Mapping the Future of Media Sales

Welcome to the media sales crucible.

The changes in media sales continue at a frenetic pace. Media companies must rapidly adapt to new buyer priorities and asks. Competition is fierce. New product introduction is the new status quo. This puts enormous pressure on the entire revenue generation ecosystem (Marketing, Sales, Fulfillment/Service) to adapt and capture growth opportunities. Sales leaders must instill a sales culture of innovation and change – knowing the sales structure of the future does not look like it does today.

The pressure is mounting in the media industry to adapt or die. Traditional methods of monetization (print, television) are under attack. The myriad of new methods can be confusing and unpredictable. While advertisers continuously look for new ways to engage potential buyers, they must increasingly adapt to delivering content that drives not just awareness, but also purchasing behavior in a seamless fashion across multiple platforms (display, interactive, print, video, etc.).

The Time is Now

Media executives are faced with figuring out how to best go-to-market and monetize their product portfolio amidst these rapid changes in technology platforms. Advertisers want to “buy” access to their specific target audience and desired results regardless of the platform. Media sales leaders must determine how to create agile sales organizations able to keep up with frequent changes, more products, increased complexity, and buyers with increasing sophistication and expectations. That’s a tall order! And, more and more traditional media executives are getting pressure to solve for this sooner than they expected. As a case in point, consider the recent moves by major media companies (e.g., Time Warner, Gannett, E.W. Scripps, Tribune) to spin off their broadcast business from their digital and publishing businesses to create stand-alone organizations. These moves were made to “allow for enhanced flexibility to accelerate growth and to provide better alignment of resources with strategic priorities to drive innovation.” Translation: No more excuses, the spotlight is on you!

With intense pressure to perform, media executives must weigh the impact and risk of introducing new or different sales strategies, including:

- How to best position multi-product sales?

- How to drive digital or new product sales, without hurting the core?

- How fast do I need to move so I don’t miss the boat and fall behind?

The Agile Media Sales Organization

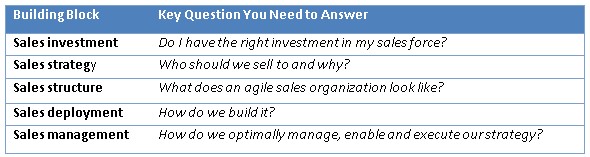

How can media executives adapt? The challenge is particularly acute for hybrid media companies. How might they best determine the sales model of the future for their business? Change is hard and risks abound. But there is some good news. Other industries have gone through similar disruptive change and transformation. Success in times of change requires a winning combination of strong leadership, an effective blueprint or road map for charting the future, and the courage to take calculated risks. This article intends to outline how media executives can effectively transform their go-to-market model and deploy an agile sales organization – one that will carry them through these times of rapid change and toward a promising future. We will explore key elements to building this road map:

- Sales investment – Do I have the right investment in my sales force?

- Sales strategy – Who are we selling to and why?

- Sales structure – What does an agile sales organization look like? How do we build it?

Sales Investment

Let’s begin by examining the first element of sales strategy, the element of sales investment. Your company’s sales investment profile is a key indicator of the organizational support behind the sales force. It should go without saying that a sales force is only as good as the organization behind it and the support the sales force receives from that organization. When evaluating sales investment, you should examine it on a dollars-per-rep basis across four key areas:

- Rep Total Compensation

- Management Total Compensation

- Productivity Levers

a. Demand Stimulation (Lead Gen)

