Executing a Successful Expansion Strategy

Expansion Selling Drives Profitable Growth

The Rule of 40 Growth and Profitability index has long been used to gauge successful and sustainable SaaS companies. Organizations with a combined annual recurring revenue (ARR) growth and EBIDTA margin percent above 40% command higher valuations and represent an outsized portion of market capitalization.

While the 40% principle equally recognizes growth with profitability, in today’s uncertain macroeconomic environment and as market valuations are increasingly being scrutinized, many commercial leaders are shifting their focus from driving growth at all costs (the ARR part of the equation) to driving profitability within their go-to-market efforts.

Sales leaders are tasked with efficiently deploying their investments. While companies often look to trim expenses in the organization, they can inadvertently curtail growth. For companies that aspire to grow, they must focus on profitable growth. To optimize their sales investment, leaders are turning to an expansion selling approach that supports reps in selling to current customers while leveraging existing relationships as an alternative to consistently acquiring brand-new logos.

Expansion Plays Focus Sales Representative Efforts

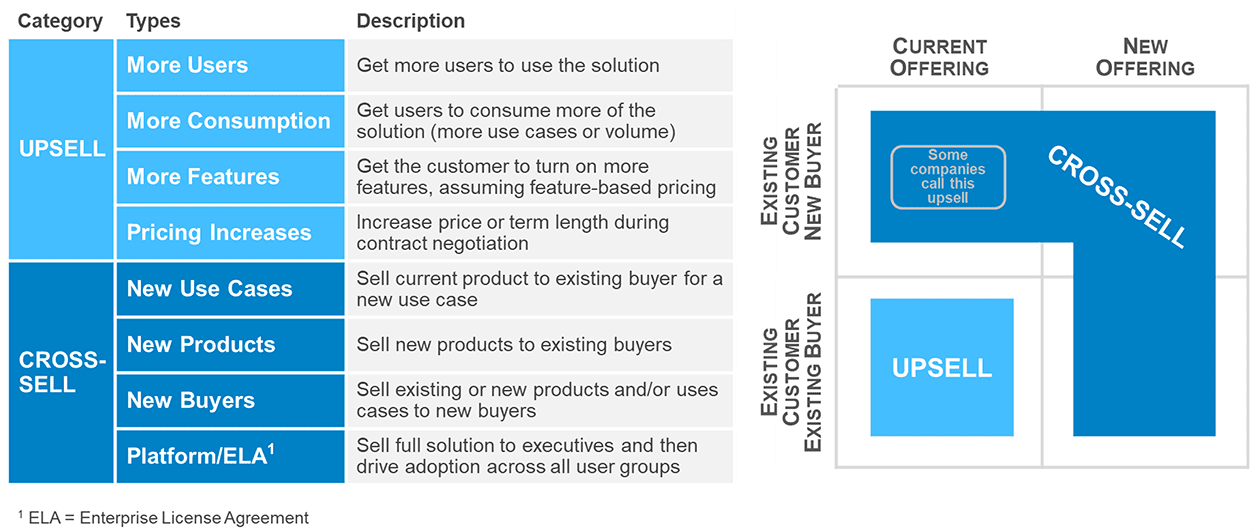

Defining and deconstructing expansion use cases is the first step in defining a customer-focused sales strategy. At a high-level, expansion plays are typically categorized into eight upsell and cross-sell strategies.

Upsell

- More Users: Get more users to use the solution

- More Consumption: Get users to consume more of the solution using more use cases or increasing volume

- More Features: Get the customer to turn on more features, assuming feature-based pricing

- Pricing Increases: Increase the price or term length during contract negotiation

Cross-sell

- New Use Cases: Sell the current product to existing buyer for a new use case

- New Products: Sell new products to existing buyers

- New Buyers: Sell existing or new products and/or uses cases to new buyers

- Platform/Enterprise License Agreements: Sell a full solution to executives and then drive adoption across all user groups

Expansion types differ in their significance across companies. Based on the product configurations and types of buyers and users, sales organizations can prioritize sources of expansion growth differently. For example, a single product company whose solution offers multiple tiers will focus on the adoption upsell, usage upsell and new buyer cross-sell. Conversely, companies with a broader product portfolio with many centralized buyers and users will focus on multi-product cross-selling or platform selling. In addition, some organizations rely heavily on their customer’s organic growth to drive usage and upsell, and they invariably may need to pivot. Finally, macroeconomic conditions may impact expansion priorities across all customer types, resulting in new strategies.

