Contemporary Practices for Consumption-Based Businesses

Core Consumption Models and How to Utilize Them Effectively

Consumption pricing as a business model has gained significant traction, with many organizations migrating towards this “pay for what you use” contracting approach. The emergence and increasing prevalence validate the various benefits with this model. First and foremost, it ensures tight alignment between customer use and payment. Second, it is both flexible and scalable, often making it easier to sell. Finally, it embodies a customer success ethos which drives high customer lifetime value (CLV).

There are many considerations to ensure the migration to a consumption model proves fruitful. It’s important to select the right contracting types (there are multiple models to consider) to align with customer preference, address revenue predictability issues and drive increased usage. Additionally, the organization’s coverage and engagement model, as well as customer-facing jobs may need to evolve to meet new selling motion requirements. Lastly, updates to the sales compensation program are needed to align and reward desired behaviors in the new model.

Contracting Types and Migration Pathways

There are four core contracting consumption models:

- No Contract (e.g., Pure PAYGo): A pure pay-as-you-go model that allows a customer to pay as they consume and requires no customer commitment.

- Uncommitted Contract: These contracts have no associated dollar commitment; they include various contractual obligations which generally includes pricing and term length.

- Committed and Uncommitted Contract (e.g., Floor with Upside): Contracts which include a committed dollar spend and uncommitted dollar spend.

- Committed Contract (e.g., Pool of Funds): Contracts with a committed dollar spend within a committed term length (e.g., one year); however, the customer pays as they use the service.

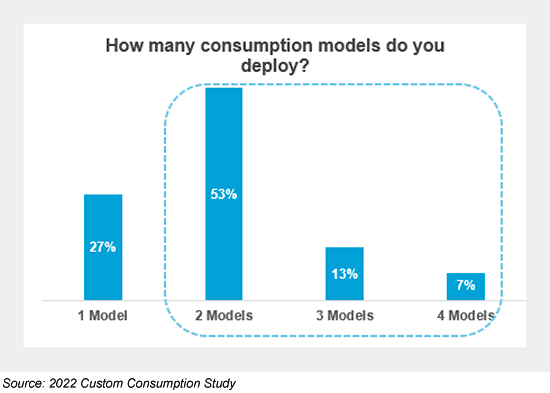

Based on recent Alexander Group research, roughly 73%i of organizations offering consumption deploy more than one consumption contracting model, with Pure PAYGo and Committed Contracts being the two most common types. Offering multiple contracting options provides flexibility for different customers at different stages in the customer journey.

For example, PAYGo is often seen as a low barrier-to-entry for new logos. Conversely, committed contracts are often seen as the desired long-term solution for many vendors. Once consumption is understood and usage reaches a certain volume, customers often benefit from unit-based discounts, while vendors benefit from greater forecasting predictability and increased stickiness. In all scenarios, the customer engagement model often means the adopt, expand and renewal motions are interlinked.

The following video shows the pros and cons of various consumption model options.

Evolving Coverage Models

When migrating to a consumption model, it is imperative to evaluate whether the current coverage approach is best suited to the evolved strategy. Most specifically, consumption models typically require continuous engagement among core reps across all sales motions. As a result, teamed models – whereby the core reps engage and disengage through the various stages of the customer engagement process – are increasingly rare. Further, many organizations with more mature consumption practices and orientation towards line of business buyers, are more commonly deploying a bifurcated model to effectively offload “land activities” to a hunter role while asking a separate core rep to focus on various expansion plays.

This is having an impact on the core rep archetype. It is moving away from “big deal selling” and towards strategic account-management geared at driving continuous and faster consumption that inevitably leads to incremental expansion. Often it involves progressing the customer journey, converting PAYGo users to enterprise-level relationships and continuously drive incremental expansion. Alexander Group research found that AEs/AMs own or co-own each consumption motion at least 78% of the time (e.g., new use cases, incremental consumption, contract renewals, down-sell avoidance).

This shift not only represents implications for the core rep, but the CSM mandate and talent profile as well. While revenue leaders have explored using CSMs for certain sales motions such as renewals and upsells, those deploying consumption models are keeping the CSM job focus fairly narrow with a singular adoption and value realization accountability.