b. Presales Support

c. Deal Support Team

d. Product Specialists

e. Admin/Ad Ops

f. Training

g. Sales Ops/Planning - Infrastructure Levers

h. Travel

i. Recruitment

j. Telephony

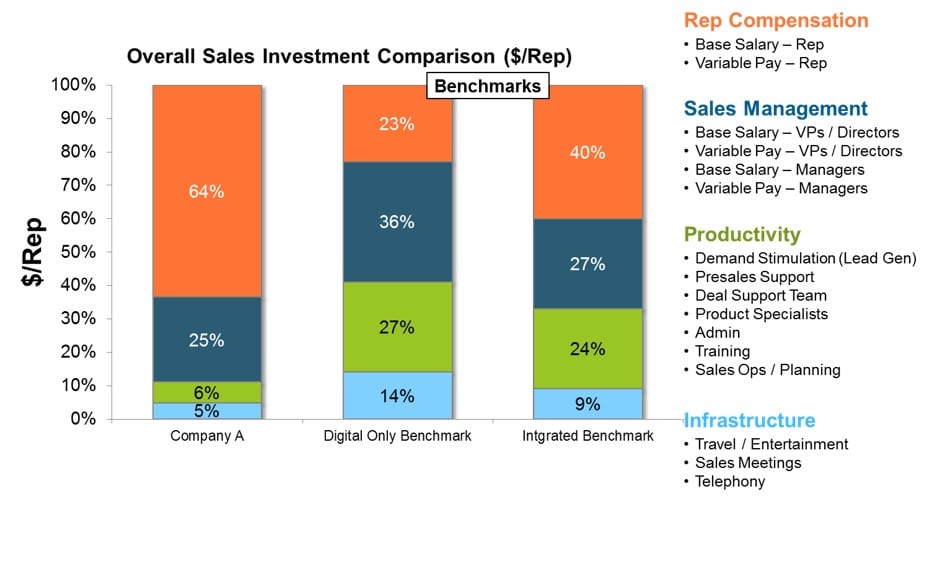

The illustration below shows the investment profile for Company A, the benchmark profile¹ for pure play digital and the benchmark profile¹ for integrated media organizations.

From a benchmark standpoint, both pure play digital and integrated media organizations allocate approximately 25% of their sales investment on sales productivity (also referred to as sales enablement). This includes things like:

From a benchmark standpoint, both pure play digital and integrated media organizations allocate approximately 25% of their sales investment on sales productivity (also referred to as sales enablement). This includes things like:

- Demand Stimulation = high quality leads that keep the top of the funnel full

- Presales and Deal Support = more impactful proposals, enhanced client insights

- Product Specialist = better positioning of the product portfolio

- Admin/Ad Ops = More time for high quality sales time, less on low value activities

- Training = continuous development, growth of sales

Just Add More Sales Heads?

Consider Company A in the above graph. Compared to benchmark, it was woefully under-invested in productivity as a percent of their total per/rep investment (only 6%, or one-fourth of benchmark). Company A’s investment profile was geared toward rep sales compensation – which means growth is dependent on reps, reps, and more reps. This is generally a very short term answer to growth. Before long, just adding more heads brings diminishing returns. This lack of sales enablement was a major contributing factor to the second-rate performance at Company A. When the focus is on adding heads, the ideas for improvement are limited to the “usual suspects,” ways to source new talent, compensation plan changes or SPIFFS, and maybe better first-line manager coaching to address comfort zone selling. But achieving higher levels of productivity requires sales organizations to make calculated investments in sales enablement.

What is Your Sales Investment Profile?

Understanding your baseline of investment in sales is a core aspect of developing the road map for the media sales force of the future. Are you prepared to consider a higher level of investment in sales to realize the desired level of organic revenue growth?

Sales Strategy

Diving into the second building block of the road map, sales strategy, we draw upon insights from our recent media research study of ten of the world’s leading digital sales organizations to share how they segment the market into groups for sales targeting and coverage.

Define Your Segmentation Framework

To begin, you must decide the inputs or variables you will use to segment your market. These variables enable you to target the most relevant accounts and de-emphasize less important accounts. Segmentation for sales strategy entails defining the current and prospective customer attributes that provide the most logical means of grouping for targeting purposes. Generally speaking there are three types of segmentation inputs:

- Current state inputs help you target accounts based on where you’ve found success with similar customers – This includes demographics, current products/solutions purchases, as well as other buying behaviors of your existing customers.

- Future opportunity inputs delineate the most attractive targets based upon market opportunity, growth potential, profitability and current penetration.

- Implementation inputs allow you to “micro-target” accounts within a segment, for example based on the impact of value propositions

Our media study research indicates the following seven most common inputs are:

- Current and historical spend ($)

- Potential spend ($)

- Alignment with strategic vertical

- Alignment with strategic products

- Share (%)

- Access to client

- Customer growth rate

It is important to note that there is no “silver bullet” when it comes to opportunity targeting data; even the most sophisticated sales organizations use a mix of inputs to predict future potential and refine targeting strategy. Make sure not to complicate the framework. The key is to create simple, clearly defined segments that allow for actionable account targets. The right framework is critical and sets the table for improved sales execution and targeted messaging which leads to higher conversion rates and return on sales investment.