Sales organizations should direct reps where to focus their efforts using a top-down prioritization of the primary expansion plays. This approach will enable the sales organization to deploy appropriate resources in a coordinated manner that drives profitability.

Six Tactics that Drive Expansion Selling Success

Expansion selling is essential but must be thoughtfully integrated into the sales organization.

Here are six key tactics that CROs and sales leaders can use to drive expansion efforts efficiently and effectively.

Tactic 1: Evaluate Key Structural Changes to Contracting and Pricing

Now is the time for companies to focus sellers on bundle licenses or ELAs. Software executives are familiar with using a platform solution to drive customer “stickiness.” This approach includes establishing connectedness using various toolsets and applications within a product’s portfolio, resulting in greater value than the sum of the parts. In addition, some organizations bundle like products while others are now migrating to a consumption model, providing access to expanded feature sets that drive increased usage. For example, a customer with a consumption contract based on anticipated use for product A can now use tokens to try product B. Adoption of product B will drive increased usage, driving expansion.

Based on a recent Alexander Group consumption study, 60% of companies with a consumption pricing model underestimate their total consumption forecasts by more than 10%, suggesting the expansion selling is successful. This strategy may require go-to-market adjustments that ensure the organization has a healthy customer success and adoption process. Commercial resources can drive efficient growth through a coordinated and cohesive approach, providing maximum customer value.

Tactic 2: Identify All Buyer Stakeholders to Craft Appropriate Messaging

Budgets are increasingly under scrutiny. Whether buyer stakeholders know it or not, incremental expenses will also require compelling ROI in a cost-constrained model. Crafting the appropriate message that influences stakeholders will require additional effort that includes:

- Clearly articulating outcomes using messaging that clarifies value to the company and each stakeholder

- Identifying new and influential buyer stakeholders and addressing their specific concerns

- Recognize when the value indicates how the solution can reduce cost and improve EBIDTA and/or margin

- Reframe the ROI by answering, “what is the cost to the organization for not implementing this solution?”

GitLab CRO Mike McBride understands the value of appropriate messaging. GitLab Inc., whose industry-leading DevSecOps platform changes the way cross-functional teams collaborate to build software faster, focuses on clearly articulating how their solution reduces customer development costs.

“When there is a new budget holder upstream, whether executive leadership or finance, that didn’t scrutinize opportunities in years past, we have to enable our champion (the customer influencer) to pitch this new stakeholder on the cost savings and how this initiative drives efficiencies,” Mike says.

Product users require specific value messaging, as do senior executives who look at the ROI and overall business value. Mike believes clear messaging pays long-term dividends: “It’s different, but it’s good, disciplined selling. People got away from it in the boom times, but it’s also an opportunity to build back the capabilities for the next three to five years.”

Tactic 3: Apply Marketing Techniques and Insights Toward Existing Customers

Leading companies use digital marketing technologies to capture sales and marketing insights and identify new prospects. Organizations with a prescriptive and diligent approach to expansion selling can apply these techniques to grow their existing customer base.

For instance, some firms now use telemetry data to inform the sales organization when to employ sales motions. Insights can reveal if customers are approaching their contracted usage limit or licenses. Data can also show which features a customer uses and indicate if they could benefit from another feature set. Combining telemetry and firmographic information can also set the stage for appropriate use cases. For example, similar customers sometimes start consuming product B after product A, indicating expansion opportunities. Since organizations are looking to optimize their sales resources, driving incremental yield through data insights can help companies achieve increased profitability and drive accelerated growth.

In the Enterprise space, firms also use an account-based marketing (ABM) approach to concentrate resources on target buyers within a customer segment. ABM employs personalized campaigns designed to engage each buyer, basing the marketing message on the specific attributes and needs of those buyers within the account.

Marketing to existing customers using expansion strategies is essential to achieve the most significant value from large accounts while identifying and accessing new buyers within an organization.

Tactic 4: Drive Coordination Between Sales and Customer Success

Many SaaS companies have deployed a customer success organization. With multiple customer success archetypes and sales motions. Two common struggles often emerge:

- Driving a cohesive and coordinated glide path from pre-sales to post-sales success

- Focusing valuable Customer Success (CS) resources on the high-value adoption and value realization activities

According to recent Alexander Group research, only 37% of SaaS companies create Customer Success plans that codify a launch plan, outline specific customer goals and create a formalized feedback loop that evaluates customer experience and use case effectiveness. Further, Alexander Group’s Customer Success and Productivity research shows that low-performing customer success managers only spend 24% on high-value performance optimization and sales activities versus 56% for the high-performing cohort. High-performing organizations understand that effective adoption and value realization activities lead to expansion opportunities.

