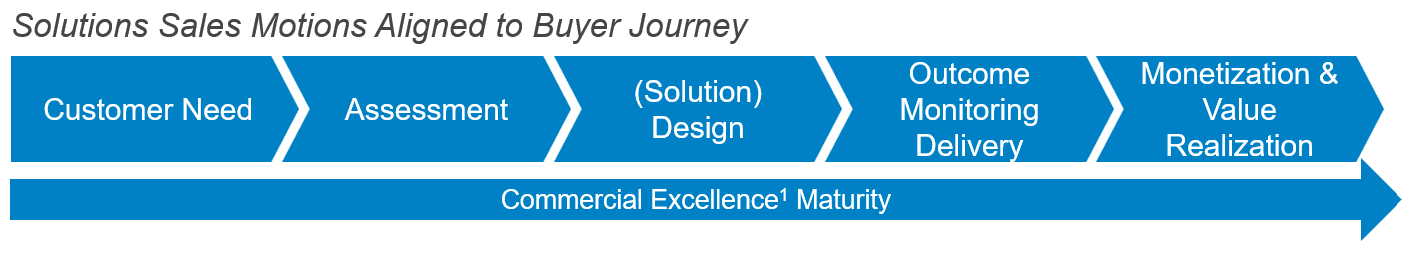

Successful sellers will need to adopt a new Commercial Excellence Maturity Model that aligns their sales motions to the Buyer’s journey and advanced manufacturing capabilities, including:

- Customer Need – Distinguish between Buyer and User needs

- Assessment – Identify client readiness and core capabilities

- Solution Design – Create effective solutions based on advanced core capabilities

- Outcome, Monitoring and Delivery – Monitor solution effectiveness

- Monetization and Value Realization – Evaluate key metrics for buyer and sellers

Buyer-Seller alignment requires additional investment and capabilities, resulting in an advanced selling model that supports the growing needs of manufacturers, helping to eliminate the current commercial buyer/seller gap. Moreover, solution selling is a team sport that incorporates multiple stakeholders on both sides and sales new roles.

Achieving Sustainable Revenue Growth

Industry 4.0 capabilities will vary depending on the organization’s maturity. The good news for sales leaders is that a solution-focused, non-linear sales process will help their organization adapt to increasingly demanding buyers who seek and are willing to pay for outcomes and results as opposed to a race to the bottom-line price on a product or service.

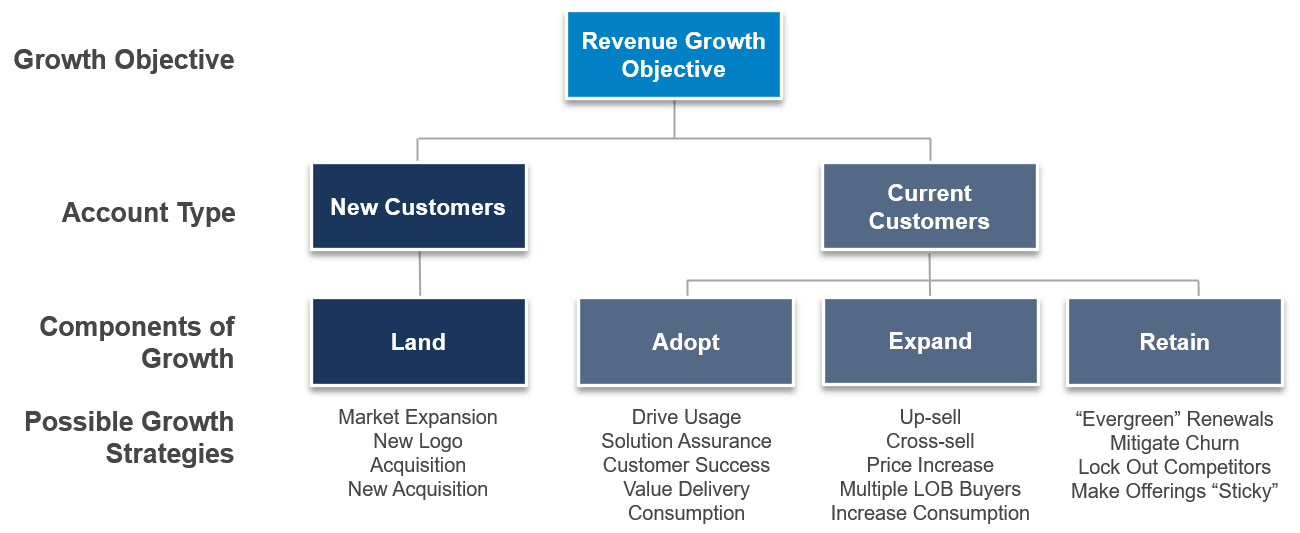

The ILAER Growth Strategy

Sustainable revenue growth employs four key revenue drivers: Identify-Land-Adopt-Expand-Renew (ILAER). This sales approach supports solution selling by using specific levers and strategies for each driver that include:

- Identifying new opportunities, by seeding the market landscape and qualifying leads