Define the Buyer Profile

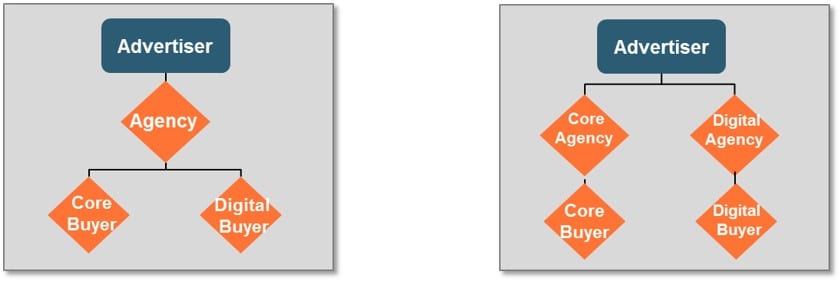

Once you know your sales segments, you’re ready to define buyer profiles. In today’s media landscape, there are many different players in the purchasing cycle. Some are more relevant than others. In order to decide how to cover the market, create a relationship map of influencers and decision makers.

The above graphics illustrate the traditional players in the buying cycle. However, the advent of networks has added more influencers to the process. Third party Aggregators focus on unsold remnant or premium ad space. Third-party Audience Networks help advertisers identify and target specific demographics or interest attributes based on content consumed. Finally, there are agencies and networks helping with real time bidding and programmatic purchase. More cooks in the kitchen means your ad sales organization must be highly organized to provide the right messaging and customized value propositions to the right players in the process.

Determine Segment Coverage

Finally, develop your coverage model to capture target opportunities. Your coverage model reflects your sales investments, i.e., where you are placing bets to focus selling effort across different channels, accounts and influencers to maximize return. It can be a delicate balancing act between geographic, category/vertical, product type, agency, and direct sales.

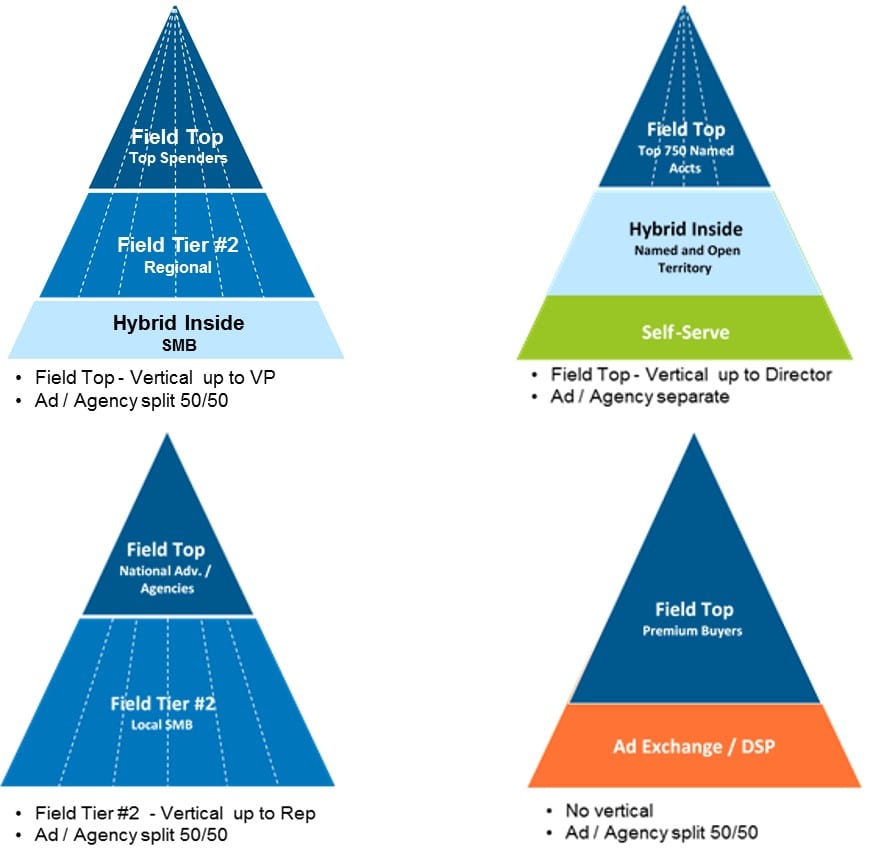

Across the ten participant media companies in our research study, there were three predominant coverage strategies:

- 50% have separate Agency and Direct coverage

- 30% have joint Agency and Direct coverage

- 20% have Agency-only coverage

Agencies are becoming more and more demanding, frequently asking for one point of contact. This puts even more pressure on ad sales organizations, as they continue to champion the goal of being customer-centric in their approach. Most of the sales organizations are in the process of ramping their agency coverage. However, a word of caution here, as not all agencies are created equal, and not all sales organizations are properly equipped to provide one point of contact that can effectively position a multi-product portfolio. Just because they are asking for a single point of contact doesn’t mean it is in your best interest when weighed against other sales investments.

