The Hunter/Farmer Model for Driving Growth

Understanding When and Where to Deploy the Bifurcated Account Ownership Model

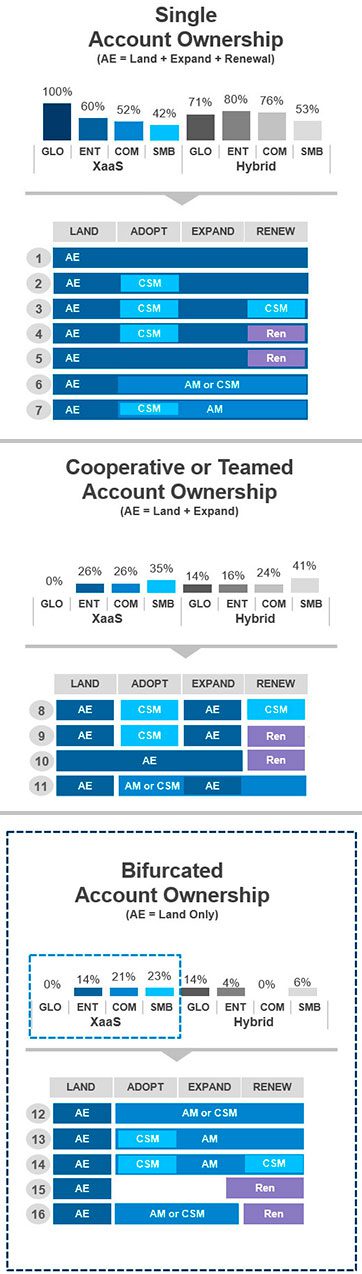

Land and expand are integral sales motions at every XaaS company. However, companies often utilize different coverage models to maximize top line growth, and the first decision sales leaders must make in designing coverage is how to assign core sales roles accountability across the customer relationship lifecycle. One such accountability structure is the Bifurcated Account Ownership model, which specifically separates ownership of landing new accounts from managing accounts going forward. Whilst this model has been deployed in the XaaS sector, there is often confusion and/or debate over when and where to deploy it. This article will describe the Bifurcated Model in context of other accountability structures, as well as provide deeper dive into where and when it should be considered.

Alexander Group’s recent XaaS Research has uncovered that there are four major hunter/farmer models:

Alexander Group’s recent XaaS Research has uncovered that there are four major hunter/farmer models:

- Single Account Ownership – There is one account executive (AE) who carries organic quota responsibility for landing, expanding and renewing accounts. The AE is accountable for the entire customer journey. A customer success manager (CSM) typically supports AE to drive adoption. A renewal representative may also get involved to limit AE time commitment on transactional motions.

- Cooperative Account Ownership – The AE owns land and expand motions while the CSM and/or renewal representative drive adoption and renewal motions.

- Teamed Account Ownership – The AE lands new accounts. The AE and account manager (AM) work together to drive expansion. The AM is solely responsible for renewals.

- Bifurcated Account Ownership – The AE is a pure hunter who passes off newly acquired accounts to an AM (i.e., farmer). The AM drives expansions and renewals, typically with the support of a CSM.

Usage of Bifurcated Account Ownership

Approximately 15% of XaaS companies use a bifurcated account ownership model. Primary reasons for using bifurcation include:

- Sales motions for hunting and farming are quite different.

- Hunting role is a very distinct land motion; more focused around finding and qualifying the right accounts and buyers.

- Farming role has distinct focus on growing an account. Firstly, quality adoption with significant additional focus that drives usage and results in large expansion (upsell). Secondly, appropriately positioning cross-sales. This motion is quite different from persuasion selling.

Alexander Group typically sees bifurcated models show up when companies focus on:

Financial Technology and E-commerce Verticals: In both verticals part of the growth comes from more internal usage. More importantly, as a platform sale, growth comes as the customer’s customers expand.