- Landing new customers, using market expansion, new logo acquisition and new acquisition

- Driving customer Adoption, by providing solution assurance, customer success and value delivery, while driving usage and consumption

- Expanding current customer sales, through upsell, cross sell, price increase, multiple LOB buyers and increasing consumption

- Renewing (or Retaining) current customers, offering “evergreen” renewals, mitigating churn, locking out competitors and making “sticky” offers

Implementing ILAER

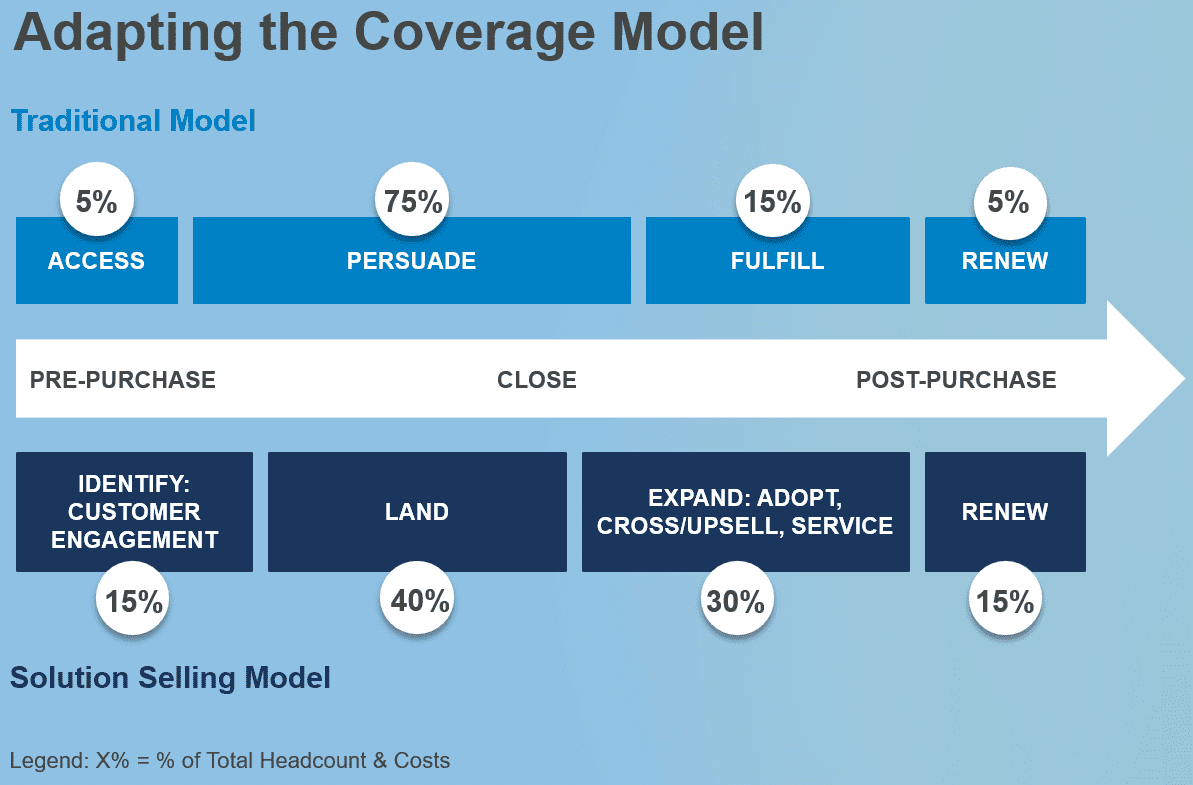

ILAER requires enhanced collaboration across the commercial enterprise, coordinating Marketing, Sales and Service, sharing their insights while keeping focused on the solutions that deliver outcomes for that customer. In addition, migrating to the solution selling approach will require an update to the traditional coverage model.

ILAER devotes more upfront investment to clarifying customer segments and needs to target appropriate ways better to Land the account. As the pool of customer decision-makers expands to include more sophisticated buyers and stakeholders, sales teams must invest more time and resources to develop the right solutions. Once acquired, often customer success managers (CSMs) step in to ensure adoption of the solution by the end users, freeing up sellers to continue to focus on the Land and/or Expand sales motion.