The other major area of differentiation had to do with category-/vertical-specific coverage. As companies grow and become more mature, they tend to provide category-specific coverage.

- 20% had no vertical coverage

- 10% had vertical coverage by AE only

- 50% had vertical coverage up to the Director level

- 20% had vertical coverage up to the VP level

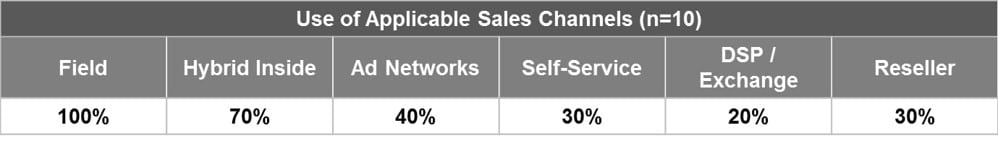

All of the sales organizations in the study provide field coverage. Most also include some type of hybrid field/inside sales channel as well. Below is the channel usage breakout:

Example segmentation and coverage combinations from the study:

Sales Segmentation, Buyer Profile and Coverage

Defining your customer targets and buying profile is essential to determining the optimal coverage model for your sales force. Unfortunately, many sales leaders err in one of two ways: Either they over complicate the framework, making it confusing to act on and stifling efforts; or they over simplify, and miss out on opportunities to focus on the changing decision makers and influencers. Not all bets will pay off. But standing still and sticking with your legacy model is sure to put you behind before the year even starts.

Sales Stucture

As we discuss sales structure and ask, “What does an agile sales organization look like?”

An agile sales organization is one that expands coverage in the marketplace, appropriately prioritizes account targeting and account planning activities, has the right seller(s) at the point of persuasion, and can adapt to the evolution of buyers – all within an acceptable cost of sale.

The structure of a sales organization involves the following three elements:

- Channel Coverage

- Organization and Job Design

- Sales Force Sizing and Deployment

Building an agile sales organization begins by evaluating your channels, or routes, to the customer based on your strategy.

Channel Coverage

The ad sales force of the future actively assesses the effectiveness of routes to the customer — direct, inside, channel and online (or self-serve). Using multiple channels in a coordinated fashion helps expand your reach and optimize your cost to cover. But the increasing number of players in the process adds complexity to the situation. You need a clearly articulated strategy to define the channel and rules of engagement for each market or set of target customers.

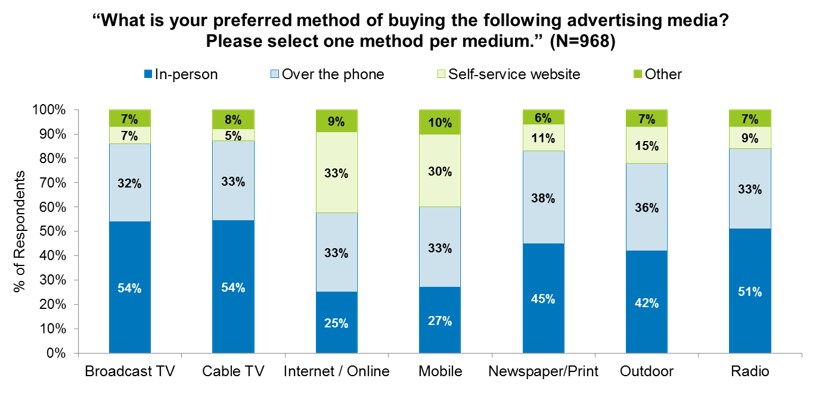

A recent Alexander Group survey of ~1,000 media advertising B2B buyers shows a willingness to buy through different channels. Notice the sizable percentage of buyers that prefer to make media purchases over the phone or online. Two out of three buyers for internet and mobile media solutions prefer to buy over the phone or through self-service.

