Go-to-Market Planning Gets Its Moment - Part 1

“We have to figure out how to make up a lot of growth in 2021.” ~ PE Operating Partner

Change is coming. 60% of PE leaders are seeing deal flow increase by 30-40%, and 80% expect strong growth acceleration in 2021. Why? Lost time in 2020. As a result, most portcos need to win market share in 2021, hopefully, while leveraging a first-mover advantage and an economic rebound. So, investing in stronger go-to-market (GTM) capabilities will be key, but which ones?

Alexander Group’s PE Insider Roundtable: Optimizing Portco GTM took on this question as part of the firm’s 2020 Executive Forum in November. The Forum hosted 550 private/public revenue leaders, including 70+ PE partners and 60 portco leaders in healthcare, industrials, tech/XaaS, media and business/financial services. PE leaders discussed Alexander Group’s latest GTM research and settled on four essential 2021 portco growth tactics.

- Quantifying new buyer groups and journeys and the right GTM path to cover them

- Deploying the right account management and expansion model for your products

- Expanding sales reach and capacity through the right inside sales models

- Aligning sales/support roles and compensation with your growth strategy

Part 1 of this two-part series will review the first and second essential growth tactics.

1. Quantifying new buyer groups and journeys and the right GTM path to cover them

“Portco leaders can’t just do more of the same sales strategy in 2021.” ~ PE Operating Partner

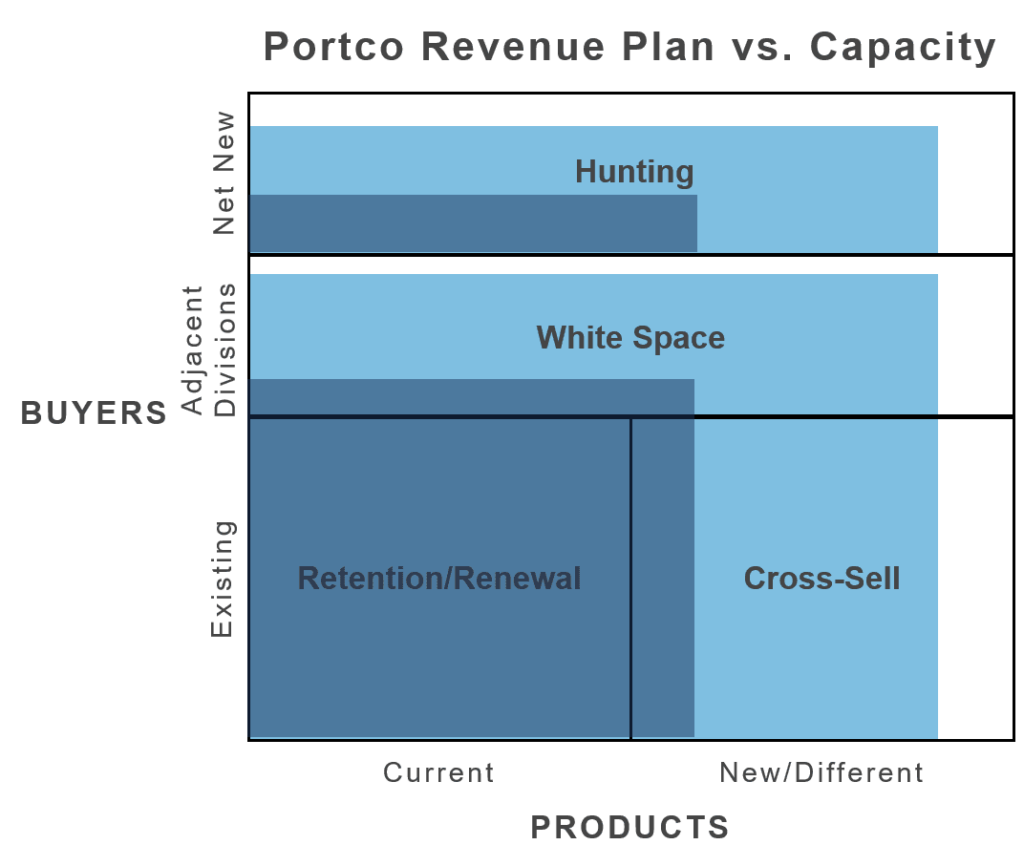

Over 50% of PE leaders surveyed stated that it’s very difficult for portcos to change their GTM model. Getting portcos to meaningfully look “beyond core revenue” first requires quantifying the “size of the prize.” Specifically, quantifying Total Addressable Market (TAM), current share (by segment) and the sales force’s ability to sell to these new buyers. Participants noted that the key is modeling out what’s really “addressable” through linear growth of the same sales motion, and what growth will require new GTM plays. Also, TAM size numbers must be modeled together with revenue growth capacity by role, headcount and skills to shape realistic 2021 growth plans (i.e., what to do, who to go after, when and how). The inability to understand that growth revenue is harder to come by than core revenue can result in under-investing in growth GTM.

2. Deploying the right account management and expansion model for your products

“The key to growth is to see early enough that the current GTM can’t or won’t drive growth through broader adoption or new use cases.” ~ PE Managing Director

Growth from new buyers is only half the battle for 2021. Equally important in today’s recurring revenue world is adoption, upsell and cross-sell. For many portcos, these are under-developed sales motions. Star performers or natural account managers may figure it out on the job, but most portco reps will continue to be territory or relationship managers no matter what their leaders say at sales kick-off. Additionally, they are often reluctant to build Share of Wallet (SOW) by cross-selling new products or upselling new divisions for fear of disrupting core revenue. This risk-aversion is often reinforced by leadership, causing Core Protection Paralysis (CPP). Indeed, over 30% of PEs surveyed indicated that financially-focused deal partners also fear that GTM change may threaten core revenue.

Participants said their job today includes helping both deal partners and portcos see the link between post-sale growth coverage and higher valuation. Specifically, getting them to see the ROI on new growth-aligned account managers, CSMs and specialists along with new quotas, coaching and sales compensation is crucial to facilitate change.

Part 2 of this series will discuss the third and fourth essential tactics for 2021 portco growth.