Mid-Market and SMB Segments: There are many more prospects in the mid-market and SMB segments and bifurcated model allows for efficient use of both hunter and farmer resources. There is typically minimal need for a hunter focused on Enterprise segment as over time the number of new Enterprise logos to hunt dwindles.

Finance and Business Buyers: Bifurcated model is also more common when selling to functional and line-of-business buyers. It is easier to transfer account knowledge from AE to AM + CSM in such situations.

Varied Product Portfolio: Finally, companies with a lot of expansion sales motions (e.g., ELA, varied portfolio of products, etc.) also leverage bifurcated model. It is typically hard for one seller to drive new logos while also mastering the various expansion pathways.

Successful Execution of Bifurcated Account Ownership Model

Hunter (AE), farmer (AM) and CSM are the three primary roles in this model. An effective handoff of a newly landed customer from an AE to a CSM is paramount for successful adoption and value realization, creating the baseline for long-term customer health. AMs, with support from the CSM, identify and execute expansion sales plays which can range from simple (e.g., add more users) to complex motions (e.g., new buyers and departments). The AM is ultimately accountable for buyer engagement and overall account health while partnering with the CSM who continually engages users to drive usage and adoption.

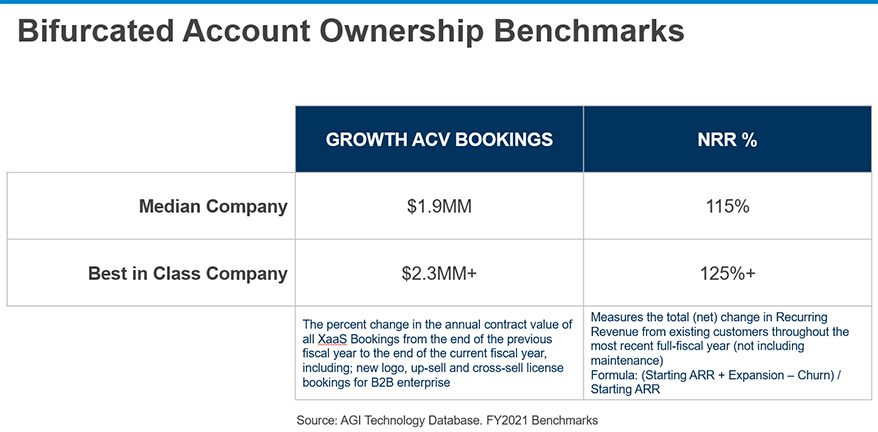

Best-in-class companies that deploy bifurcated models produce more than $2.3MM growth ACV bookings per seller. Such companies use a combination of technology and support resources allowing AMs to generate exceptional NRR levels. Renewals may be automated with built-in price increases. CSMs or other resources may develop reports that AMs use for account reviews and expansion planning efforts. Effective AMs then conduct quarterly or twice a year reviews with their accounts to proactively uncover cross-sell opportunities without relying on the renewal process to do so.

Many companies also deploy technologies such as Gainsight, Totango, ChurnZero, ClientSuccess, etc. to drive AM and CSM productivity. These tools provide the functionality and visibility needed to manage and enhance the customer experience. Key processes include case management, tracking of customer usage, alignment of usage toward expected business goals, predictive analytics to support early warning issues that might prevent a renewal, and/or new use case identification.

The most advanced organizations combine predictive account spend potential models and newer marketing tools that allow for account level targeting by AMs vs. a broad-based marketing email campaign.

In summary, the Bifurcated Account Ownership model typically works best in select segments (mid-market/SMB) or verticals (financial technology and e-commerce) where there are distinct sales motions for hunting vs. farming. Leading companies have well defined rules of engagement and RACI to ensure customer handoff from AE to AM + CSM is seamless to drive both initial value realization and long-term expansion.

Speak With Our Experts

Are you interested in learning more about various coverage models and what is appropriate for you? Contact the Alexander Group Technology practice to learn how Alexander Group can help.