It’s imperative for a media sales force to offer effective phone and online channels in order to capture this demand, and do so at a much lower cost of sales. However, just because clients prefer those mediums, that is not what they often get. Many traditional media organizations have been slow to develop these channels. Does this mean the high touch, direct sales model is going away? Definitely not! Sales leaders must proactively determine the channel coverage strategy based on what is best for both the ad sales organization and the client. While self-serve is a valuable low-cost option for many simple transactions (often more commoditized media buys), higher touch methods are critical for more complex and higher stakes solutions. Solutions that include multiple products and solutions that leverage different platforms or mediums need the voice of a direct seller—mostly to ensure that the client clearly understands the value and ROI of the campaign.

It’s imperative for a media sales force to offer effective phone and online channels in order to capture this demand, and do so at a much lower cost of sales. However, just because clients prefer those mediums, that is not what they often get. Many traditional media organizations have been slow to develop these channels. Does this mean the high touch, direct sales model is going away? Definitely not! Sales leaders must proactively determine the channel coverage strategy based on what is best for both the ad sales organization and the client. While self-serve is a valuable low-cost option for many simple transactions (often more commoditized media buys), higher touch methods are critical for more complex and higher stakes solutions. Solutions that include multiple products and solutions that leverage different platforms or mediums need the voice of a direct seller—mostly to ensure that the client clearly understands the value and ROI of the campaign.

Organization and Job Design

Do we have the right organizational model defined? The three most prominent ways to organize your sales model are by geography, product or customer. Each is appropriate but has its strengths and weaknesses. For example, a geographic organization is suitable for sales teams with limited solutions and little need to provide industry focus; however, it makes it difficult to cover clients that span multiple geographies. Product organized sales forces provide strong domain expertise but can become confusing to the customer when multiple product sellers are pitching individual solutions. Customer-based organizations can really dig deep on customer needs and provide a universal marketing message, but typically they must be supported by a specialist organization because of a lack of multi-product expertise.

The alternative to the single-focused structure is a combination, or a matrixed organization. These structures can create additional complexity, but they also can address the shortcomings of a single-focused structure. The determining factor in the decision-making process is the structure and buying process of the customer, and the value of the customer to the sales department.

From a job definition standpoint, a sales role must clearly be defined across four dimensions:

- The steps in the sales process they are responsible for

- The customers they are responsible for

- The products, services and solutions they are asked to represent

- The sales strategy (new business, retention, hybrid) they are asked to execute

A proper balance of all four elements is key to ensuring a job is tasked with an appropriate workload and ensures the high value sales personnel have the right type and number of accounts with the time necessary to actively work them. When jobs become overloaded, sellers tend to self-select the efforts that they believe will get them the incentive dollars.

To that end, given the rapid change in marketplace dynamics, sales organizations have been wrestling with trying to understand when to use specialists, how support roles can help to maximize seller productivity, and how to deploy inside sales. The number and type of specialist support continues to expand, particularly to help support the articulation of new and cross-product solutions. More and more sales organizations are using “insight teams” that provide information and trends across markets, products and industries. Client Success Managers, Programmatic Buying Specialists, Video Specialists and Mobile Specialists are all commonplace roles.

Specialists are always a hot topic. Too often, the role of the specialist isn’t clearly defined, and this can lead to sub-optimized customer coverage. When deployed in an overlay fashion, with four-legged call expectation, they will also increase your cost to serve. However, if they aren’t used, and they are needed, it can stall the growth of new product introduction or new market penetrations. The decision criteria to determine the need for specialists revolve around certain considerations.

- The strategic importance of the product/solution. The more important, the more you should consider a specialist.

- Can you afford it? The more efficient your sales org, the more options you have to use specialists.

- Is the buyer the same? When there is only one buyer, adding more cooks in the kitchen can sometimes be unwanted, or overkill.

- Buyer knowledge. The more knowledgeable the buyer, the more comfortable they are purchasing ad solutions.

- Is the product portfolio complexity beyond the capacity of the generalist sales rep? If existing or new products are extremely complex, in order to properly develop value propositions and client solutions, specialists may be needed.

- Agency sophistication. The more sophisticated the agency, the less likely the need for specialists.