Customer Success is a significant commercial expense. To gain the most value from this investment, they must identify the appropriate CS archetype based on the customer journey and expansion strategy. Once defined, the sales organization must detail the rules of engagement and create the coordinated glide path along the land, adopt and expand continuum. Customer Success organizations are essential in leading expansion opportunities but must have a clear, consistently executed strategy.

For example, HashiCorp, whose software enables organizations to provision, secure, run and connect cloud-computing infrastructure, focuses on driving this connectivity across the sales organization. Their strong growth metrics bear this out. In their pre-sales process, the sales engineers and account executives create a success plan, collaborating with their customer on the use case to solve, agreeing to relevant metrics for success and finally receiving customer sign-off. When the deal closes and CS has its first meeting, HashiCorp already has a prescriptive approach to engage with their customer drive towards successful outcomes. It is this customer-centric approach that positions HashiCorp for success.

Mike Ogden, vice president of Global Revenue Operations, sums it up best, “The reason we now have a Customer Success organization is because we want customers to be successful, but ultimately when we have that customer intimacy and we start to see other issues that we can help with.”

Tactic 5: Prudently Use Sales Engineering and Solution Architect Resources

Sales engineers are commonly the most resourced sales overlay, playing a critical part in driving expansion success. Using this resource requires the organization to have a well-defined engagement model between the sales engineer (SE) and the account’s Customer Success (CS) reps. CS has a unique understanding of how the customer uses existing products and features. CS insights are critical to enable SEs to identify and demonstrate new use cases that may lead to expansion opportunities.

Secondly, once defined use cases are in place, SEs must partner with the lead seller to create compelling value propositions and design a compelling solution, demo and/or proof of concept. While it may be natural for SEs to promote technical features and capabilities, effective SEs will translate the needs of the buyer stakeholders to the solution’s value.

According to Mike Ogden, SEs are critical to expansion selling at HashiCorp.

“When you are landing the very first time, you are identifying and solving a problem, so you are demonstrating a use case for how you solve that problem. As you expand, you are often upleveling towards driving outcomes by solving multiple problems with multiple products. In our case, this is where we are having higher order conversations about the cloud operating model and how our technology fits in.”

Tactic 6: Drive Focus Through Performance Management

Choosing the correct performance management lever is essential to direct a seller’s focus. For example, sales leaders should incorporate performance metrics into the coaching cadence if expansion selling is critical to short-term or mid-term success. In addition, leading sales organizations align performance metrics to strategic goals.

Sometimes, there are more accessible pathways to get at the growth ACV booking. For example, upsells often require less selling rigor but may not be as valuable to the organization to drive sustained growth. As a result, reps may focus on upselling, resulting in a skewed breakdown of the growth ACV bookings than what leadership deems healthy. Organizations can measure the different types of expansion, with a focused split between “easy expansion” (i.e., usage or capacity upgrades) and sales motions that require more effort and more strategic (i.e., cross-selling new products or buying centers). Applying the correct metrics will support strategic priorities and recognize strong performance.

Organizations can even incorporate associated metrics into sales compensation plans if differentiating expansion selling is particularly important. According to Alexander Group’s benchmarking database, the primary measure for core reps is a growth ACV metric, usually achieved through new logos, cross-selling and upselling. One approach to weaving a subtle expansion element is to apply a non-weighted strategic cross-sell expansion hurdle or uplift on the growth ACV bookings measure. In the case of a hurdle, a rep would receive reduced (or no) above-goal acceleration on their growth ACV measure unless the rep exceeded a cross-sell bookings target. An uplift would apply a multiplier to all eligible strategic cross-sell bookings to incent and reward reps for the more valuable deals that require additional effort. A cross-sell component in sales compensation plans has its own challenges. If under consideration, it is imperative to have rigid definitions and policies in place to minimize ambiguity and potential gaming.

Expansion Selling is an Essential Strategy for Profitable Growth

In today’s environment, profitable growth is critical to maintain valuations and assure investors that the underlying business model is sustainable. As a result, expansion selling is an essential part of corporate strategy, driving alignment through a focus on individual buyer stakeholder needs, an integrated sales and support organization and performance management metrics that drive success.

If you or your team are interested in learning how to execute a successful expansion strategy, contact one of our Technology practice leaders.