Sales Compensation Implications

While many nuances exist based on the consumption strategy, there are emerging pay practices for how organizations pay reps for consumption.

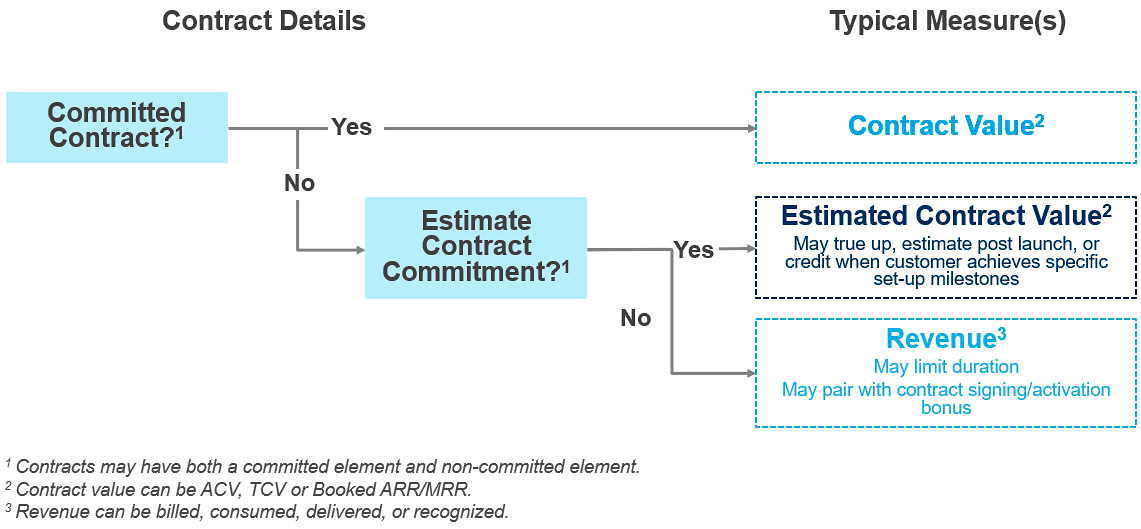

Like subscription models, for committed consumption contracts, the prevalence is to pay at booking. This more closely (and appropriately) ties the reward to the persuasion event. But what about for non-committed contracting models? In this scenario, the prevalence is to pay on actual consumption as opposed to estimated revenue at booking. This maintains rep involvement and aligns company strategy/success and rep benefit. It also reduces bad sales behavior by discouraging reps from inflating up-front commitments. Finally, it is predictable, stable and avoids the likelihood of true-up/claw-back scenarios.

Second, while many companies desire to pay on incremental consumption, 62%i still pay on total consumption. While total consumption can work well for reps responsible for the renewal motion, it does not differentiate pay between run-rate and expansion. Being able to distinguish this differentiation is a key limitation for many organizations looking to make the transition. More transaction history, better data, and sophisticated forecasting capabilities are often needed to overcome challenges and minimize risk associated with an incremental consumption measure.

Key Considerations

Consumption yields many benefits for both customers and vendors. As more and more companies migrate to a consumption model(s), change management, long a challenge at most companies, is becoming paramount to successfully shift transition. Key considerations if you’re considering migrating include:

- Establishing a clear consumption contracting model and pricing strategy to land new logos and drive expansion opportunities most effectively

- Evolving coverage models, rules of engagement and resource deployment

- Revising role expectations and the associated talent and recruitment strategy

- Updating sales compensation programs to align to the business strategy and desired role behaviors in accordance to where your organization is in the consumption journey

To learn more about our consumption benchmarks, perspectives and best practices, contact Alexander Group’s technology practice to learn how we can help.

__________________________

i2022 Alexander Group Custom Consumption study

___________________________________________________

Recommended Insights:

Video: 2022 Technology Industry Predictions – Partners & Alliances

Article: The Hunter/Farmer Model for Driving Growth

Article: Effective Lead Management – Governance and Lead Attribution

Article: Attracting/Retaining Sales Talent Using Career Paths and Competencies