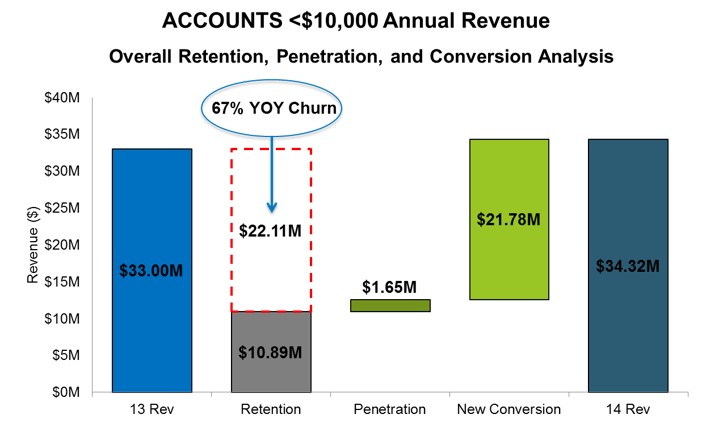

A vibrant Inside Sales team can be a secret weapon for the organization. The term “inside sales” can mean different things to many people. There is a place for multiple types of inside sales deployments. Inside sales can act just like an outside multi-product solution seller, just organized over the phone. One of the many advantages to this is it allows for expanded coverage in the market place. They can help keep focus on potential accounts that have a high propensity to churn revenue, due to lack of focus from the outside reps. For example, an account-level analysis of small accounts for a recent media organization showed a stunning churn rate of 67% year-over-year revenue for accounts that were less than $10,000 of annual spend. These accounts are prime targets for outbound, inside sales channel.

The aggregate year-over-year revenue of 104% in these accounts clearly masked the sales coverage and job design deficit on these accounts. In this example the field organization clearly wasn’t getting the job done, mostly due to lack of focus on the smaller accounts. An account-by-account churn of 67% is unacceptable. It is the job of the sales organization to uncover these job design flaws.

The aggregate year-over-year revenue of 104% in these accounts clearly masked the sales coverage and job design deficit on these accounts. In this example the field organization clearly wasn’t getting the job done, mostly due to lack of focus on the smaller accounts. An account-by-account churn of 67% is unacceptable. It is the job of the sales organization to uncover these job design flaws.

As buyer knowledge continues to increase, those with higher levels of product knowledge and sophistication may prefer to buy over the phone. We have also seen a trend, as buyers become more familiar and comfortable with the solution offerings, that inside sales can sell more and more of the solution suite.

Finally, inside sales can be a valuable enabler for the sales team when asked to perform pre- and post-sales support activities.

Sales Force Sizing and Deployment

Do we have the right number of roles? Are territories well-defined and balanced? Do we have the right manager and support ratios?

Each unique BPO should have its own account-level expectations. Existing revenue, new product penetration, and new business opportunity should be built into the deployment planning process. Based upon the segment profile, each seller within a defined segment should have both a revenue/head and account load range that is acceptable. Too often sales organizations have loosely defined production expectations for a variety of reasons. This can lead to wide ranges of territory size within a given segment. It happens because of the historical evolution of the territory, existing relationships that sales leaders deem too important to reassign, and a lack of focus on a balanced workload.

These factors can lead to territories that are either under productive with revenue per head ranges too low or the opposite, territories that are overloaded that inhibit the ability of the territory to grow.

An agile sales organization defines the appropriate productivity expectations for each segment. It then actively manages and plans for the appropriate headcount based upon existing and project sales expectation. This leads to a multi-year workforce planning projection of headcount needs by segment.

This bottom up approach provides the necessary input for the manager and support ratios for the core sales force. Manager ratios will vary depending on a number of factors. Some considerations:

- Sales Channel. Outside, Inside or Channel. Outside tend to have lower span of control.

- Sales Motion. Fulfillment, Advocacy, Innovation. As you move from fulfillment selling to innovation, the amount of complexity and value added increases. The manager to rep ratio for fulfillment is generally greater than innovation sales motions.

- Experience of hire profile. Those with less experience will require more manager time, yielding a greater manager to rep ratio.

- Sales efficiency and support. The more support and efficient internal process, the more reps a manager can support.

Summary

Designing an agile sales structure is an ongoing process. Getting it right can lead to great gains in market coverage, sales organization efficiency and accelerated growth. Remaining stagnant leads to missed organizational goals, individual seller frustration and stalled growth. The recipe for success has to be clearly defined, proactively coordinated and actively managed.

Speak With Our Experts

Need help? Have questions about developing an agile sales structure for your media sales force? Learn more about our Media Sales Practice.