Transforming Sales Force Capabilities and Value

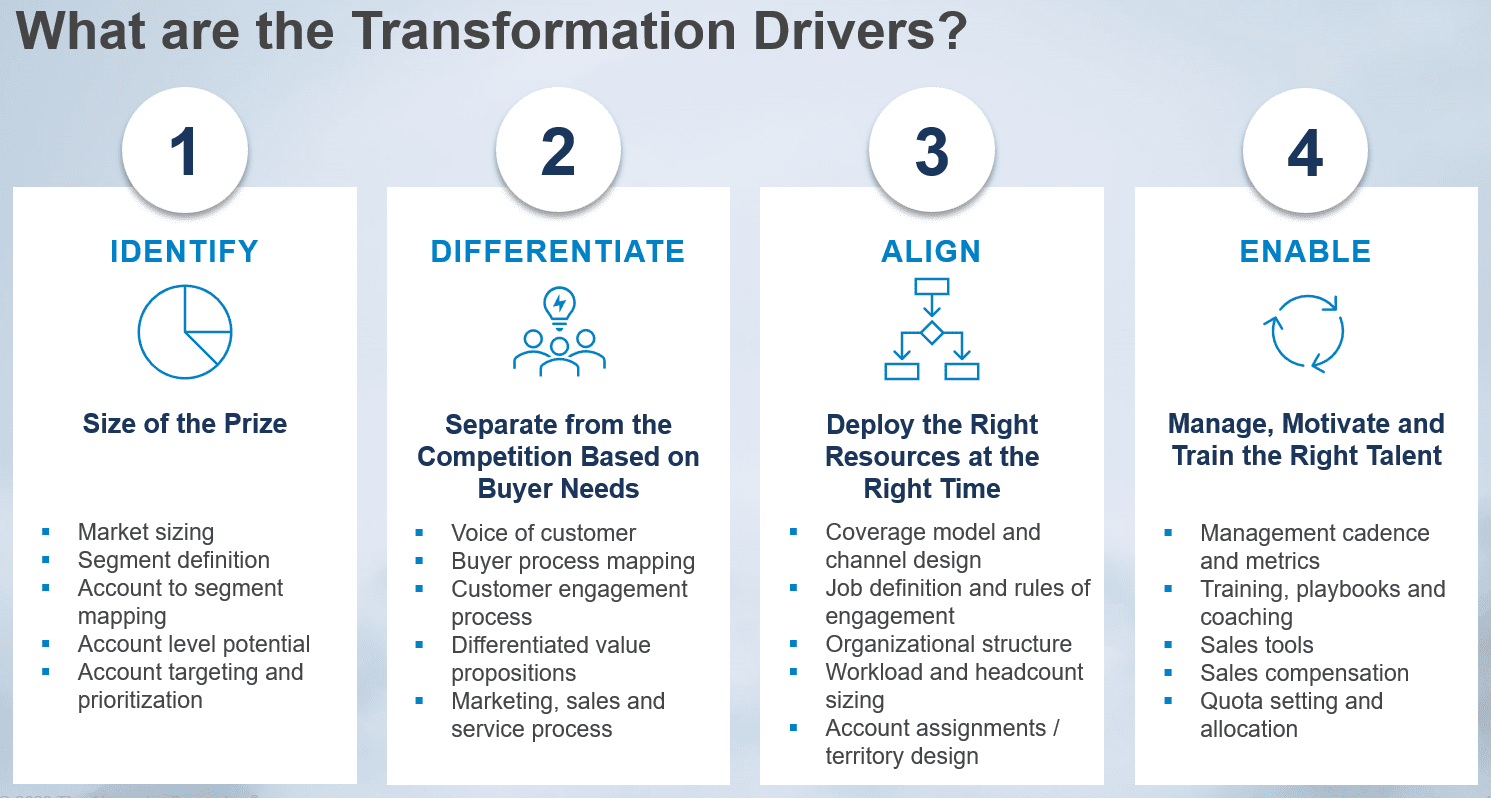

The increased complexity of Industry 4.0 solution selling amounts to a significant amount of change management with the marketing, sales and service team. Fortunately, there is a proven set of four transformation drivers to help organizations navigate the evolution of people, processes and technologies.

- Identify the size of the prize using market sizing, segment definition, account-to-segment mapping, account level potential, targeting and prioritization.

- Differentiate from the competition through VOC, buyer process mapping, customer engagement processes, value propositions and marketing, sales and service processes.

- Align and deploy the right resources at the right time, using updated coverage models, refined job definitions and rules of engagement, aligned organizational structure, workload and headcount sizing and account and territory assignments.

- Enable those resources by managing, motivating and training the right talent, implementing management cadence and metrics, training playbooks and coaching, sales tools, aligned sales compensation and appropriate quota setting and allocation.

When done effectively, solution selling can transform the sales organization into a mature, focused, profitable revenue-generating center. The enhanced strategy of the Identify-Differentiate-Align-Enable approach adds distinctive value and complexity to the sales organization.

- Buyer relevancy. Non-traditional buyer stakeholders are now relevant (e.g., CIO, Operations). When integrating solutions into the enterprise infrastructure, the sales process is often longer and more complex.

- Differentiated value propositions. Sellers are skilled in delivering the nuanced value propositions important to advanced buyers by articulating how the integrated service enhances usage of the individual products.

- Defined sales roles. New pre-sales, core-sales and post-sales roles are deployed effectively through clear rules of engagement to ensure appropriate customers are targeted with less confusion and minimal customer impact.

- Enhanced competencies. New roles require different competencies and skills, and new metrics to monitor performance. Compensation practices should be benchmarked to high-tech software industry trends as a best practice.

Adapting to a New Landscape

Alexander Group assists sellers as they align their business model to the needs of Industry 4.0 and the growing complexities of manufacturing buyers. For more information, please contact an Alexander Group manufacturing practice lead.